BRICS to announce gold backed currency – MUST READ

News

|

Posted 12/07/2023

|

9365

Imagine if you will a new group of countries comprising well over half the world's population and including the fastest growing economies in the world forming a coordinated bloc. Some of the main sovereign states have been the victim of the weaponisation of the world's current reserve currency and others the recipients of rampant inflation effectively exported from that same hegemonic issuer of that reserve currency. Carrying record levels of debt denominated in that currency, the interest rates on that debt have been skyrocketing on the back of its central bank hiking rates at an unprecedented rate. That same hegemony has ‘printed’ into existence more new supply of this Fiat currency (Fiat being backed by nothing more than the promise of the issuing government) in the last few years than in all of its century long existence prior. When fundamental properties of the definition of ‘money’ are intrinsic value and trust, such scale of debasement laughs in the face of any reference to that currency being money. It would appear we are getting very close to the world losing their sense of humour.

Last week we learned that the BRICS group of nations is set to announce a gold backed common currency for their next summit in Johannesburg in August and that there are an increasing list of nations wanting to join the bloc. As reported on RT here (click to play video).

Initial sceptics will rightly ask why on earth these countries would give up their own ability to print money at will, just as the US does as the issuer of the reserve currency. However the abovementioned reasons speak volumes to the desire and indeed need, and the possible impact of doing so with the scale of the bloc’s impact potentially countering the downside to losing that convenient privilege. That last word will resonate as many will recall then French finance minister Valéry Giscard d'Estaing describing granting the US the Fiat reserve currency status an “exorbitant privilege.” That ‘privilege’ has been grossly abused and the ‘world’ is increasingly fed up.

So why might such a prolific money printer themselves like China willingly give that same privilege up? The key to this is they are not the reserve currency and are fighting a currency war where blind Freddy can see no one wins. There must, therefore, be an alternative, and ideally one where power is tilted to the proponent from the incumbent defender. History proves that such Fiat based reserve currency status’s have always ended (on average between 40-60 years) and almost always are reset with a gold backed standard. The so called Golden Rule says ‘He Who Holds the Gold Makes the Rules’.

A gold backed currency utilised by over half the population and fastest growing economies may see a reasonably rapid decline in the prominence of the USD. Let’s not forget the USD currently accounts for over 80% of world trade so we are by no means downplaying the scale of this theory. However, as the USD is used less and less globally, it effectively returns to the US. In 1962 the famous economist Milton Friedman stated “Inflation is always and everywhere a monetary phenomenon.” That is, the more money in the system chasing that same of amount of goods sees prices rise. To be clear this is about persistent inflation, not the sort of supply shock inflation seen recently. Quite simply more money coming back to the US sees it worth less and less. That sees the US at a distinct disadvantage buying goods from the gold backed currency bloc. To buy that new currency would effectively see the US having to sell its gold to get the currency. We all remember this famous and much repeated cartoon…

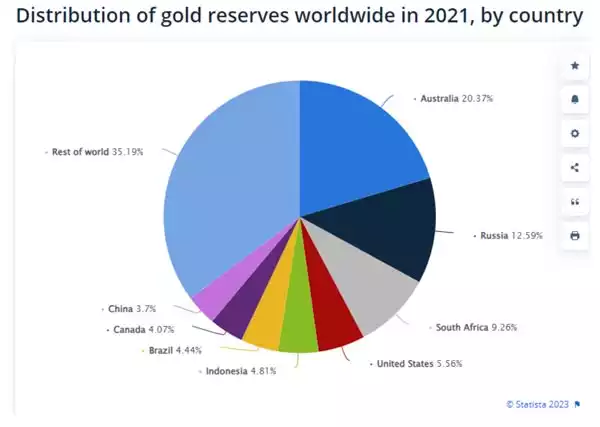

Now you may well say ‘but the US has the biggest gold holding!?’, some 8133 tonne. Well, for a start that is ‘official gold reserves’ reported as held and never audited. Many speculate the US is overstating and that China is understating such official reserves, but let’s leave speculation there. When one looks a little deeper, beyond vaulted bullion in official reserves, we get a very different picture….

You will note a lot of the BRICS are already the worlds largest gold owners when viewed more broadly on what they have access to, not just what’s already in their ‘vaults’. Reassuringly Australia is sitting pretty in this sense.

People too readily discount the collapse of the USD as the reserve currency. To date that has been well founded. The formation and sheer magnitude of the BRICS bloc, even in its current composition let alone the line up to join, changes everything, as does the escalating hubris with which the US is treating their “exorbitant privilege”. History is littered with changes to reserve currency and the ascendance of gold. Again to repeat the words of the founder of the world’s largest hedge fund, Ray Dalio:

“If you don't own gold, you know neither history nor economics”