Bank of Japan Steps in to Control Yield Curve

News

|

Posted 04/08/2023

|

1863

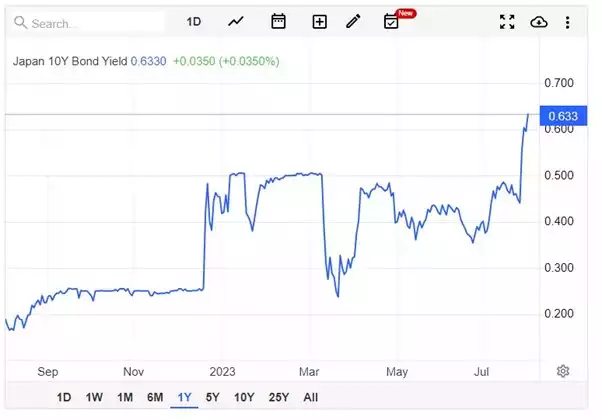

Last Thursday, Japan’s 10 year bond rate was still well below the upper bound of 0.5%, but has since pushed clearly through that range to 0.63% Mid this week. This has been met with a new quantitative easing from the Bank of Japan, and claims that the economy may well be able to cope with a cash rate of 0.5% to 1%. The bonds spiked immediately after the announcement that the BOJ would be willing to let rates move either side of 0.5%.

Source: https://tradingeconomics.com/japan/government-bond-yield

Whilst the rest of the world’s Central Banks have 10 year rates pushing 5%, Japanese bonds are still yielding less than 1%. In an effort to keep a lid on sudden rate spikes, the on Monday the Bank of Japan announced a 300 billion yen ($3.2 billion) “special market operation” to buy up debt issued by the Japanese Government.

This was the first purchase since February, and comes as almost every other central bank is aggressively reducing their balance sheet. Japan has long been held up by Modern Monetary Theorists (MMT) as an example of why countries don’t need to worry about their national debt, but Japan may be the canary in the coal mine as they struggle to cope with official interest rates of even 1%.

Japan has the highest debt to GDP ratio in the world, an eye-watering 264% according to IMF data. It may come as no surprise then that they are one of the countries least able to cope with the cost of debt rising. They have the lowest yields by a country-mile.

Source: https://tradingeconomics.com/bonds

As long as holders of Yen hold the line, there isn’t going to be any panicked race to dump the currency. However, markets have been speculating for months that the last major central bank to retain a dovish position could finally cave as persistent inflation and rising global interest rates put constant pressure on Japan’s bond yields and currency. We wrote to this in terms of the so called Yen Carry Trade earlier this week. Yesterday too was a reminder of the patience of ratings agencies getting thin amid such reckless accumulation of government debt.

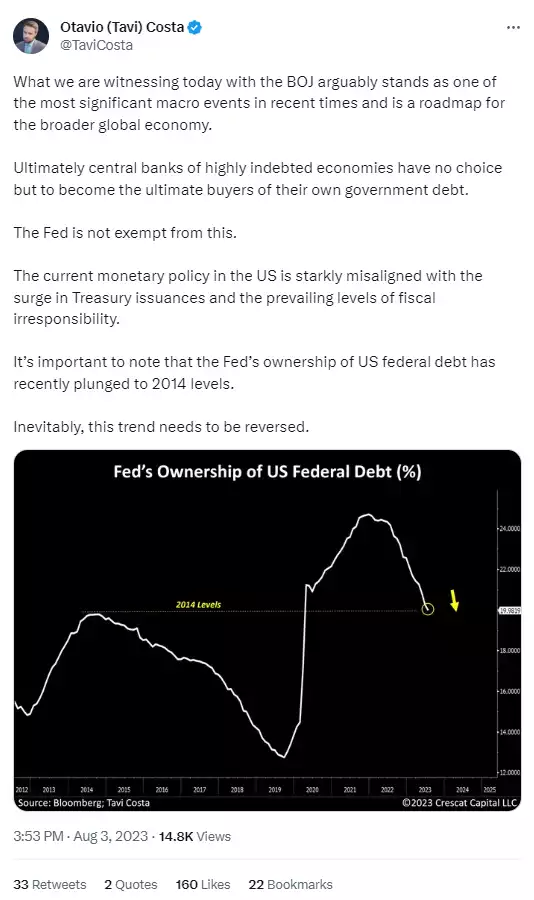

Critically too, Japan is increasingly becoming the ‘roadmap’ for other central banks. This is not lost on Crescat’s Tavi Costa who (typically) insightfully tweeted as follows:

As the global debt implosion gathers pace, Japan may well be one to watch as national currency holders see their savings purchasing less and less and their governments continuing to artificially control markets.