Banning Cash & Negative Interest Rates

News

|

Posted 11/02/2019

|

12554

The unprecedented monetary stimulus unleashed by central banks post GFC has had many unintended consequences. One stimulus measure was cutting interest rates, in a number of countries even into negative territory. Whilst the US Fed raising rates is grabbing global headlines and rattling global markets, the fact remains that most countries are still maintaining historically very low rates as all that stimulus is simply not really working.

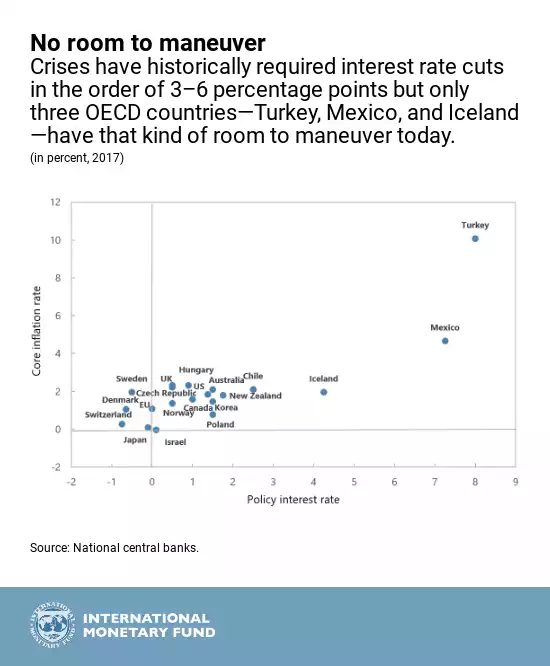

The IMF recently released a paper discussing this setup with the core issue being presented that severe recessions historically require central banks to cut interest rates by 3 to 6 percentage points to prevent complete collapse. The problem is that there are only 3 OECD countries in the world with rates high enough to do that without going negative.

The paper, titled “Cashing In: How to Make Negative Interest Rates Work”, then starts to address that ‘issue’ of negative rates.

Quite simply, if rates go negative, you need to pay the bank interest not them paying you. That’s awesome for inflation (which is what they want) because who is going to leave money in the bank if it’s devaluing before your very eyes. It forces people to take it out, borrow more, and then use that to invest and consume. However the issue then becomes people withdrawing cash and sticking it under the bed, removing the need to pay the bank the interest.

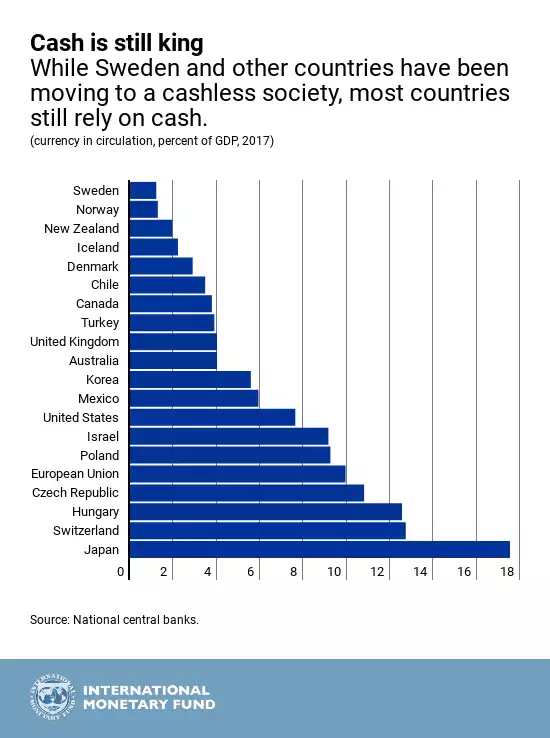

And so again we are faced with the reality that governments around the world would really like to phase out cash altogether… it’s just too hard to rob from you. But as you can see below, whilst gaining traction, it is still hard to achieve quickly. Quickly is the key word here if a recession strikes.

So what to do? The ideal is the make cash as costly as bank deposits so they can make interest rates deeply negative if ‘needed’. And so this is what the IMF suggest:

“The proposal is for a central bank to divide the monetary base into two separate local currencies—cash and electronic money (e-money). E-money would be issued only electronically and would pay the policy rate of interest, and cash would have an exchange rate—the conversion rate—against e-money. This conversion rate is key to the proposal. When setting a negative interest rate on e-money, the central bank would let the conversion rate of cash in terms of e-money depreciate at the same rate as the negative interest rate on e-money. The value of cash would thereby fall in terms of e-money.

To illustrate, suppose your bank announced a negative 3 percent interest rate on your bank deposit of 100 dollars today. Suppose also that the central bank announced that cash-dollars would now become a separate currency that would depreciate against e-dollars by 3 percent per year. The conversion rate of cash-dollars into e-dollars would hence change from 1 to 0.97 over the year. After a year, there would be 97 e-dollars left in your bank account. If you instead took out 100 cash-dollars today and kept it safe at home for a year, exchanging it into e-money after that year would also yield 97 e-dollars.

At the same time, shops would start advertising prices in e-money and cash separately, just as shops in some small open economies already advertise prices both in domestic and in bordering foreign currencies. Cash would thereby be losing value both in terms of goods and in terms of e-money, and there would be no benefit to holding cash relative to bank deposits.

This dual local currency system would allow the central bank to implement as negative an interest rate as necessary for countering a recession, without triggering any large-scale substitutions into cash.”

Now to be clear, this is not a cunning plan conjured by Baldrick. This is from the International Monetary Fund as a considered solution to the next crisis. That next crisis will no doubt come about from the extraordinary debt burden added to the world from the last debt induced crisis of the GFC. Negative interest rates make not taking on more debt seem silly. Who wouldn’t take on more free debt to buy stuff yeah? And so the ante is upped until complete collapse or complete loss of faith. Our whole ‘monetary’ system is completely and utterly faith based. That $50 note in your wallet is a piece of plastic, those numbers on your bank statement are electronic digits and you are just an unsecured creditor of the bank.

It is this kind of folly that reinforces the value of a 5000 year old hard asset like gold and silver. Practically however, you may indeed question ‘how can I carry my gold and silver around easily and transact on day to day goods and services’? We will discuss tomorrow how combining 5000 year old gold and silver with the new world technology of blockchain can overcome that very question.