Back To The Gold Standard?

News

|

Posted 24/02/2023

|

15001

With increasing pace and activity, individual states in the US are reasserting their right to make gold and silver legal tender for payment of tax and debts. At present twelve U.S states accept gold and silver coins as legal tender, and more are seeking to clear the way for the precious metals to be returned to their rightful place as ‘money’.

Between the 1933 departure from the gold standard to a gold exchange standard and the untethering of the Dollar completely from gold in 1971, it was illegal for citizens in the US to hold any significant amount of gold or use it as a money in commercial activity. Instead Federal Reserve notes, backed only by the full faith of the U.S Government, were the only option.

All of those moves by the Federal Government were unconstitutional. Under Article I, Section 10, Clause 1 of the U.S. Constitution:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts.

The first state to (re)elevate precious metals was Utah which moved to constitutionally recognize gold and silver as legal tender under the Utah Legal Tender Act (passed 10 March 2011). The State of Utah "recognizes gold and silver coins that are issued by the federal government as legal tender in the state and exempts the exchange of the coins from certain types of state tax liability."

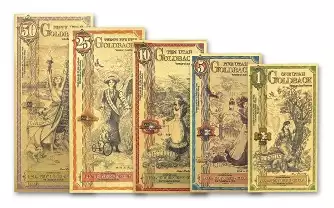

A collection of Utah Gold-backs

In 2014, Oklahoma Senate Bill 862 was passed: "Gold and silver coins issued by the United States government are legal tender in the State of Oklahoma. No person may compel another person to tender or accept gold or silver coins that are issued by the United States government, except as agreed upon by contract."

In 2018, Wyoming House Bill 103 was passed, whereupon the State recognizes as legal tender "coin having gold or silver content; or refined gold or silver bullion which is coined, stamped or imprinted with its weight and purity and valued primarily based on its metal content and not its form."

Rules related to gold and silver in the United States vary significantly, with many states imposing sales tax on gold and silver. Here is a full list. Some of the more notable oddities are California which has a 7.5% rate on transactions below $1,500, Illinois charges 6.25% for South African Krugerrands only, all other bullion is exempt, and Ohio: Basic sales tax of 5.75% applies to silver and gold bezels, high-purity bullion is exempt.

A 14-karat Bezel

At first, change is slow, but gold and silver, as natural money continue to make their long march back to their rightful place as money-de-jour. Australia is a little farther back in some senses, but we can feel lucky we don’t need to navigate a patchwork of different states rules and taxes, and that all pure bullion, regardless of whether it is an ingot, legal tender coin or round, is GST exempt.