Australian Inflation and Oligopolies one of the reasons the RBA may pull the trigger today

News

|

Posted 04/07/2023

|

7959

It’s RBA decision day – and from what is out there in the media this one is the most controversial in a while. Most economists believe there will be one today – Philip Lowe may not be RBA Governor for much longer, and inflation is still high, so he could give it one more push to make the job of the incoming Governor easier, however the stress in the 1/3 of Australian households with mortgage payments is starting to look very unfair and this disproportionate pain needs a better solution. A recent talk by Economist Ross Garnaut is also adding heavier weight against more rate rises with current inflationary pressure coming from ‘Oligopoly market rents’ and the interest rate rises used to circumnavigate this which he claims are unlikely to work due to the extraction of Economic Rent from these firms. We discuss further below…

Oligopolies

Talk to any business owner today and they will have 2 gripes, the first is an age old, hasn’t changed in forever answer – labour. Dealing with people in a short labour market has significant management issues but in a good labour market there are also issues in management, lots of personalities always hard to get right in any company. But dig a little deeper and the second answer, although different for different industries, has become another always the same – Oligopolies. If you’re a farmer, your lamb prices are half but not on Woolworths and Coles shelves. If you’re a manufacturer world energy prices have dropped, but not in Australia. If you’re in property development, you’re having trouble getting loans for projects with the Big 4 banks. This country has been built on Oligopolies and it is coming home to roost, with the Economic Rents these industries and companies are extracting adding to inflation which, much like migration the RBA can keep shooting, but they’re only going to be blanks.

Oligopolies and Ross Garnaut

On the 3rd of May, Ross Garnaut delivered a speech at the 2023 Bannerman Competition Lecture in Sydney discussing Economic Rents and profiteering among monopolistic industries in Australia. His analysis was alarming identifying inflationary pressures from the monopolies and a lack of understanding and political action in dealing with it. He stated that ‘Most importantly, there has been a large increase in the rent component of total income. This has diminished growth in productivity and output, while reducing the share of income accruing to the general run of citizens.’

‘Different sources of rent can interact with and reinforce each other. Rents from any source can be invested in influence over public policy and its implementation to maintain and extend oligopolistic positions.’

So what does this mean for Australians, the RBA and what examples are out there that clearly show this…

Oligopolies and Real wages

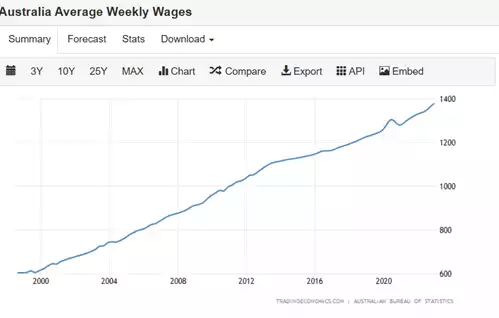

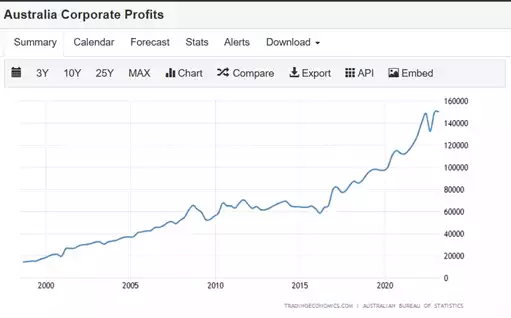

Although not a perfect indicator of Economic rent – looking at corporate profit and wage growth in Australia since 2008 gives some indication of the ‘Economic Rent’ being extracted by these corporations. Since 2008 wages have risen around 60%, where corporate profits have risen by around 150%.

Now this feels like a tolerable path, when housing has become more expensive, making people feel richer, whilst mortgage payments have reduced. But with the recent aggressive path of the RBA raising interest rates at the fastest rate in history, these economic rents extracted by these Ogilopolies in Australia are becoming both more noticeable ad unbearable and are in fact adding to inflation and therefore the compulsion of the RBA to raise rates (although this we argue is also adding to inflation with huge rent increases). Real wages will continue to fall and Australian standards of living will continue to fall without government and industry competition framework changes.

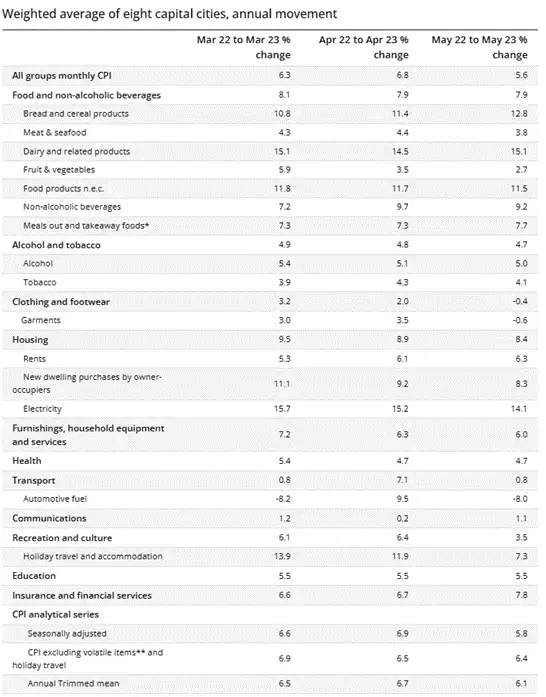

Australia’s current CPI basket can be seen in the below table as well as its progressive inflationary pressure. We have previously spoken about housing rents and the inflation being dealt by the RBA with interest rate rises feeding into rents (blue highlighted). We will now look into 2 areas of Ogilopolies – supermarkets (yellow) and electricity providers (green) who appear to be not passing savings on adding to these inflationary pressures that are adding to RBA’s case to raise rates, with little impact except on the 1/3 of households with mortgage repayments too high.

Lamb Market

Highlighted in yellow is the current Meat and Seafood Inflation from the May CPI increase, although only 3.8% it may surprise you that in the last 18 months lamb prices have nearly halved.

A recent article from the ABC highlighted the plight of sheep farmers, as supermarkets continue to offer manipulated pricing. High lamb prices at the supermarket frustrate farmers as saleyard price drops year-on-year - ABC News – the article identifies both farmers and Livestock agents ‘who are at the coalface of marketing farmers' lambs, are also perplexed at the current price gap between the saleyards and retailers selling lamb.’

Now lamb is just one item in the meat and seafood basket, however prices have fallen since last year from $800 to now around $500 per lamb, and yet again there is inflation in meat in the CPI - surely this doesn’t make sense?

A recent Guardian article Australia’s big supermarkets increased profit margins through pandemic and cost-of-living crisis, analysis reveals | Supermarkets | The Guardian identified 2023 is likely to be the most profitable year on record for both Coles and Woolworths, whilst they ‘shield us from’ cost increases from ‘suppliers rather than pass them through to customers’ – they also appear to be ‘shielding’ consumers’ from passing on those savings – like on lamb…

Energy Market

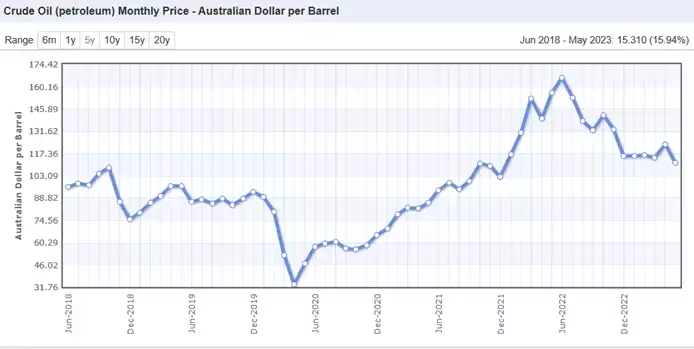

Now draw your attention to the “weighted average of eight capital cities, annual movement” CPI basket breakdown. Highlighted in green are the cost of two energy inputs – fuel and electricity. Now arguably both are oligopolies, but I‘d suggest that as ‘price at the bowser’ can be seen daily by all consumers as they drive to work there would be more ‘uproar’ with obvious rent extraction. Oil prices per barrel in May 2022 were around $156AUD per barrel, and in May 23 have dropped to 111 – a 28.8% drop compared to an 8% yoy drop.

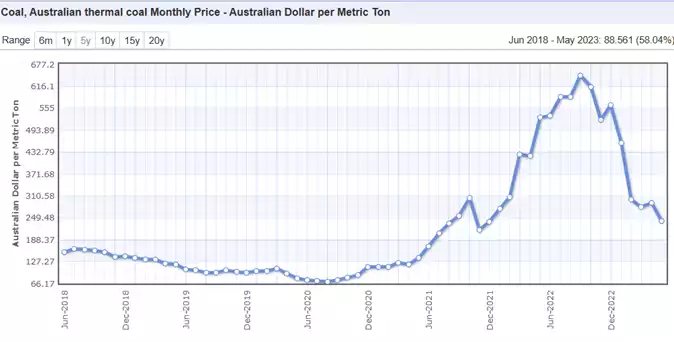

Now look at Energy – the main input to energy is coal, thermal coal out in Australia in May 2022 were priced at 532/tonne and in May 23 the price is 24/tonne – a drop of 54%. In the meantime houses have seen an increase in electricity prices of 14.1% - an Increase against a drop of over 50%. The energy companies excuses of ‘we are operating in a global economy’ is not something we’ve heard for a while as apparently we only do that when prices are high, when they are low we extract profit from Australians.

This country right now is being held hostage to oligopolies. We understand seasonality and contracts are a great ‘reason’ *excuse* for this variability but I haven’t seen anything like these drops in any forecasts going forward so the only logical reason these increases are being accepted as – ECONOMIC RENT. Garnaut has correctly identified that the lifting of rates has little impact in dealing with these economic rents and until a new political framework is established rate rises are targeting the wrong part of the economy.

So as the RBA lifts or threatens future interest rate lifts today – it would be in their best interest to look at firstly what their interest rate rises are doing to CPI as Garnaut put it "Higher rents feed into a higher CPI, which is interpreted by the RBA as a signal to raise interest rates again. Higher interest rates reduce investment in housing and after a time raise rents, and so strengthen the single-instrument case for even higher interest rates." But also look at the other Economic rents and ask does monetary policy do anything to these rents or is this again a policy misstep of current and past governments that is coming home to roost?