Australia Joins Money Printing Party with a Bang

News

|

Posted 23/10/2020

|

13198

Against all odds our Aussie dollar has held firm for some time now around the 70c mark. It doesn’t seem that long ago that the majority of economists were calling for a much lower AUD, into the 50’s, but it just hasn’t eventuated. Why is that? Because in a global mix of currencies our central bank’s reluctance to open the printing flood gates like nearly all others have, has made our currency comparatively more attractive in terms of yield than most others.

We reported at the beginning of this week the minutes from the last RBA meeting where they made it clear they would let inflation run hot before easing rather than the traditional (but repeatedly premature) method of pre-emptively moving or holding at the first sign. What those minutes also revealed was that they had been briefed on the budget before their subsequent announcement to hold rates steady, arguably to give the budget ‘clean air’. Those same minutes make it abundantly clear however that they will likely drop rates and start QE shortly. The obvious takeaway is they could see the fiscal stimulus measures announced in the budget (and taking us into the $trillion dollar deficit club) would not suffice to drag the economy out of this recession. Westpac’s summary from the minutes were as follows:

“The Board will cut the cash rate; the three year bond target and the rate on the Term Funding Facility from 0.25% to 0.10%.

In addition, it will reduce the rate on surplus Exchange Settlement Account balances from 0.1% to 0.01%.

We expect the Board will announce the intention to purchase bonds issued by bot Australian Government and semi government authorities in the 5 – 10 year maturity range.

However, we do not expect a specific quantity target for these purchases or an explicit yield target beyond the existing three year target.”

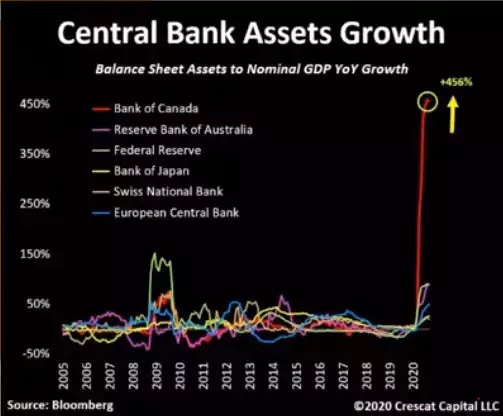

Already we are struck by the following chart just released by Crescat that shows us 2nd only to Canada (also off a low base) and almost identical to the Fed in terms of growth in central bank ‘assets’ (newly created bonds to fund deficits):

So just to reiterate, their ‘asset’ is a debt instrument sold to print more money….

It is actually worth reading the RBA minutes where they discuss how and why and we add our [comments] within:

“Members recognised that the substantial, coordinated and unprecedented easing of fiscal and monetary policy in Australia was helping to sustain the economy through the current period. Members noted that public sector balance sheets in Australia were strong, which allowed for the provision of continued support, with the Australian Government Budget for 2020/21 to be announced that evening. The Secretary to the Australian Treasury briefed members on the main features of the Budget. Members considered that fiscal and monetary support would be required for some time given the outlook for the economy and the prospect of high unemployment [i.e. it was clear to them the fiscal stimulus announced was not going to cut it].

The Board discussed the case for additional monetary easing to support jobs and the overall economy. As in previous meetings, members discussed the options of reducing the targets for the cash rate and the 3-year yield towards zero, without going negative [for now…], and buying government bonds further along the yield curve. These options would have the effect of further easing financial conditions in Australia. [they are essentially talking about yield curve control as we explained and discussed here]

In considering the case for further monetary measures, members discussed monetary policy developments abroad and their implications for financial conditions in Australia, through the yield curve and the exchange rate. Members noted that the larger balance sheet expansions by other central banks relative to the Reserve Bank [clearly only in quantum not % per the chart above] was contributing to lower sovereign yields in most other advanced economies than in Australia. Members discussed the implications of this for the Australian dollar exchange rate.[as we discussed above, simply put, other central banks are forcing lower yields on their sovereign bonds and hence our higher yielding bonds look more attractive and so forcing up the AUD when they want a lower AUD to make us more globally competitive. Lower AUD, higher price of gold in AUD for you]

Members also discussed how much traction further monetary easing might obtain in terms of better economic outcomes. They recognised that some parts of the transmission of easier monetary policy had been impaired as a result of the restrictions on activity in parts of the economy. However, as the economy opens up, members considered it reasonable to expect that further monetary easing would gain more traction than had been the case earlier. [the main game of monetary stimulus is to entice more borrowing to buy more stuff and expand the economy. That doesn’t work when everyone hunkers down and tries to pay off debt. Their hope is as things appear to improve and they facilitate all this cheap debt, that this will turn. Remember we already have the 2nd highest private debt rate debt rate in the world…. It also means you aren’t getting any interest on cash deposits, further enticing you into spending on investments that do or have capital gain potential like gold. That’s a perfect segue for their next sentence….] Members also considered the effect of lower interest rates on community confidence and on those people who rely on interest income. [this is their dilemma. Zero rates really hurt retirees and the like living off cash deposits hoping for some interest. Real rates are negative and so they are literally going backwards. That’s why gold thrives in negative real rate territory as we illustrated yesterday]

Members discussed the possible effect of further monetary easing on financial stability. A further easing would help to reduce financial stability risks by strengthening the economy and private sector balance sheets, thereby lowering the number of non-performing loans. [sorry but this appears a little disingenuous… lowering rates on all that debt we lured you into so you don’t become a zombie company unable to even service your debt cost…please] This benefit would need to be weighed against any additional risks as investors search for yield in the low interest rate environment, including those resulting from higher leverage and higher asset prices [refer exhibit A, the NASDAQ – money piling into shares with sky high P/E valuations using cheap margin lending, or for Aussies>>>], particularly in the housing market [but they are the same effect as we detailed here]. On balance, the Board thought it likely that there were greater financial stability benefits from a stronger economy, while acknowledging that risks in asset markets had to be closely monitored. [..or.. we know we are creating asset bubbles chasing inflation in the broader economy but we will do it anyway because the Government is not doing enough stimulus themselves]”

That chart above is BEFORE all this happens. Here we go…