Australia’s Interest Rate Difference – Driving a lower AUD

News

|

Posted 22/02/2023

|

9662

We have spoken at Ainslie many times about the inflation spiral the world is in, but thought it was time to look at why what the US does has an uncontrollable impact on Australia, particularly the Australian consumer, and what this may mean for future interest rate rises both in the US and Australia.

The US 30 year Fixed Rate Mortgage History

The 30-year fixed rate mortgage in the US owes some foresight to the US government actions to fix dislocations in the mortgage market. During the Great Depression (1929-1941) 1 in 4 homeowners lost their homes to foreclosure. In response the government created the Home Owners Loan Corporation (HOLC) to buy defaulted mortgages and reinstate them, moving these loans from 3-5 year loans (sound familiar)? to 20 year fixed rate loans. Fannie Mae and Freddie Mac came into existence after this, allowing for government owned vehicles to mop up these no penalty, fixed 20 (now 30) year rate mortgages by way of sophisticated portfolio managers managing the investment risks.

What are Fannie Mae and Freddie Mac and what happened during the Global Financial Crisis

Fannie Mae was first created in 1938 to help solve the Great Depression mortgage market woes. It was a government owned company. In 1968 Fannie Mae was privatized and in 1970 Freddie Mac was created as a private company to boost competition in the secondary mortgage market. Neither company originates its own loans but buys mortgages from lenders and either keeps them or repackages them for sale to the secondary market.

Who Regulates Fannie Mae and Freddie Ma

Freddie Mac and Fannie Mae although both private companies have government sponsored enterprise status. According to the congressional charters:

- The president of the United States appoints five of the 18 members of the boards of directors.

- The secretary of the Treasury can buy up to $2.25 billion of securities from each company to support its liquidity.

- Both companies are exempt from state and local taxes.

- Both companies are regulated by the HUD (Department of Housing and Urban Development) and FHFA (Federal Housing Finance Agency)

As we saw in the GFC, Fannie Mae and Freddie Mac gave the US sub-prime mortgage market a backstop, being placed into the direct supervision of the federal government so they could intervene and assist with liquidity.

Australia vs US Fixed rate mortgages

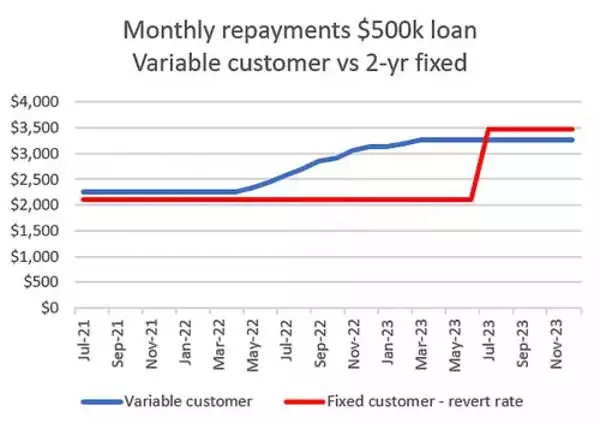

As we know, Australia is approaching a fixed interest rate mortgage cliff, as Australian banks only offer 5 year fixed loans, with most people on variable home loans. In the US 90% of loans are fixed rate mortgages, 6% 15 year mortgages only 2% variable. This means as interest rates rise it is mortgage holders in Australia that feel the burden unlike the US. So, consumer spending in the US continues to forge ahead as their mortgage payments don’t change and their wages continue to rise. Australia’s consumer spending continues to drop as mortgage payments become more expensive and the fixed rate cliff comes closer faster than the US (by about 25 years!)

*source: Interest rate rises Australia: What is the fixed rate mortgage cliff, and how is it going to impact the Australian economy? | Explainer (9news.com.au)

Why do the Federal Reserve Rate rises matter to Australia

These fixed rate mortgages that are held in the US mean mortgage holders in the US do not feel the same effects as Australian variable interest rate holders. Each time rates go up in the US, the Federal Reserve is trying to stop mostly business investment by making it more expensive to borrow, meaning expansion is slower, meaning unemployment rises and wages stay subdued, thus lowering peoples spending. This ultimately means both businesses and the government pay more. Houses become ‘cheaper’ as to buy a new house on a fixed loan at a higher interest rate costs more, but unless you’re forced to sell you can maintain your mortgage at the lower rate.

In Australia if the RBA lifts interest rates, mortgages for our current houses become more expensive, lowering prices and business investment drops and unemployment rises making houses even more expensive.

So what this ultimately means is the consumer in Australia feels these raises in rates a lot more than their US consumer counterparts. With low migration rates in the US compared to Australia, the wage growth in the US is vastly outstripping Australia’s wage growth, but Australian consumer costs are vastly outstripping their US counterparts in housing costs.

If however Australia was to choose a different path and stop raising rates our exchange rate will drop and inflation increase even more. It’s time the RBA and government started looking at what can be done to untie us from this US inflation spiral that, had it not been for the reopening of China and higher commodity volumes, would have our exchange rate drop even more and inflation grow even more.

Fed Rate Rises vs Australian Rate rises impact on housing

US Houses

- Houses for sale become cheaper

- Individuals stop selling houses as they have cheaper fixed rate mortgages

- Rental return grows as to get into the market becomes more expensive

- This creates a house price floor

- Inflation rises on rents, not mortgages

Australian Houses

- Houses for sale become cheaper

- Rent becomes more expensive

- Individuals and investors need to sell homes to lower repayments

- This means houses become even cheaper

Australia’s situation good for gold (not green)

As our fiscally responsible (sarcasm intended) politicians parade Philip Lowe in front of the media through the Senate Estimates, it becomes clear that Australia’s options are limited to fiscal manipulation, just like in the US after the Great Depressions the 30 year mortgage was invented and supported by the US Government.

So our options even more than the US are fiscal, but we are in a global economy where monetary policy will continue worldwide. We need to work out how to lower inflation without raising interest rates, this like Garnaut pointed out in September 2022 is easiest through mining taxes as commodity prices grow, also sharing the burden of inflation through increased taxation and paying down our debt and finally fixing this energy circus that started 2 weeks after Labor came into office.

This is unlikely to happen in the short term. It is becoming increasingly clear the government wants to blame this mess on the RBA without looking at their mistakes. This means the likely scenario for Australia in the short term is increased inflation and a lower AUD, held down rates by a change in the RBA governor or governance – whatever achieves the objective, higher unemployment and higher energy rates, and therefore higher Australian gold (and commodity) prices