Australia’s Cost of Living Crisis – Government v RBA

News

|

Posted 27/02/2023

|

10832

We have talked at length about the current issues in Australia being those that can only be fixed fiscally (if you missed this excellent interview with Alex Hutchinson it’s a must watch). Today we will investigate what these fiscal or government policies are that are driving the biggest real wage fall in Australia since data began to be collected in the 1970s, as well as comparing it to other developed countries to show just how far behind we are falling.

Australian Monetary Policy is failing

As Australia continues to put extra strain on its mortgage holders, other developed countries with longer termed mortgages (Canada 25 years, US 30 years and UK 40 years) can tolerate higher rates under increasing interest rates. NZ like Australia has maximum 5 year fixed loans, with most mortgage holders on variable rates. But unlike Australia, NZ’s current mortgage rate is sitting a lot higher, 4.75% and inflation is starting to recede as the monetary policy takes effect. In Australia our interest rate is now sitting a whopping 1.4% behind NZ and the US. The ability of NZ to tolerate these increased interest rates can be understood when looking at their real wage increases of 0.2% compared to Australia’s minus 4.5%.

Now understand that NZ has a real possibility of a wage spiral, adding increasingly to their inflation – but at this point monetary policy can still be effective for them as wages rise at a comparable rate to cost of living, the scene is very different in Australia so let’s investigate why…

|

Country

|

Interest Rate

|

Inflation (I)

|

Wage Growth (W)

|

Real Wage (I-W)

|

|

US

|

4.5-4.75%

|

5.40%

|

5.10%

|

-0.30%

|

|

Canada

|

4.5%

|

5.90%

|

3.40%

|

-2.50%

|

|

UK

|

4%

|

8.80%

|

6.40%

|

-2.40%

|

|

New Zealand

|

4.75%

|

7.20%

|

7.40%

|

0.20%

|

|

Australia

|

3.35%

|

7.80%

|

3.30%

|

-4.50%

|

| |

|

|

|

|

|

Fiscal Real Wage drivers:

It’s becoming pretty evident that the wage price spiral that still may take effect overseas is having limited impact on inflation. So what is causing this ‘Real Wage Crisis’? We’ve identified 4 drivers that come directly from government policy which need to be moderated and curbed to ensure Real Wage drops are addressed. These are:

- Government Expenditure

- Corporate Profits (Monopolies and Duopolies)

- Immigration Policies

- Energy Costs

Government Expenditure

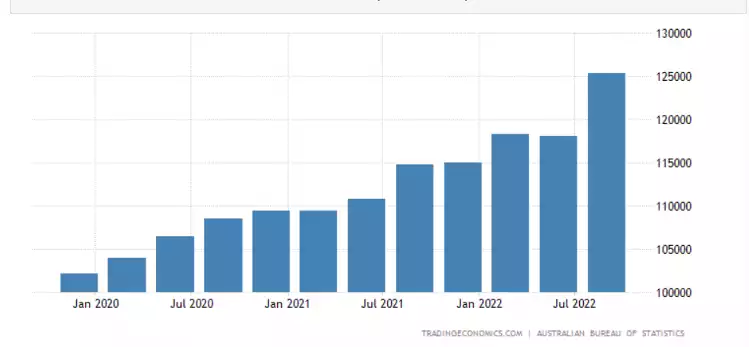

According to the Australian Bureau of statistics Government Spending in Australia increased to $125.3billion in the third quarter of 2022 from $11.8billion in the second quarter of 2022, a whopping 6.2% increase.

As Government expenditure is a major driver of inflation this whopping increase is putting huge inflationary pressure and employment pressure on the Australian economy. This ridiculous conflict between RBA monetary tightening and fiscal loosening/expansion is something we’ve discussed before. Tellingly, where most public servant jobs are in Australia there is a stark contrast in average wages, with the ACT having average wages nearly $10,000 more than NSW.

|

State

|

Average Wage

|

|

NSW

|

$52,849

|

|

Victoria

|

$51,996

|

|

Queensland

|

$51,197

|

|

South Australia

|

$50,440

|

|

Western Australia

|

$47,909

|

|

Northern Territory

|

$62,010

|

|

ACT

|

$68,325

|

*November, 2022 Source: Australia’s average income revealed (yahoo.com)

Corporate Profits (Monopolies and Duopolies)

Though not a direct government policy, the Australian monopoly and duopoly corporate environment is helping to drive inflation as companies like Coles and Woolworths, Qantas and Virgin and the Big 4 Banks have created an environment where profit gouging goes relatively unchecked and is a major contributor to December’s mammoth 8.4% inflation reading.

A recent report by the Australia Institute's Centre for Future Work has revealed these businesses have been increasing prices well above input prices and are contributing more to inflation than the wage increases. The research found that these price increases contributed 70% to the acceleration in inflation, with labour only adding 18%. So without competition and possible government intervention, Australians have little choice but to pay the higher at the counter prices, while corporate profits continue to rise benefiting shareholders only.

Immigration Policies

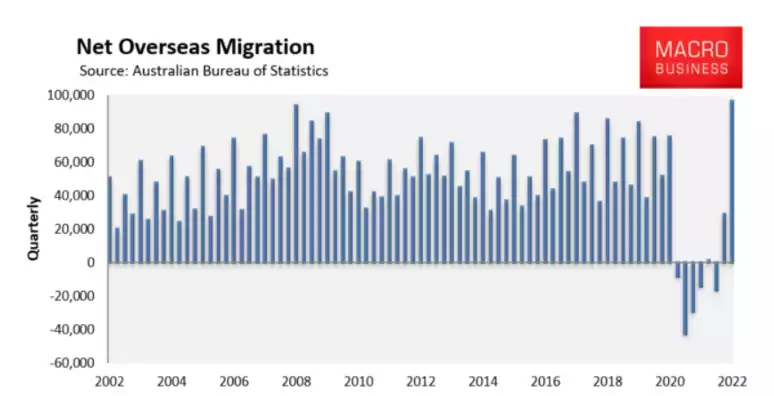

Immigration policy has been great for Australian businesses, in 2022 a crisis of workers loomed that due to the unemployment figures reaching an all time low of 3.4%, a labour supply crisis could have crippled business. However after the September Jobs and Skills summit, the Albanese government lifted permanent migration intake from 160,000 to 195,000. It appears this immigration influx has not only moderated the unemployment figure, now sitting at 3.7% but has probably assisted in wage growth being considerably lower than the rest of the world who have stricter immigration targets and rules.

*Source: Australian immigration rockets back - MacroBusiness

Our Net Immigration now sits higher than the 2009 Rudd immigration policy that helped Australia navigate the Global Financial Crisis. Remembering that this crisis is an inflationary crisis, unlike the GFC, and increasing immigration puts higher strain on supply side costs .

Energy Costs

Let’s now take you to the Red Herring of Australian policy, one the government would like you to believe it has solved with its gas and coal capping. However according to reports we can confirm that not only is that price cap not working, government intervention and poor policy has meant gas companies will not even supply some companies as they cannot guarantee price or supply under the current framework without being subject to potential government fines.

Have a look at the graphs from the US and Australia below. Gas prices in the US (first chart) are at a similar level to where they were pre Ukraine war. Now compare this to Australia (2nd chart), one of the largest gas producers and exporters in the world. Natural gas in the US has fallen from around $4/BTU in January 2022 to $2.50/BTU currently. Australian gas market prices have increased from around $10/Gj to $25/Gj, hardly tracking the $12 cap the government so proudly spruiks.

*Source: Natural gas - 2023 Data - 1990-2022 Historical - 2024 Forecast - Price - Quote - Chart (tradingeconomics.com)

*Source: www.aer.gov.au/wholesale-markets/wholesale-statistics/gas-market-prices

Clearly these government energy policies have exacerbated the current inflation crisis, and rather than fix them they have thrown Australian businesses and consumers under a bus and continue to look the other way whilst advertising their $12 ‘win’. Let’s be clear there’s no $12 win, in a free market this gas price would be 2 times lower than where the market currently sits……

Fiscal is the only fix

So in conclusion, we will say it again, monetary policy moderates demand – which it is currently doing for the low to middle class Australians whose mortgages continue to rise and their disposable income falls at the fastest rate since 1980, and their real wages decreasing the most in any recorded period. Monetary policy will be forced to continue to rise as we are in a Global Economy and need to keep up with the Jones’s or risk a plummeting AUD that will add even more inflation pressure to Aussies (unless they hold AUD priced gold of course…).

But this is a supply shock and therefore fiscal crisis, with record government expenditure, high immigration policies, poor energy policies and unchecked corporate gouging, we would suggest the government stop parading Lowe as a scapegoat and start fixing its own mess.

This monetary v fiscal conflict has no easy solution and a well diversified portfolio is essential to protect your wealth from forces unknown and unresolved.