Best time to buy Gold and Silver – Historic Seasonality says now

News

|

Posted 01/07/2021

|

15878

The start of a new financial year often sees investors reviewing their investment strategy for the year ahead. The timing of such a review when considering gold and silver could not be better when it comes to the coincidence of the best time to enter each market from a seasonality perspective.

Best time to buy Gold and Silver – Historic Seasonality says now

Precious metals analyst Jeff Clark digs up all the empirical data from 1975, coinciding with when Americans were allowed to buy gold again, and charted the average gain and loss for every entry day of the year.

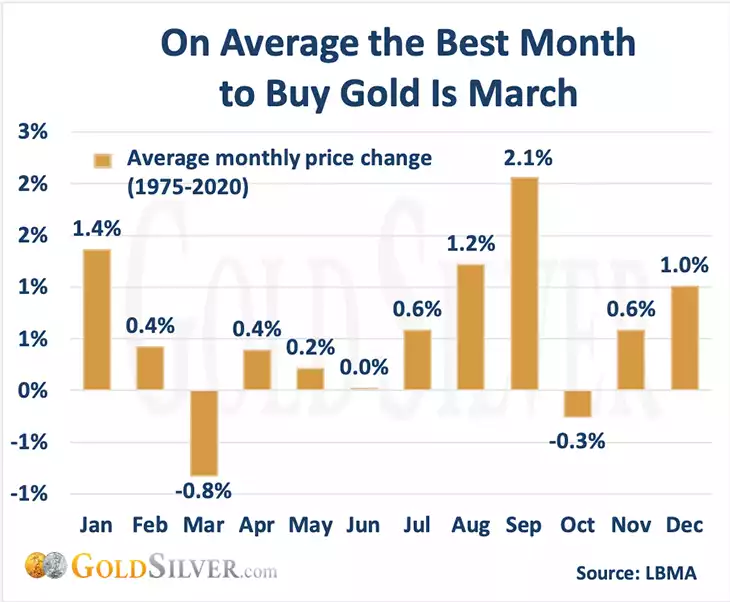

Firstly, looking at gold, it tends have a bit of a surge in the first couple of months, tracks a slow and lumpy grind up through to July and then performs increasingly strongly right through to the end of the year. And so whilst early January is the standout best time to buy, so to are March, early April and around right now.

Silver is a fairly similar story with early January the best, and good entry points in mid March and right now, then off to the races for the rest of the year at percentages around 50% better than gold’s gains.

Looking at this a little differently, the following charts show the best month to buy each metal. Remember you are looking to buy in the dips so the low to negative numbers are best…

This is data averaged over 45 years (a little less than how long Ainslie’s have been around by the way) so how does that correlate to this year so far? You will see from the chart below it is actually a fairly good correlation with that bottom in March and the correction in June setting up now as a solid entry point for potentially great gains.

In silver this looks like the following:

Again the correlation with this year is reasonably compelling with the March to May lows, particularly that March bottom fitting the chart and this June dip as well. If history repeats we should hope for a strong rally this month of July.