Australia’s High Immigration Experiment & What it Means

News

|

Posted 05/06/2023

|

10114

Australia’s High Immigration Experiment & What it Means

In Ainslie’s previous article on the ‘Australia’s cost of living crisis – Government V RBA’ we started touching on the immigration drive that was occurring in Australia, and discussed why real wages in Australia were not keeping up with the world. Rather than tempering the immigration the Australian government has new policies that are accelerating this trend. We compared both the UK, US and NZ to Australia who had bottlenecks in their policies stalling the ability to grow immigration, however that appears to have all changed. Now there appears to be two trains of thought: the – ‘immigration will blunt the impact of inflation’ Shemara Wikramanayake, Macqaurie Bank CEO; or those touting that this high level of immigration will put pressure on ‘capital stock, especially housing, which will in turn manifest in higher consumer prices’ - RBA

Real Wage Growth

So go back a quarter and look at where real wage growth was at in February 2023 and compare it to now April 2023

|

Country

|

Interest Rate

|

Inflation (I)

|

Wage Growth (W)

|

Real Wage (I-W)

|

|

US

|

4.5-4.75%

|

5.40%

|

5.10%

|

-0.30%

|

|

Canada

|

4.5%

|

5.90%

|

3.40%

|

-2.50%

|

|

UK

|

4%

|

8.80%

|

6.40%

|

-2.40%

|

|

New Zealand

|

4.75%

|

7.20%

|

7.40%

|

0.20%

|

|

Australia

|

3.35%

|

7.80%

|

3.30%

|

-4.50%

|

| |

|

|

|

|

|

February 2023 Real wage growth

|

Country

|

Interest Rate

|

Inflation (I)

|

Quarterly Inflation change

|

Wage Growth (W)

|

Real Wage (I-W)

|

|

US

|

5.0-5.25%

|

4.90%

|

-0.50%

|

5.00%

|

0.10%

|

|

Canada

|

4.50%

|

4.40%

|

-1.00%

|

5.40%

|

1.00%

|

|

UK

|

5%

|

8.70%

|

-0.10%

|

5.90%

|

-2.80%

|

|

New Zealand

|

5.50%

|

6.70%

|

-0.50%

|

7.60%

|

0.90%

|

|

Australia

|

3.85%

|

6.80%

|

-1.00%

|

3.70%

|

-3.10%

|

May 2023 Real wage growth

So what’s in the numbers? Last year, Britain like Australia saw the highest ever net immigration in its history, with 1.2million people moving to Britain and 300,000 in Australia. To put that in context, the UK has a population of 67 million so this was an increase of 1.8% and Australia has a population of 26 million, so this was an increase of 1.2%. Extraordinary numbers…

More recently, the US and NZ have opened their borders to greater immigration with 1.4million people expected to move to the US this year 0.4% increase. NZ saw a net migration in the month of March 2023 of 65,400 a 0.12% month on month.

Looking at the quarterly change data – you would argue that the countries with the lower real wage growth are still Australia and the UK whose inflation figures are dropping faster, but with real wage growth maintaining well below 0, these countries feel like they are in recession more than countries with some positive wage growth.

Migration Acceleration

In Australia you don’t need to look far to see the hospitality and health service’s roles being filled by immigrants, and now our rising unemployment rate from an all time low of 3.5% now at 3.7% as immigrants fill the vacancies left by the Covid economy. In fact Canada now has a target of 1.5 million immigrants in 2023, Australia is expecting 350,000 immigrants in 2023 and the US is now debating increasing their levels.

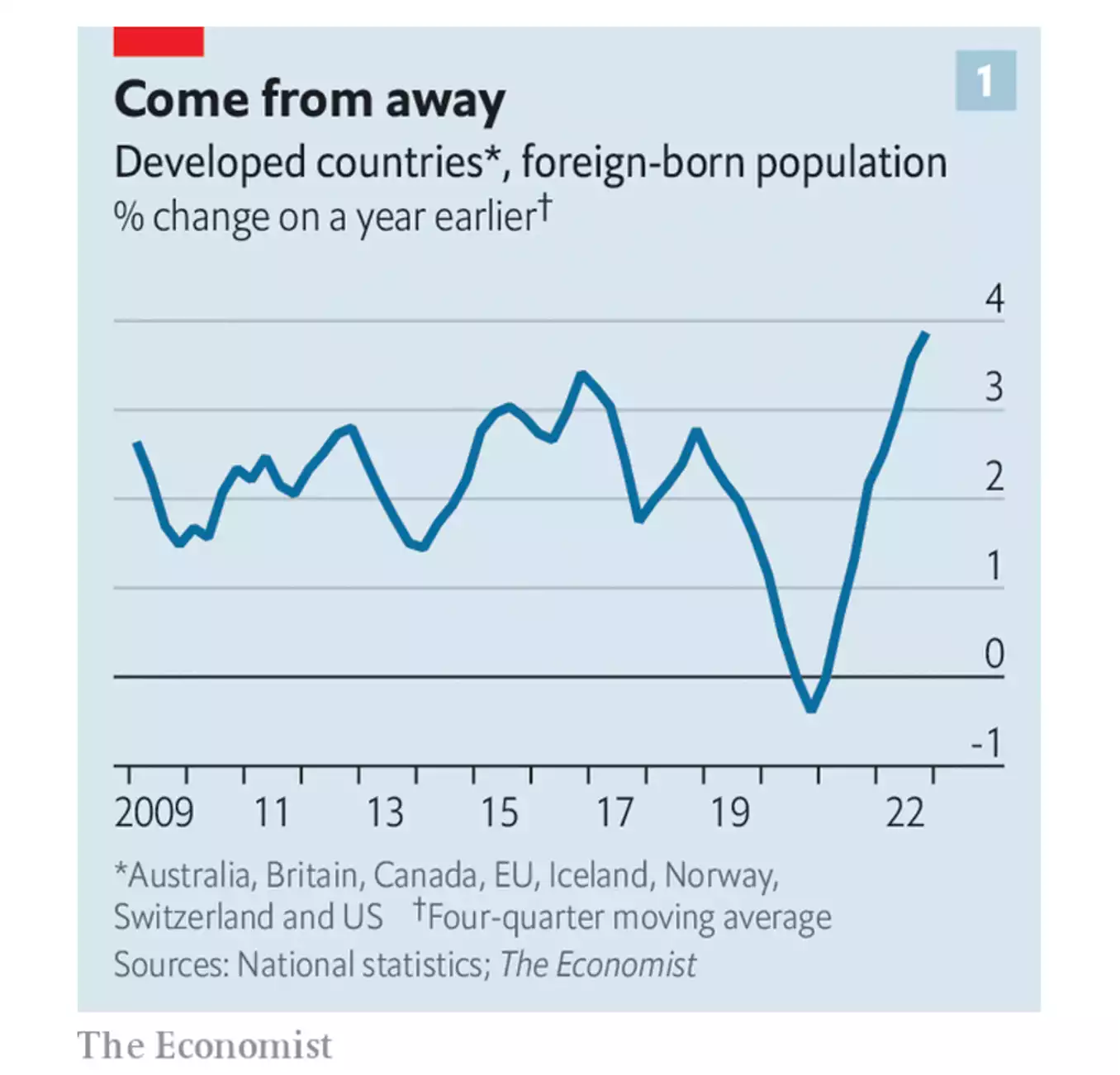

Source: The Economist ‘A new wave of mass migration has begun’

A reversal of the political wave that saw both Brexit and the election of Donald Trump under ‘America First’ with low fertility rates and high immigration, the foreign born population in the Western World is rising faster than at any point in history.

New Growth Experiment?

Post Quantitative Easing, is this the next economic modelling experiment governments are going to undertake to ensure an ever growing economy? The US currently sits behind other Western countries in immigration %, despite the end of Title 42 with refugees and migrants arriving on mass at the border. Interestingly in the US there have been several economists recently come forward with new modelling suggesting immigration could temper inflation and fill employment gaps Mark Regrets, a labour economist and a senior fellow at the National Foundation for American Policy recently stated ‘Increasing our ability to produce by increasing the supply of labour is the least painful way to control inflation’ and in a recent study by George Mason University showed that ‘admitting more immigrants can help drive down inflation. The US economy will be stronger and Americans today will earn more in Congress acts today to increase immigration’. Unlike Australia however the US needs unemployment to drive inflation down as they do not have the consumer mortgage mechanism that occurs in Australia due to variable rate mortgage increases.

Australia and the UK a warning to the rest of the world

But looking at two countries that have employed this experiment over the past year – puts forward an argument that inflation has not been tempered and yes consumers may earn more but it does not appear to be keeping up with inflation and causing a real wage recession. The finite inputs of food and housing appear to be under immense strain in both these countries, causing huge inflation.

In Australia despite interest rate rises to where they are today house prices have now stopped falling, and in 2022 fell a modest 7.9%, where economists were predicting much higher losses of 20%. In fact in 2023 up until May Australia house prices have now risen 1.55%, on the back of record rental increases, with rent on apartments now up 22.2% year on year in March 2023. A 22.2% rise in a long way from the 3.7% real wage rise that Aussies have received in the same period.

Looking at food, in the UK, they recently reported their annual inflation rate on food and non-alcoholic drinks hitting 19.1% with its overall inflation remaining well above forecasts and ahead of both the US and Europe. The UK being the world’s 3rd largest importer of food and an importer of gas, a raw import of a lot of food manufacturing is not keeping up with demand on food and adding 1.5 million immigrants to the equation is exacerbating the lack infrastructure and manufacturing to keep up with demand encouraging greater inflation.

Higher immigration also masks real economic performance with Australia having already entered a per head recession.

Inevitably this means more debt, more inflation meaning higher rates, putting more pressure on the cost of that debt and so the spiral goes. The 8.6% increase to the minimum wage last week is part and parcel of this same spiral. The RBA can see this coming and is thumping the table to the extent it can without being ‘political’. Gold has, throughout history, been the ultimate hedge against inflation and the collapse of credit cycles (which could otherwise be called credit spirals…).