Australian Labor Proposed Budget

News

|

Posted 26/03/2025

|

5147

Increased red tape, growing deficits, and minimal consumer savings highlight the challenging state of the Australian economy, with Labor failing to deliver meaningful measures to shift the country’s trajectory. If you think your $256 per annum tax saving sounds great, consider the $150 loss in energy rebate reductions and the inflationary impact of government spending eroding the value of this saving while keeping mortgage rates higher for longer.

For small businesses struggling to survive—amid an estimated 7,000 closures per week—the removal of the direct asset write-off will discourage future investment, making it harder to future-proof operations. This budget is nothing more than a pig in lipstick, attempting to convince Australians they are better off when the reality is far different.

Small Business – Not a Dime in Sight

With small businesses being the backbone of the Australian economy – with 2.5 million small businesses employing 5 million people in Australia, this budget has been a huge miss and most likely leaves these businesses worse off. Key concerns include:

- Energy rebate of just $150 per year—a small concession after years of skyrocketing energy prices.

- $20 million allocated to a ‘Buy Australian’ campaign—a slogan-driven initiative lacking clear, tangible benefits.

- Instant Asset write-off reduced to $1000—reducing the main investment incentives of small businesses – reducing future innovation and competitiveness.

- Removing non-compete clauses for workers earning under $175,000—increasing workplace mobility and employee loyalty

- Increased scrutiny from ASIC and ATO—adding to the administrative and regulatory burden on already overwhelmed businesses.

With “For Lease” signs appearing across the country and small business closures accelerating, this budget offers no meaningful solutions—only more obstacles.

Deficits as Far as They Can Forecast – What It Means for Your Mortgage

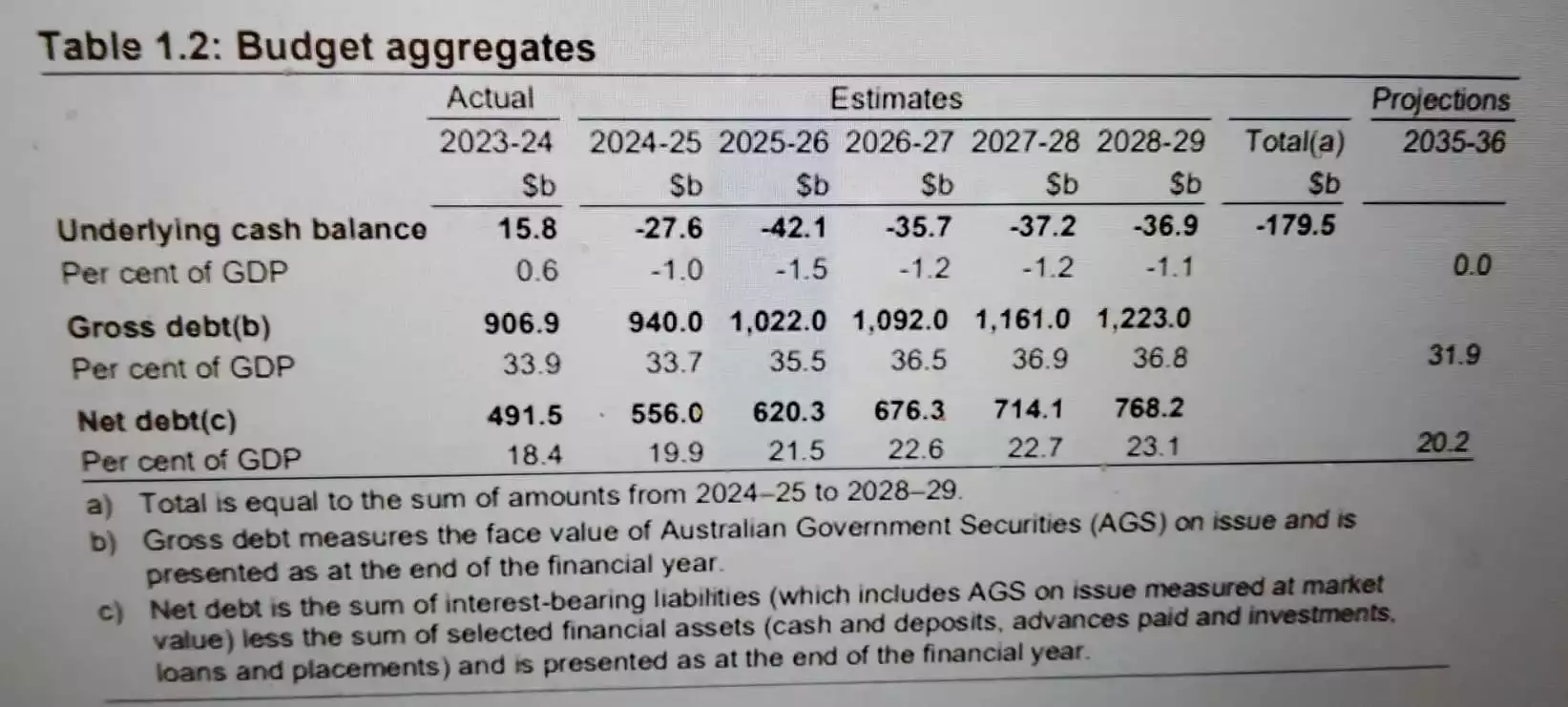

Despite limited tax and energy relief, the budget projects continued deficits well into the future. This ongoing debt burden translates to higher interest payments and no end in sight for a decade-long $1 trillion shortfall by 2025/2026.

For everyday Australians, this means prolonged government spending will continue driving inflation, making it unlikely the Reserve Bank of Australia (RBA) will meaningfully cut interest rates anytime soon. The per capita GDP recession has already seen Australia slip back eight years, with estimates suggesting Australians are now $10,600 worse off than four years ago. If government spending continues unchecked, these economic setbacks will only deepen.

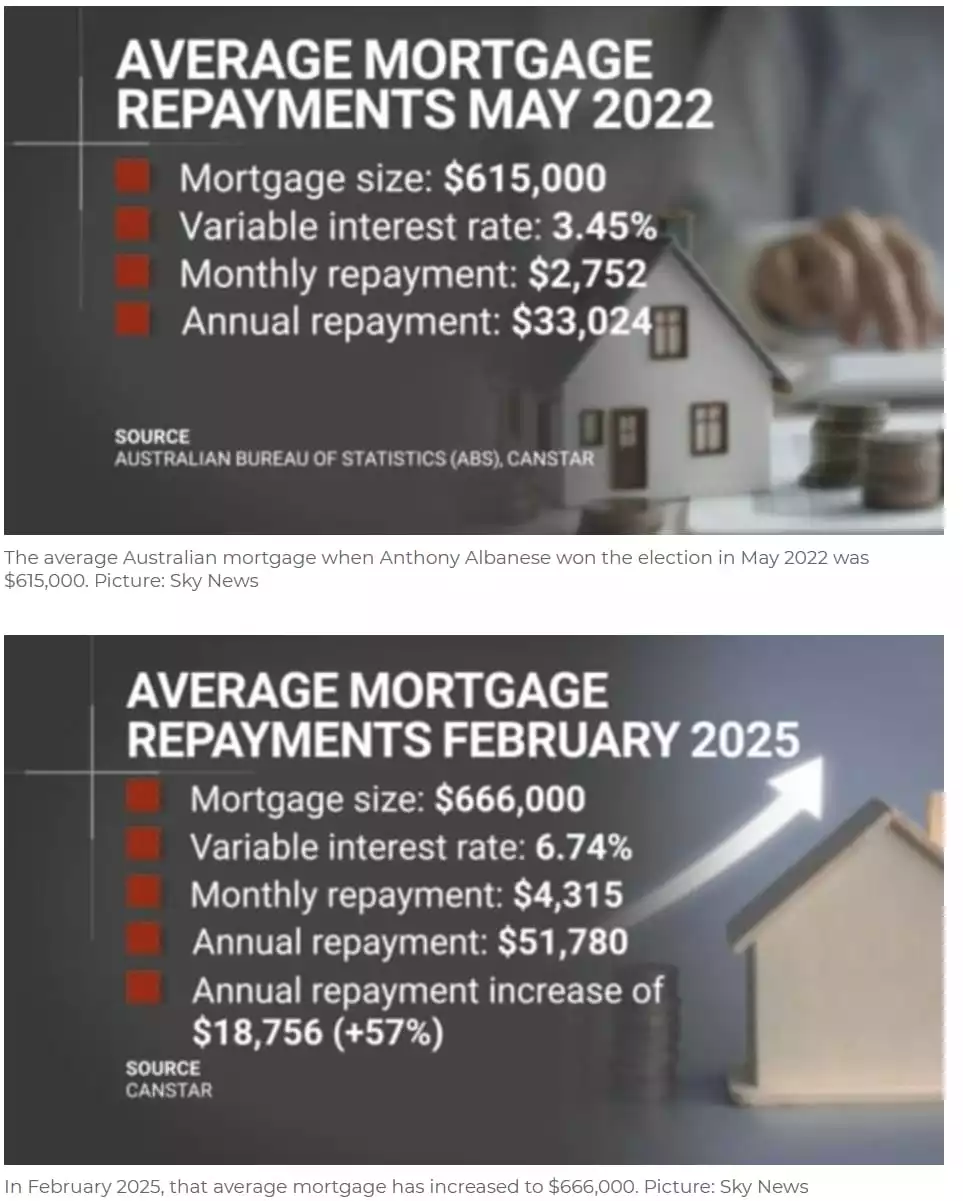

While other countries have begun easing their interest rates—Canada dropping from 5% to 2.75%, New Zealand from 5.5% to 3.75%, and the UK from 5.25% to 4.5%—Australia lags behind. Since Labor came into power, the average mortgage holder is now $18,756 worse off, with no real relief in sight.

Tax Cuts in 2026 – Factor in Inflation, and You’re Worse Off

While Prime Minister Albanese and Treasurer Chalmers celebrate their proposed tax cuts, a closer look reveals a different reality. The headline promise of a $256 monthly saving sounds appealing, but when adjusted for inflation, it quickly loses its value.

For example, assuming inflation remains at a conservative 3% (noting that electricity prices have risen by 8.9% this year), a $50,000 basket of goods would effectively increase in cost by $166 per annum. By 2026, this erosion means that in real terms, Australians will be $56 per month worse off than they are today.

If inflation runs hotter—say, at 6%—the entire $256 saving will be wiped out in the first year, and in the second year, Australians will be $238 worse off.

The government is presenting these tax cuts as a win, but in reality, they are just another example of dressing up a poor deal—yet again, lipstick on a pig.

The Devil is in the Detail

The 2025 Labor budget offers no substantial changes to support businesses or households, leaving most Australians worse off. Without policies that drive real business innovation and productivity, the country will continue to lag behind international competitors.

Beyond the small and delayed tax cuts, the budget fails to deliver a meaningful, science-backed energy policy while increasing bureaucratic red tape. Rather than setting Australia on a path toward prosperity, it reinforces a cycle of stagnation and economic uncertainty.

Australians deserve better than a budget that merely puts a fresh coat of paint on old problems. Without structural reform, Australia faces an increasingly difficult economic future—and no amount of lipstick can hide that.