Australian Sovereign Wealth Fund Is Now Extremely Bullish on Gold

News

|

Posted 22/12/2022

|

17686

In case you needed even more convincing during these turbulent times to invest in precious metals, it was recently announced that The Future Fund, Australia’s $200 billion sovereign wealth fund, have recently joined the yellow metal's fan club.

The fund cites the persistent risk of inflation and the "fracturing of the geopolitical order, bigger government, and more extreme forms of monetary policy" as reasons for holding "a few percent" in gold.

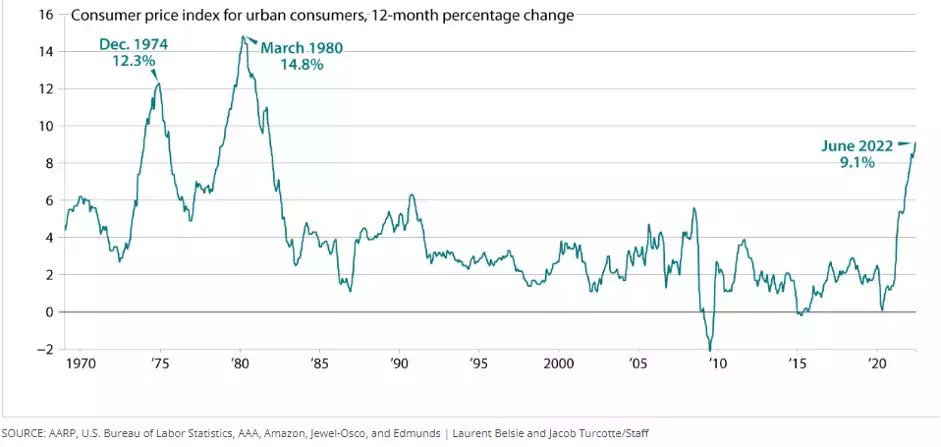

In a note to investors, The Future fund went to compare the economic conditions we are currently seeing to that of the treacherous 1970s.

“In this kind of environment there is a real risk of simultaneous slow growth, high unemployment, and rising prices that has some parallels with the stagflationary period that struck developed markets in the 1970s.”

A greater focus on increased liquidity and a more dynamic approach to asset allocation appears to be their strategy moving forward, not the traditional approach of buying and holding equities we’ve seen succeed throughout previous market cycles.

“There are no simple answers for the investment community. Traditional approaches have delivered strongly, but it is doubtful thy are fit for purpose in the future.

Of course, the time to pay attention to positive forecasts for gold is not necessarily when just the gold industry itself is promoting them, but rather when high-value independent funds and analysts express strong confidence in precious metal.

In this case, the Future Fund's endorsement carries significant weight as an independent entity with a strong capital base.

Furthermore, the current favourable outlook for gold is not just based on the potential for sustained inflation and the related economic conditions. Other factors include a more bearish cryptocurrency market, which can impact investor sentiment into becoming more risk-off, along with a rise in the popularity of gold exchange-traded funds (ETFs).

In Australia specifically, the local currency appreciation of gold is also a factor in the bullish outlook. For example, while in US dollars, gold has done little over the past year and may finish the year down 1%, in Australian dollars it is up about 7% for the year.

It's important to note that investing in gold, like any other asset, carries its own set of risks and uncertainties. For the bullish outlook for gold to fail, we would likely need to see a sustained increase in interest rates, a stronger US dollar for an extended period of time, and no recession in the US. Having "a few percent" in gold, as the Future Fund recommends, could be a good diversification strategy for the year ahead.

Where we disagree with Future Fund’s direction is the use of derivative gold in the form of an ETF. Amid the very turmoil and uncertainty they cite, why add counterparty risk to your safe haven investment? Nothing beats physical gold. As the old adage goes, ‘If you don’t hold it you don’t own it’.