Australian Consumer Recession Warning

News

|

Posted 10/04/2024

|

5270

Recent reports from ANZ Roy Morgan provide a more and more pessimistic outlook for Australian households. The pessimism is driving reduced consumer spending and a slew of insolvencies in the retail sector. Australians now believe in increasing numbers they will be no better off in a year’s time, with inflation expectations continuing to increase. So what is causing this reduced confidence, to levels not seen since the 1990s recession and is the worst over?

ANZ-Roy Morgan Consumer Confidence Report

Future financial consumer views continue to deteriorate with only 31% of Australians believing they will be better off financially in a year (down 3%) and 33% (unchanged) believing they will be worse off. Additionally, inflation expectations have risen to the highest level in 2024. In the report Madeline Dunk, ANZ Economist identified that consumer confidence has stayed below the threshold of ‘85pts for a record 62 weeks - 23 weeks longer than during the 1990s recession’.

Even worse is the expectation of just 1 in 10 Australians now expecting ‘good times’ for the Australian Economy over the next 12 months.

Retail Insolvencies Rising

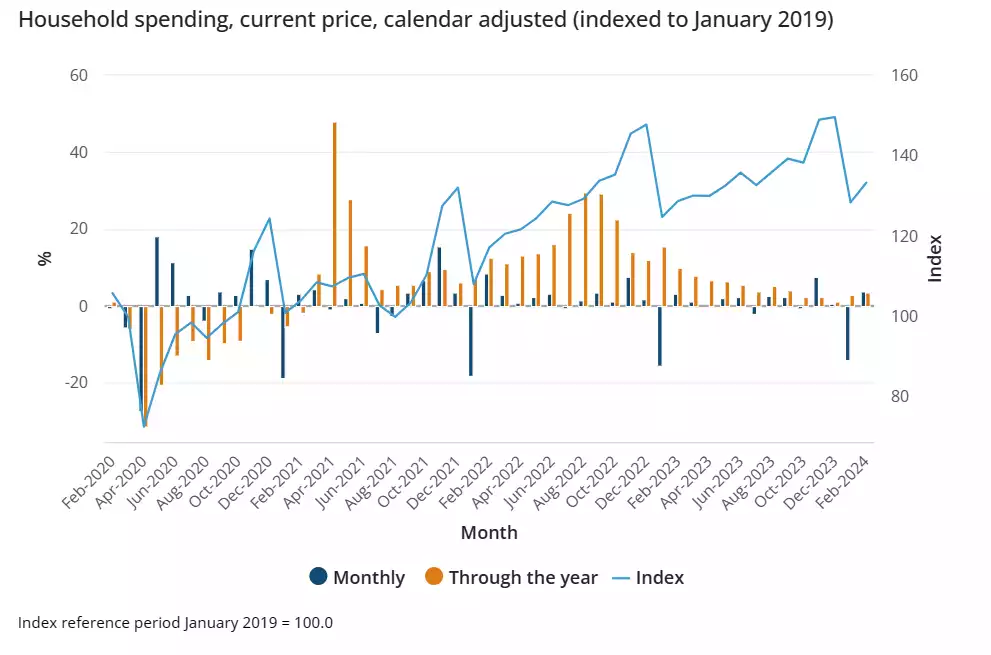

Consumer confidence is hitting retail the hardest with consumer spending declining from all the way back to June 2022.

Wage growth has not kept up with inflation with consumer price rises outstripping wage growth by 6% over the last 3 years. It’s no wonder consumers are tightening their spending.

2024 has seen a slew of insolvencies in the retail space, including Tigerlilly, Godfreys and more recently Marquee Retail Group, with 400 employees and 60 locations. You don’t need to drive far these days to see all the ‘For Lease’ signs on shop fronts and very few retail outlets scatted amongst the coffee shops, restaurants, and Thai massage businesses. In fact, retail appears to be being decimated. This year alone with the cost-of-living crisis crippling consumer spending the retail sector insolvency rate has more than doubled in 2 years, with 502 retail businesses entering administration this year alone (more than doubling last year). To put that in perspective the average business insolvency in Australia is 23,000 businesses per year. Just retail is 502 and March is only just over.

Where’s the interest rate relief?

The U.S. had six priced in at the beginning of the year – now only 2.

Rate cuts not materialising.

Like Australia, the U.S. is continuing to see sticky inflation, growing CPI and a declining unemployment rate which all support higher not lower interest rates.

Sticky inflation appears to now be being driven by 2 things:

- Home prices (rent and mortgage payments).

- Oil prices.

With the price of crude jumping nearly $20 per barrel since January on OPEC output cuts as well as increased Geopolitical tensions, particularly in the Middle East this inflation pressure is more likely to increase than decrease.

Similarly with the outlook of interest rates cuts less likely and the ever-surging migration specialty of woke governments, the pressure on mortgages and rent are also unlikely to subside again putting pressure on inflation. With pressure on inflation the RBA will be unable to cut rates, meaning no relief for the flailing consumer.

So where does this leave us for 2024? Jamie Dimon CEO of JPMorgan has summarised these risks perfectly in his annual letter.

Words from Jamie Dimon

As early as 2023, Jamie Dimon, head of the U.S.’s biggest bank, had been sounding the alarm of optimism around potential rate cuts touting sticky inflation as the likely reason. In his annual report to shareholders 2 days ago Dimon spoke about the potential of 8% interest rates, identifying several risks including, government expenditure;

‘It is important to note that the economy is being fuelled by large amounts of government deficit spending and past stimulus’

The unwinding of quantitative easing…

‘I remain more concerned about quantitative easing than most, and its reversal, which has never been done before at this scale.’

And of course, the gold at the end of the rainbow or the ‘soft landing’

‘Equity values, by most measures, are at the high end of the valuation range and credit spreads are tight. These markets seem to be pricing in 70 per cent to 80 per cent chance of a soft landing – modest growth along with declining inflation and interest rates. I believe the odds are a lot lower than that,’

No Relief in Sight

The recent consumer confidence deterioration appears to be driven by the slow realisation that things are not getting better in 2024. War, government deficits and sticky inflation are putting rate cuts off the table and baking sticky inflation into the economy. As we pass the first quarter of 2024, what if anything will change to turn the tide on the world steering itself out of a recession. Gold is arguably sniffing exactly this scenario out right now as it rallies ahead.