Ban the Bank Shorts - What’s in A Rumour?

News

|

Posted 08/05/2023

|

8192

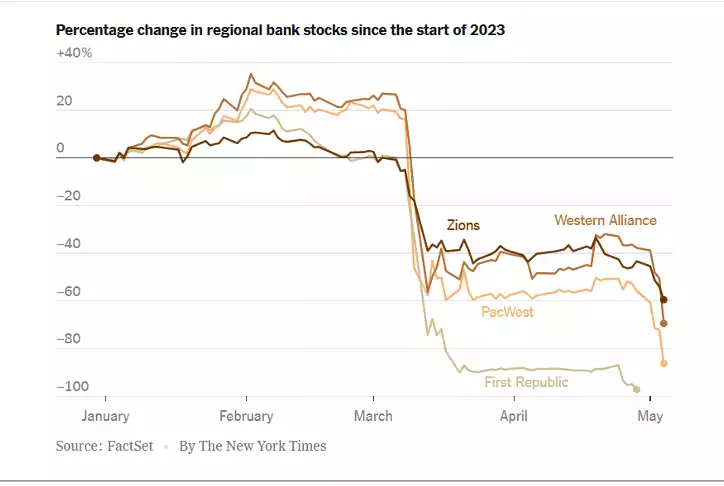

Nothing to see here, just another scapegoat for the US financial system creaking and cracking under enormous pressure from the Federal Reserve’s historically fast rate escalation, with last week seeing another 25bp hike, and 3 banks’ stock prices subsequently collapsing. The scapegoat this time is the practice of short-selling, with 5 banks in 60 days collapsing, the fear of more possible collapses is now in the front of mind for depositors. PacWest has seen its share price fall by 90%, Western Alliance 75% and Zions 60%. So is this a last ditch attempt to contain the contagion regulators had hoped to contain? And what happened in September 2008 when Regulators banned short selling?

What’s in A Rumour?

‘Short-Selling Ban’ rumours in the US go starkly against the recent Fed commentary ‘The U.S. banking system is sound and resilient’. On Thursday last week, Karine Jean-Pierre, the White House Press Secretary told reporters the Biden Administration was closely monitoring the markets ‘including the short-selling pressures on healthy banks’. Analysts at JPMorgan and other industry players are now saying regulators may be forced to enact a short-selling ban on financial stocks, with short-selling rumours scaring people into thinking more banks will fail. This is notably after CEO of JPMorgan Jamie Dimon, fresh on the heels of his $26billion windfall from the absorption of First Republic, stated that this would hopefully draw the “mini-bank crisis” of the last two months to a close.

And then three more banks started to collapse:

Source: New York Times

Short Selling Villains

So if anyone is making money in this crisis, they must be the problem, nothing else behind the green curtain. With short-sellers reportedly making $1.2billion in the first 2 days of May in shorting these regional bank stocks (notably they made $380 million just in shorting First Republic) the government and JPMorgan are now arguing these ‘villains’ must be stopped before more banks face the same fate.

But numerous studies have been undertaken into these bans, and they have notably seen added costs as opposed to any benefit. Looking back at 2008, the ban was the beginning of the end for the bank stocks.

2008 Market Top

As Gregoire DuPont tweeted on the weekend ‘Short Sell Ban on Banks be careful what you are wishing for. On the 9th of September 2008, the SEC prohibited short selling in financial companies. Banks rallied 27% on the day, but went down -75% before the March 2009 lows.’

After the collapse of Bear Stearns in March 2008, 10 banks followed between the 6 months to September 2009 when the short ban was enacted. Within the next 6 months 34 banks followed, see here: List of bank failures in the United States (2008–present) - Wikipedia.

The 2008 ban had serious ramifications and some culpability in the September 2008 share rout, that current estimates believe added $500 million in additional costs to traders and damaged the public faith in financial markets. In 2009, Chris Cox, the then SEC Chair that was in charge of the decision, stated that he came to regret his decision, ‘While the actual effects of this temporary action will not be fully understood for many more months, if not years, knowing what we know now, I believe on balance the commission would not do it again,’ Cox told Reuters in a telephone interview in 2009 ‘The costs appear to outweigh the benefits.’

Be Careful what you wish for

Banks have had very little time to adjust their portfolios to the Federal Reserve Freight Train that has had a collision course with the US and World economy. A short selling ban is a ‘look over there’ tactic to remove the blame from where it squarely sits – interest rates need to rise, but this rapidity doesn’t allow individuals, companies and, most importantly right now banks, time to adjust. 2008 marked the start of an escalation in bank failures and 2023 is not looking different no matter who they blame.