Basel III And Gold

News

|

Posted 20/11/2012

|

8236

In the never-ending and important debate over whether gold is money, there is a voice that has recently spoken, and you might want to hear what it said. Many voices worth listening to have said gold has no utility. For example, Warren Buffett is famous for saying that we dig gold out of the ground, then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility, he says. Anyone watching from Mars would be scratching their head.

But there is another voice, much more important than Buffett, that has, in the last 6 months, uttered the opposing view. It's not the voice of a newsletter or any analyst or expert, or any one person, although many agree with this voice, including me. It is actually the voice of a group, a club, that has been described as the most exclusive, secretive and powerful club in the world. The New York Times has called them "the secretive panel that establishes global banking rules" - the central banks' central bank. They meet four times a year in a little town called Basel in Switzerland. Edward Jay Epstein did an article on them for Harper'sMagazine back in 1983 where he describes their shyness about publicity and the sophistication of their clubhouse. They have a nuclear bomb shelter in the basement, an entire hospital, as well as some 20 miles of subterranean archives. They make the Fed look like a lemonade stand.

It's an important voice. When did it speak and what did it say? Well, they have spoken, with comprehensive new rule sets, "frameworks" they call them, only three times since their inception in 1974. In 1988, they issued Basel I and in 2004 it was Basel II. And now in 2012, they are issuing Basel III. They are men of few words. They issue no binding legislation, but in the banking world, what they say goes. Both Basel I and II took the then fashionable view of what money is - government bonds, mortgage backed securities, cash, etc. Gold was included in what they allow as capital, but as a "tier 3 asset" (not real money), and thus was only allowed to be reserves for loans at just 50% of its market value, much like, say an art collection would be. Since 2004, a lot has changed with all that. Mortgage-anything has become ultra-toxic, major countries are teetering on bond defaults, and the race to debase cash is raging. These developments have moved the Basel Committee to make some changes, but I'll focus on just two here.

The most significant change is moving gold from its tier 3 status to tier 1 capital as 100% loan-backing reserves, the same as cash and bonds. For the first time in 42 years, gold is being brought back into our financial system as money. All the world's banks are now storing this metal, not as some 3rd rate "asset," but as all the world's working capital - its money. So it's not just any voice, it is the ultimate voice on what is money that has spoken. Gold was removed from our system by Nixon in 1971, when he took us off the gold standard by disallowing foreign governments to exchange their dollar reserves for US-held gold. Ironically, they were doing this in great volume because of Washington's lack of fiscal discipline. Now, as gold has appreciated from $35 to $1700 in the unofficial gold standard interim, Washington's lack of fiscal discipline is again an issue, and we are now being forced to recognize gold as official money again.

You probably were not aware of any kind of return to gold as official money, but these Basel III rules are set to go into effect January 1, 2013 and have prompted Brian Hicks to call it "The Secret Return to the Gold Standard." Brian Hicks is the managing editor and chief investment analyst of The Wealth Advisory. In addition, Brian is a contributor toWealth Daily and Crisis And Opportunity. He has been a keynote speaker at international investment conferences, as well as a guest commentator on the financial television networks, CNBC, and others. Hicks was part of a small minority opinion (including me) years ago, the peak oil nuts, saying that with oil going to a then shocking $70, we were entering a new age of higher oil. This was in the face of the prevailing opinion verbalized best by Steve Forbes when he said that market forces would fix the oil "spike," and we would soon be back to a normal $40. Now we are paying $110 Brent in a really bad global economy. He was right about oil, and so far, he has been right about what is happening with gold.

In his "Secret Return" report, Hicks points out several news reports lately that investors seem to have glazed over. He mentions John Butler, managing director of Deutsche Bank of London, saying "In what might be the most under-reported financial story of the year" we are seeing an "important step in the re-monetization of gold." Reuters, he says, has quietly reported that "Banks are already preparing for the full implementation of gold's dominance as the new first class security for banking." The Basel Committee is not alone in this new trend to re-monetize gold. Major brokerage firms such as JP Morgan have started accepting gold as collateral in a role typically filled with Treasuries or their equal. Even back in February, 2011, when the Basel move was just being whispered about, The Wall Street Journal online ran a story J.P. Morgan Will Accept Gold As Type Of Collateral; the lead sentence was: "Gold hasn't reinvented itself as a currency yet. But it is getting closer."

However, there are those who are buzz-killing the possible effect of Basel III on gold, such as Jon Nadler, Senior Metals Analyst at Kitco. At his blog, In The Lead, he recently wrote an opinion, "In The Lead - Basel Bull", where he calls on Jeff Christian's CPM Group to explain how the tier 1 change will not induce more gold buying by the banks:

Much hard money newsletter noise has recently been made about gold and its role in the international banking system. The focus by the writers has mostly been on central bank purchases and on the putative Tier One asset status to be conferred upon gold by the Basel Committee. Well, not all is what it appears to be. Central bank purchases have not been overly large compared to historical levels seen in recent years and the massive gold purchases that certain banks are envisioned as making immediately in the wake of gold's attaining Tier One status are simply wishful thinking. But, hey, don't take our word(s) for the above. Let's look at a cogent take on these matters by the good folks over at CPM Group New York.

In their May 31 Market Alert, the researchers at CPM bravely expose certain myths and misconceptions surrounding gold and banks -central or otherwise- as follows:

There is an aura of desperation in the internet gold press, as those who still expect gold prices to rise grasp for any-thing that could be interpreted as being potentially bullish for gold. The collapse of the euro, a stock market crash, a Chinese 'recession,' and other potential catastrophes are pointed to with glee. Other potential developments within the gold market are being trotted forth by gold marketing groups as reasons to believe gold prices inexorably must rise sharply...

As for the Basel Committee's re-rating of gold, CPM Group reminds us that "First, one must point out that it is not at all clear that the Basel Committee on Bank Supervision, which sets these guidelines, will re-rate gold. Even if it did, the purpose on the part of commercial banks in seeking this change is not to allow them to buy more gold. They want to use their existing gold deposits - deposits their clients have made with them of gold - as Tier One assets for the purpose of meeting the tighter liquidity ratios. They are not planning to buy more gold. It would be highly unlikely that any bank would purchase any gold, transferring funds to gold from currencies."

The CPM Group is a respected authority on commodities in general. While not being outright bearish on gold, they are viewed by gold bulls as an official wet blanket that has been dragged kicking and recanting all the way along gold's bull market so far. In fact many use CPM Group's forecasts as a contrarian indicator. For example, Jesse's Cafe Americain, a popular gold website, responded on March 27, 2012, when CPM projected flat gold prices for the next of couple years:

In one of the more bullish developments for precious metals, the CPM group has announced that 'The Top' is in gold (Jeff Christian and CPM Calls 'The Top' In Gold), Given their track record in forecasting the metals, this is rather bullish.

Both Nadler and Christian got put on a roster with Dennis Gartman recently in the unflattering piece titled "Grandich vs. "The Three Stooges of Gold Forecasting" - Gartman, Nadler, and Christian". munkee.com had this to say about that unpleasantness:

The fight started last Wednesday when Peter Grandich, the well-known goldbug and author of The Grandich Letter, wrote a scathing missive that called out fellow investment newsletter writer Dennis Gartman on his assertion earlier this week that gold is now entering a bear market ... as reported in an article by Bloomberg entitled Death of Gold Bull Market Seen by Gartman:

Gartman has since made news with such articles as "I'm Back Into Gold: Dennis Gartman" last March wherein he proclaims "I was wrong." Gartman has a distinguished style of speech in his analysis where he says "I'm short of sugar" or "I'm long of corn." After the gold change, this induced Tyler Durden to name a Zero Hedge piece "Dennis Gartman Now Long Of Flip Flopping In Laughing Stock Terms". Gold bulls like to point out the persistent error on the bearish side of gold for all three of the stooges. And they like John Maynard Keynes as Shemp.

Brian Hicks strongly disagrees with the above bland outlook of Nadler and Christian on recent bank purchases of gold in light of currency debasement. He writes in "Secret Return":

The biggest gold-buying spree we've seen over the last four decades is going on right now, as banks have begun to stockpile more of it. In fact, the World Gold Council revealed net central bank purchases in 2011 exceeded 455 tonnes (14.5 million ounces), the largest purchases since 1965. And it reported banks will purchase 700 tonnes (22 million ounces) of gold for this year alone...(The Secret Return To The Gold Standard)

There is a definite trend away from bonds, mortgage-based "products" and even national currencies among the bankers, especially among the emerging Asian banks. Most of the increase in gold purchases since 2008 has been by these banks pushing the total to 400 tonnes a year and possibly beyond.

The second of the Basel III accords I want to focus on is the requirement to, not only include gold in tier 1, but to raise minimum tier 1 capital reserve backing of loans and all other risk assets, the tier 1 capital ratio, from the current 4% to 6%. This is a 50% increase, which is a big jump for this fairly stable number. While 4% is the minimum, 6% or better is recommended, and the banks of the world have been averaging a steady 8%-9% in recent years. So the raise in the minimum to 6% does not demand any global increase in tier 1. If you assume that banks like to operate at a certain margin of safety relative to Basel, they would seek to do at least the 50% ramp-up recommended by Basel III.

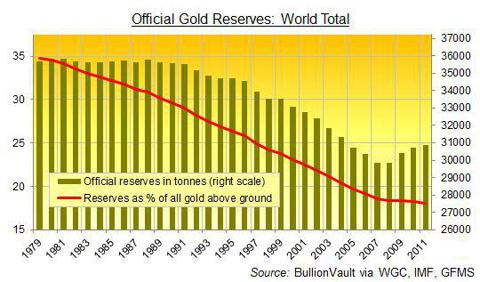

Moving the bank held gold up from current levels is something that may be happening with or without Basel III as this graph shows:

After the last bout with currency problems in the '70s, a high 35000 tonne gold level persisted for years before a slide back down from 1992 to 2008 - the careless age of debt-based reserve. That trend has been in clear reversal since 2009. With Basel III, the new trend may increase in intensity. Just how far a reversal might go is strikingly illustrated by this chart:

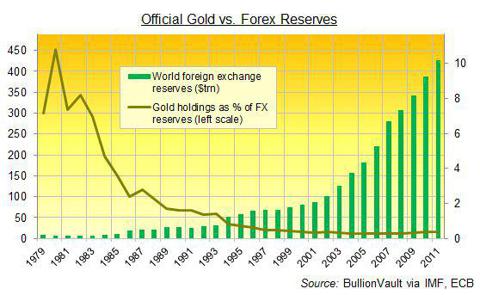

This shows the vast switch that has taken place since the '70s in bankers' confidence away from gold reserves into the blizzard of printed money as reserves. Keep in mind that the supply of new gold is flat while the supply of new paper money is boundless. To just get back to the gold/currency balance averaged over the decade of the '80s, gold would have to increase in price some 15 fold. Many investors fear gold when they look at a price chart (especially a linear one) and see the sharp rise well beyond the 1980 high. The word "bubble" floats into their mind. But if a monetization trend is to be a major fundamental driving gold, charts like the two above (and there are many more) suggest we are nearer the beginning of a bubble than the end. The price may seem so overextended only because you have such a massive amount of "money" wanting into such a small space. The move of this money could still be in the early stages.

As if the bank currency reserves were not unstable enough, I think there could be rotation soon away from bonds into gold as a safe haven not only by banks, but by all investors. The bond market is 14 times the size of the gold bullion market. The supply of bonds can be increased willy nilly while the investment gold supply is increasing at just 0.5% a year. It wouldn't take much of a rotation to force the price of gold sharply higher.

In response to Basel, it has been noted in a piece "Is The Next Big Thing 1700 tonnes Of Gold Purchases?" that if we would see a modest 2% a year migration away from debt counterparty to gold in all the commercial bank tier 1 capital in the world, this would be about 1700 tonnes of gold a year at current prices. To put such a possible trend of tier 1 capital into perspective, think of jewelry. Gold jewelry gobbles up over 60% of the measly 2400 tonnes a year in new mine production (just 1.4% of the above ground supply). So gold price analysts like to study every small variation that happens there, because it moves the needle on the gold price. A mild 2% a year tier 1 migration into gold is roughly equivalent to the entire demand coming from jewelry! Heaven forbid there should be any kind of panic out of bonds and/or currencies.

In light of this possible migration of tier 1, let's consider the assertion by Jeff Christian above that commercial banks are not interested in buying any gold because the Basel change automatically boosts their tier 1 capital via the re-rate of the gold already deposited with them. It's true, that will be a big boost. According to World Gold Council figures, the world total for privately held investment gold currently (end of 2011) stands at 33,000 tonnes. Of this, a large amount (estimates are scarce) is placed in storage services outside the realm of banking, but let's assume it is only about 10% leaving 30,000 tonnes deposited with the banks. There is about $4.3 trillion of tier 1 capital in the commercial banks. At a current gold price of $1700 and a current average tier 1 capital ratio running around 9%, you can calculate that, of the 50% increase in tier 1 ratio the banking world seeks, the re-rating of gold to tier 1 accomplishes around a 40% tier 1 ratio increase. That leaves some 10% to be made up by either bonds, currencies, and other endangered species of money - or new gold purchases. If they would prefer to make all of this increase with gold, and that certainly is the growing preference, you can also calculate that this amounts to 5 times the entire demand coming from jewelry spread out over however many years the banks want to take for the implementation of a 50% increase. They may want to do more than 50%. Heaven help us if our bankers like Basel and gold too much.

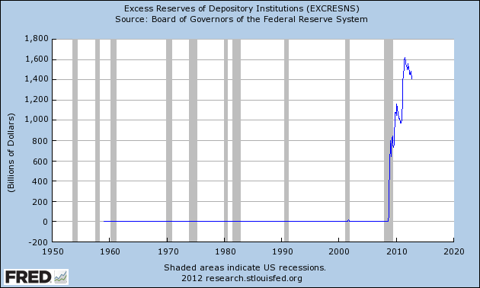

And they do like gold more and more. There is a definite trend afoot. If you take the Nadler/Christian view on bank buying of gold, you must (1) deny any trend to higher reserves over and above requirements, and (2) deny any migration of reserves into gold. But there is now a shocking trend by banks in both of these things. To illustrate point, one need only to look at a chart of excess reserves (those beyond required):

I think it's safe to say there is a trend here in our post Lehman world. And as for point, clearly, banks want more of this reserve cushion in gold as discussed in a recent Moneynews article Banks Across the World Catching Gold Fever. Speaking of Basel III, the article said:

This move, if adopted, could cause more banks to invest in gold to dress up their own balance sheets. U.S. Treasury bill rates are so low that many bankers will ask, "Why not hold at least 10 percent in gold, giving us the chance to earn a lot more than 1 percent per year in a 'currency' that no government can inflate?... What this possible new banking regulation means, in practical terms, is that individuals who hold gold in their bank account might soon be able to take out a bank loan using nearly 100 percent of their gold's market value as collateral.

If the trend continues, the WGC (World Gold Council) might need to add another category to its gold demand reports.

If the trend continues, your neighborhood banker may be offering more than a free toaster to open up a gold deposit. Commercial banks will now want gold reserves for the same reasons central banks want them - and there is a definite new trend there since 2009.

Like Basel II, there is a long implementation time-frame for Basel III. There is a schedule with full compliance required by January 1, 2019. Basel II was gradually done in the sleepy years until the Lehman debacle. Then Basel II was sped up and Basel III was hatched (a little like QE II, QE III, and QE Infinity). The implementation of Basel III may be quick. As Wikipedia phrases it:

Politically, it was difficult to implement Basel II in the regulatory environment prior to 2008, and progress was generally slow until that year's major banking crisis caused mostly by credit default swaps, mortgage-backed security markets and similar derivatives. As Basel III was negotiated, this was top of mind, and accordingly much more stringent standards were contemplated, and quickly adopted in some key countries including the USA.

Banks have been reluctant to loan, but when the much discussed uncertainty log-jam breaks and tier 1 capital begins competing for new customers, banks will want to have their Basel ducks in a row. If banks prefer gold for any new loan making capacity, as they seem to be doing more and more, it could put a strain on mining capacity and the price of gold.

The best way for investors to benefit is not with short-term trading, but with at least a year or two planned hold of a good spot price ETF like (UGL). This is an 2X tracking fund that returns twice the movement of the gold price and tracks well over long periods. It is not an ETN, which is structured as a debt instrument, a definite negative in today's world. It does not promise to hold gold for you, which is also a potential problem.

As another choice, the small gold miners come to mind as a way to leverage a gold move. However, these are fraught with problems that are hard for investors to analyze. The ones with a high level of insider ownership reflect the cases that have been "analyzed" and liked by the most knowledgeable of people, the ones running the company. I like to call them the high "IH" cases (Insider Held), and it's the first thing I look for in a miner. I don't know gold mining, but they most certainly do. I like to keep tabs on how the IH is changing. Miners that have a sharply decreasing level tend to be poor performers, and ones with stable or climbing levels seem to do well. A non-miner investor can look at the financial results and see a good buy per current production, but the IH factor says a lot about future production, the part that is not baked into the stock price already. And with a raw speculation with all of their gold still in the ground, it is about the only solid thing to go by.

If you don't like miner risk, you can invest in one of the royalty companies. These serve as capital sources which fund a small miner's costs where a bank would hesitate. In return, they contract to buy a percent of future production at current gold prices. Depending on the development period, this usually means buying a stream of current gold at years-ago prices from when the capital was provided. A royalty company gets discounted gold minus the miner risk. The royalty stocks tend to be more stable in the gold stock selloffs, and individual miner catastrophes don't buffet you. My favorite is Royal Gold (RGLD), but Franco Nevada (FNV) and Sandstorm Gold (SAND) are two other choices.

Source: http://seekingalpha.com/article/1016161-basel-iii-and-gold