Bitcoin Breaks $25k Barrier. Where To Next?

News

|

Posted 21/02/2023

|

8668

Bitcoin experienced a robust week of price performance, rebounding from the previous week's correction. Surpassing $25.0k, the cryptocurrency achieved its highest price point since June 2022. Despite regulatory pressure in the US regarding digital assets, Bitcoin's market strength persists. The recovery in Bitcoin's price indicates continued investor confidence in the cryptocurrency. However, it's important to acknowledge that Bitcoin remains a volatile investment, subject to sudden changes in price due to market conditions and regulatory developments. Nevertheless, the recent price surge represents an optimistic outlook for the future of Bitcoin and the potential for it to be a valuable investment option. As the cryptocurrency market continues to evolve, investors must remain vigilant and informed to make the most of the opportunities presented.

So, let’s have a look at the data.

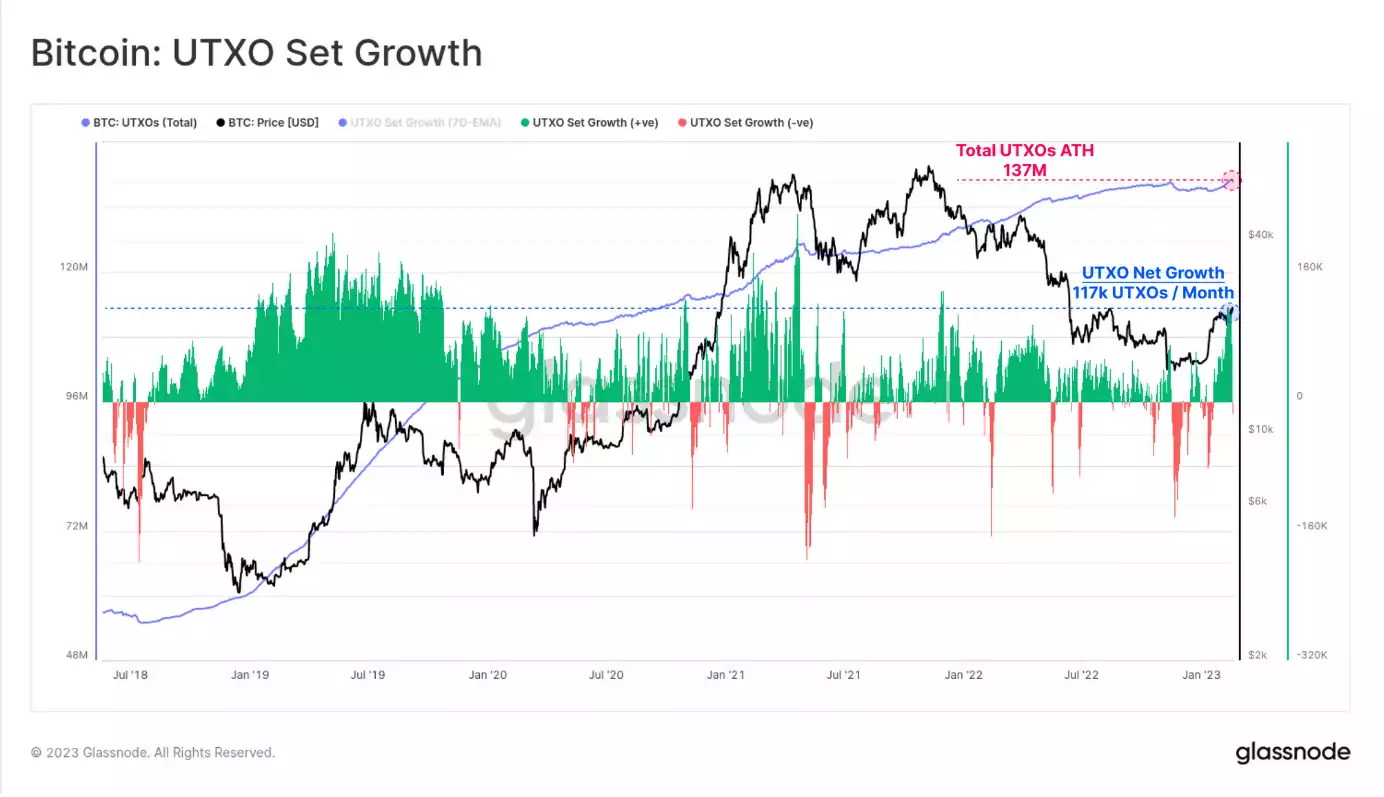

The cryptocurrency market has seen a significant advancement in the way of data storage and non-fungible tokens (NFTs) creation, thanks to the introduction of Ordinals and Inscriptions on Bitcoin in February 2023. This revolutionary system allows for on-chain activity while keeping the coin transfer volume relatively light. Our recent discussion on Ordinals and Inscriptions has shed light on how they have changed the game for the blockchain industry. The technology has proved its worth as the total number of unspent transaction outputs (UTXOs) in the set reached an all-time high (ATH) of 137 million during the initial Inscription wave. Furthermore, the UTXO count has been increasing at an impressive rate of 117k per month since last week, making it the highest growth rate since December 2022. This progress in data storage and NFT creation is a significant step forward for the blockchain industry.

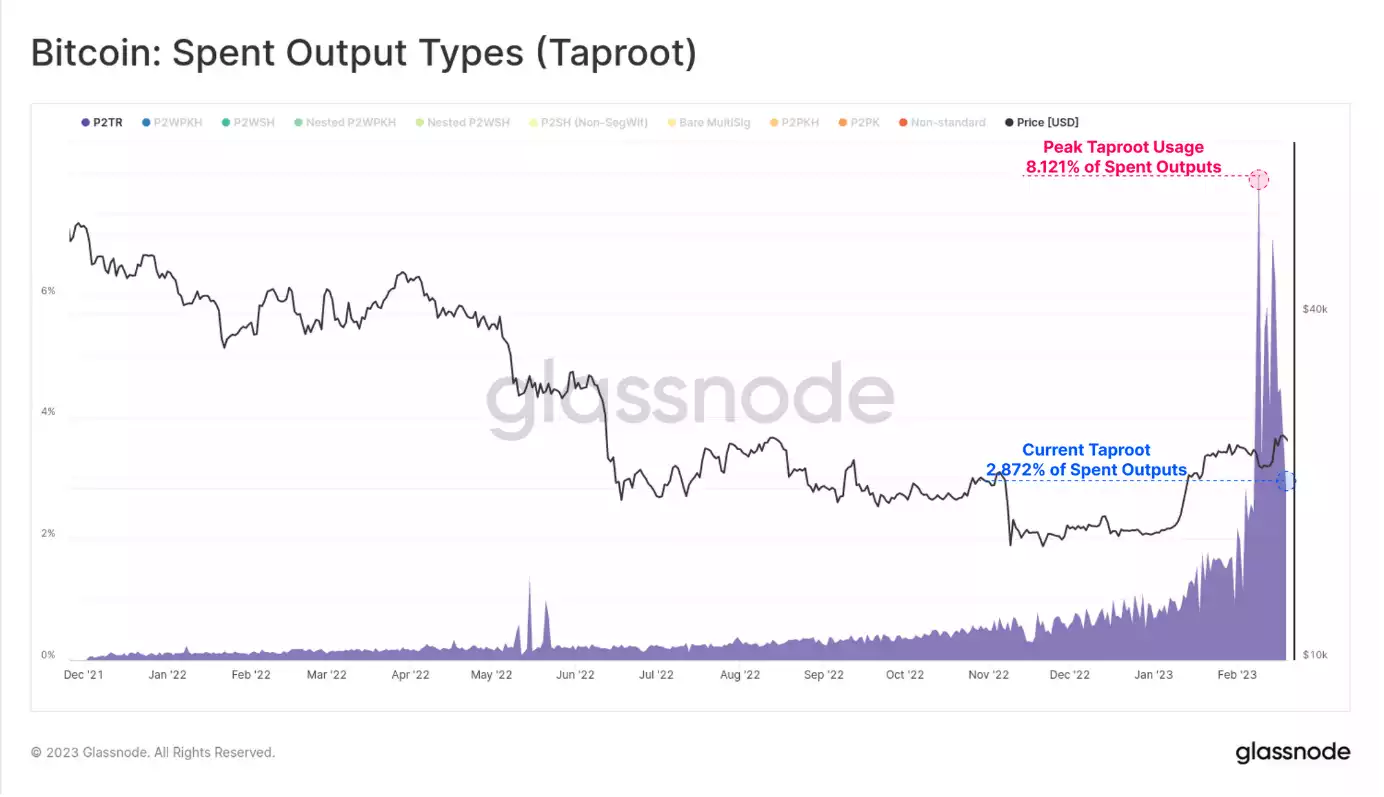

Taproot, the newest Bitcoin script type, has seen a surge in usage in recent times. Last week, the usage reached an all-time high of 8.121% of all spent outputs, indicating a growing interest in this technology. The total number of Inscriptions, which allows users to upgrade to Taproot, has also crossed 100k. While the initial wave of excitement has cooled down, the growing adoption of Taproot is a positive sign for the future of Bitcoin. Though Taproot script usage has fallen by 65% since the peak, it is currently at 2.872% of spent outputs spent. This may seem like a significant drop, but it's important to note that the overall usage is still high, and the slight dip could be due to market fluctuations. As more users adopt this technology, we can expect to see further growth and development in the Bitcoin space, paving the way for a more advanced and secure financial system.

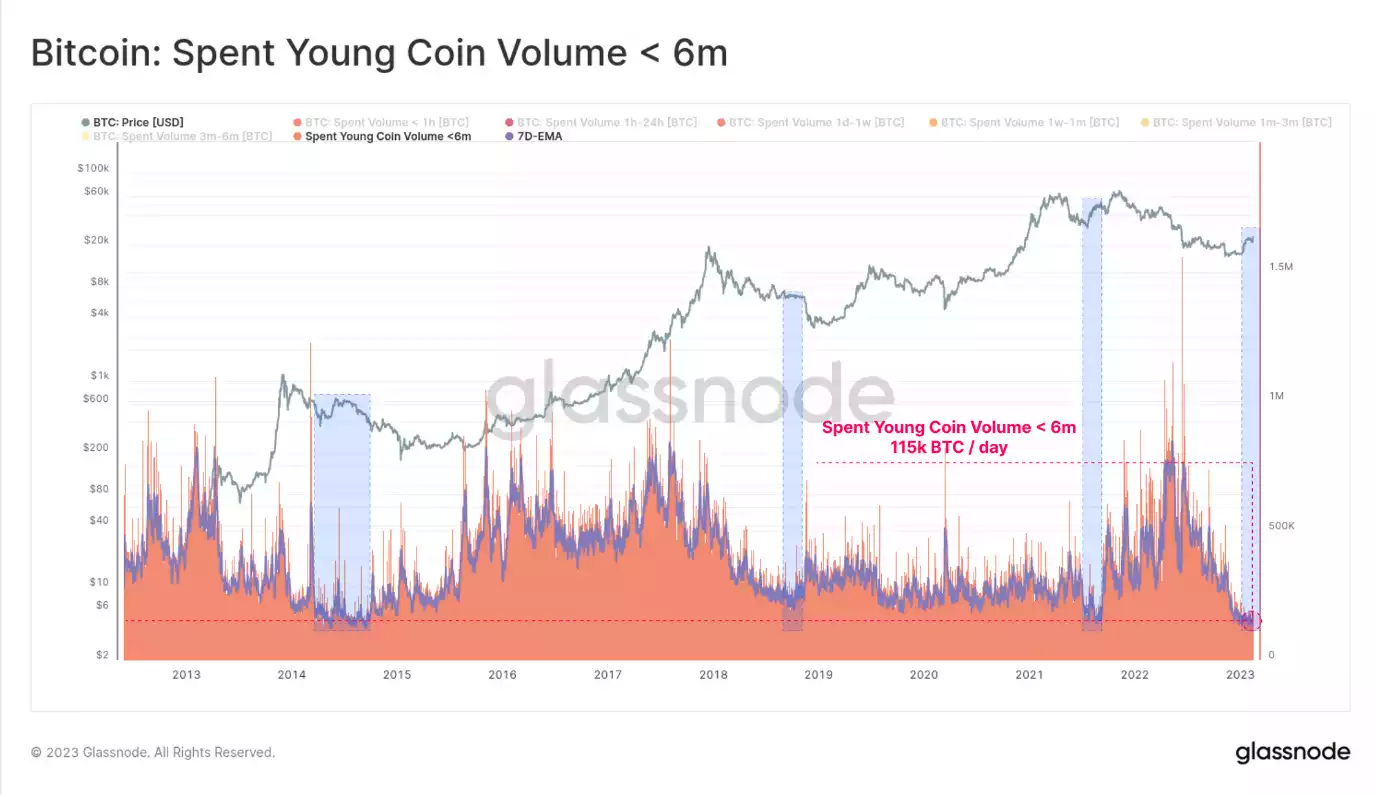

Recent data has shown that the adoption of Bitcoin is increasing, with both inscriptions and the price action of Bitcoin on the rise. While this may seem like a positive indicator for the cryptocurrency market, it is important to note that the volume of transferred coin value remains relatively low. In fact, data reveals that less than 115k BTC/day in total transfer volume can be attributed to coins younger than 6 months old. This low transfer volume is a rare occurrence in the history of Bitcoin and raises concerns about the sustainability of its current price level. However, it is important to remain optimistic as this may present an opportunity for the market to mature and stabilise, ultimately paving the way for more substantial growth in the future. As we continue to monitor the market and its fluctuations, it is crucial to keep in mind that while low transfer volumes are cause for concern, they may ultimately serve as a catalyst for the development of a more robust and stable cryptocurrency market.

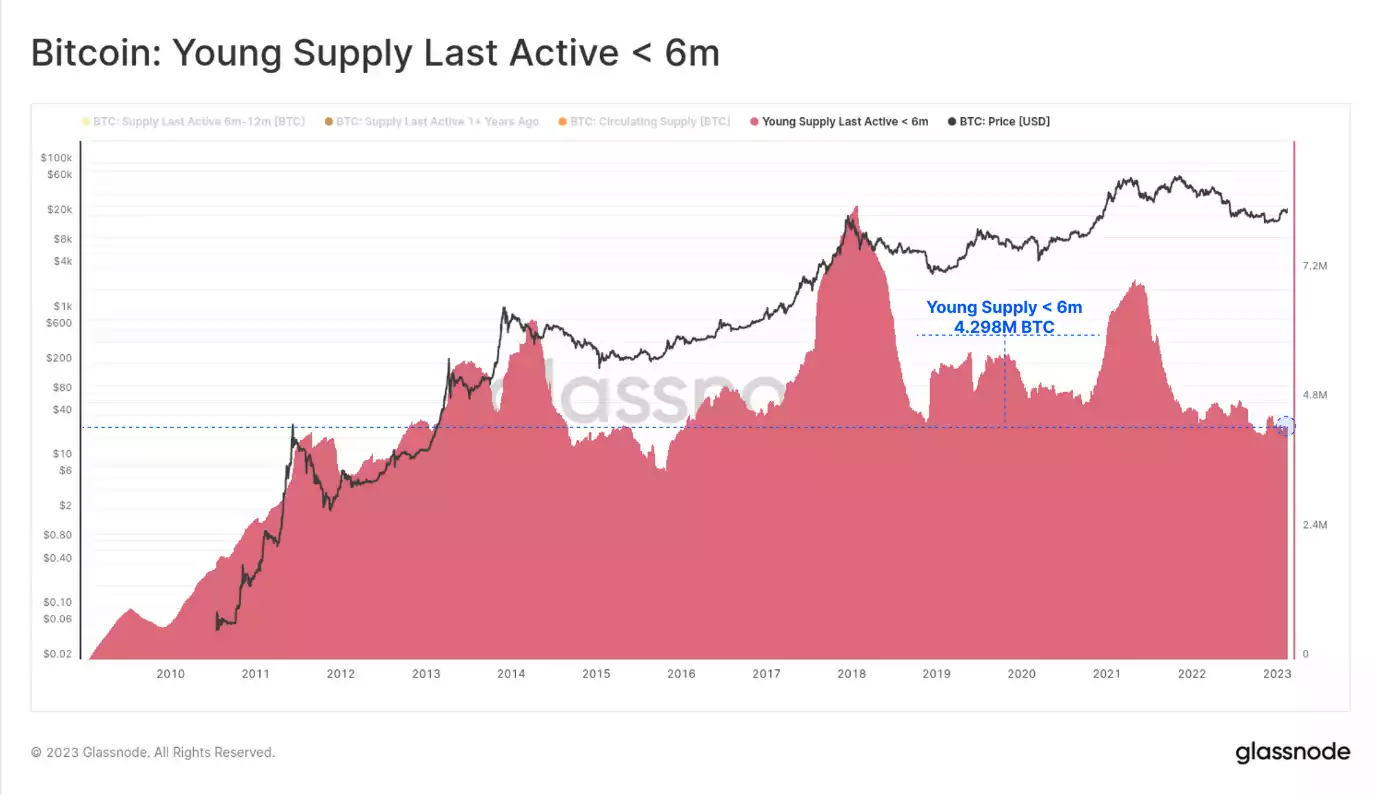

Despite the unpredictability that characterises cryptocurrency markets, some promising trends have been emerging in the Bitcoin arena. One such trend is the stability of the total supply of Bitcoin younger than six months, which has remained largely unchanged since the beginning of the year. This stabilisation is especially significant given the high levels of volatility that are typical of the cryptocurrency market. Currently, the total supply of Bitcoin is hovering around 4.298M BTC. To better understand these trends, experts have used a binary system that classifies coins based on their age, i.e., whether they are older or younger than six months. By doing so, it is clear that coins that are older than six months are currently extremely dormant in the aggregate, meaning that they are not being traded actively.

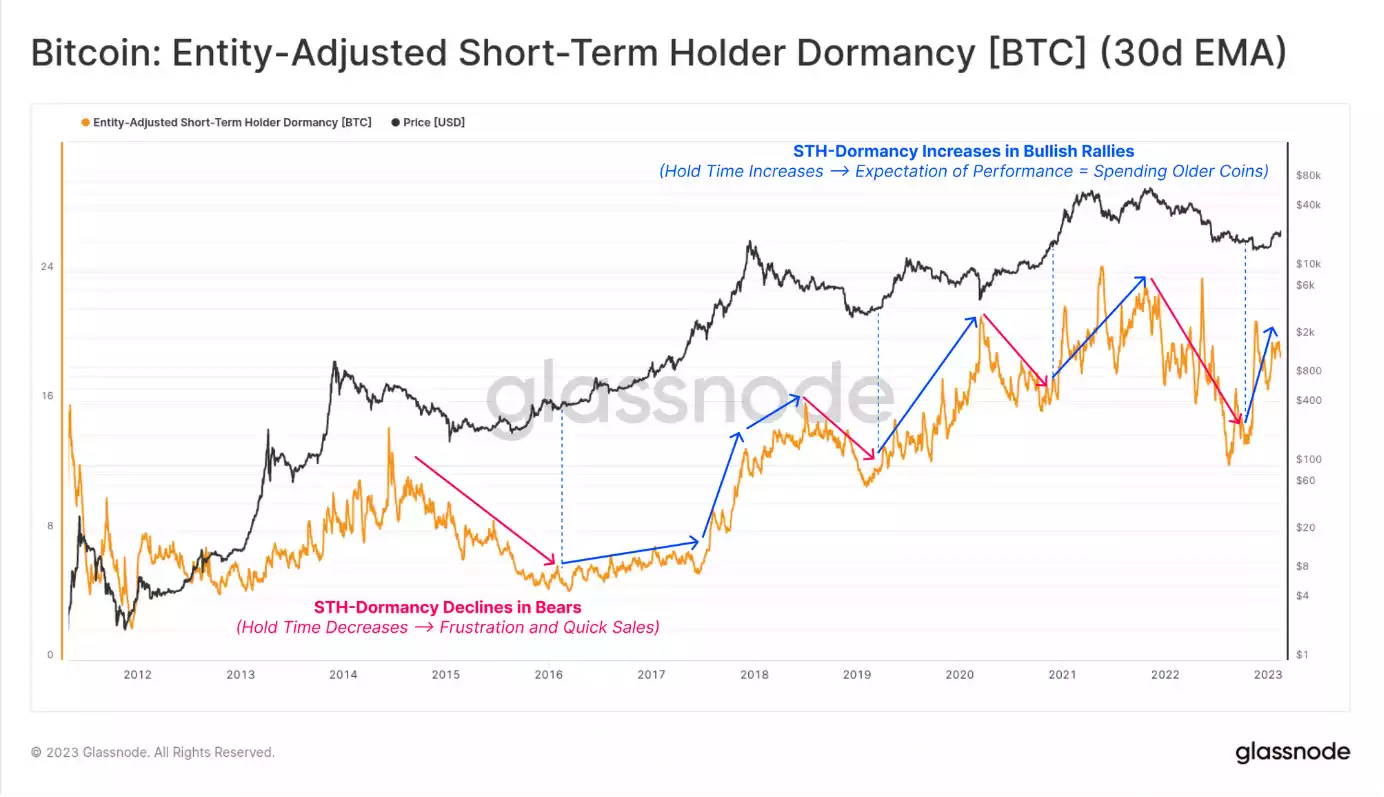

On-chain tools provide a powerful way to analyse investor behaviour patterns, offering insights into holding time and realised profit/loss. For instance, the Short-Term Holder Cohort (STHs) can be studied using Dormancy, which reflects the average age (in days) of coins spent by the STH cohort. When values are lower, it suggests that STHs are spending coins they acquired recently and are not holding for long, a behaviour that is typical in bear markets where frustration and price depreciation lead to quick sales. On the other hand, higher values indicate that STHs are spending coins with a more extended holding period, which is typical during bullish impulses when expectations of gains encourage investors to hold on longer. A sharp increase in STH-Dormancy suggests that investors are holding onto their coins a little longer during a market swing.

Despite the recent downturn in the market, there is a reason for optimism among long-term holders (LTHs). As evidenced by recent data, LTHs have dominated the losses experienced by investors during bear markets, with their dominance gradually increasing over time. While some top buyers of the prior cycle have been shaken from their position and experienced a final washout, final capitulation has peaked near the bottom of the macro bearish trend, signalling the potential for a turnaround. In fact, LTHs in loss have declined significantly from a peak of 58% in mid-January to just 21% today, a trend that has been seen in each prior cycle. Despite the declines in this metric, LTHs have found the necessary hope to hold onto their investments once again. As we move forward, it is important to recognise the strength and resilience of the LTH cohort in times of market volatility.

To conclude, the potential of the Bitcoin blockchain continues to grow, with the use of Inscriptions paving the way for a new era of data storage. Over 100k files have been immutably stored on the blockchain, creating a reliable and secure method for businesses and individuals to store their data. The beauty of Inscriptions is that they do not require large amounts of BTC to be transferred, yet still hold significant value for both owners and buyers. On-chain activity has seen net growth, indicating a rising level of trust in the technology, though transfer volumes remain subdued for both long and short-term holders. A shift in investor behaviour patterns is also evident, particularly in the filtering of coins sent to exchanges. This trend highlights a more strategic approach to investing in Bitcoin, with investors seeking to maximise profits and minimise risk. The use of Inscriptions has created a new and unexpected source of demand for block space on the Bitcoin blockchain, signalling the vast potential for this technology to revolutionise the world of data storage.