Australia Doubling Down on Debt

News

|

Posted 06/10/2020

|

11206

For years Australia has been ranked 1 or 2 in the world’s most indebted households. Conversely our government debt has been one of the lowest. 2020 would mark the year that household debt eased and government debt exploded however changes to lending laws and yet more stimulus for new housing (together with a record deficit funded rescue package) might see both end the year on a ‘high’.

Up until the GFC Australia’s political agenda of running a surplus saw our government debt fall to less than 10% of GDP. Rudd’s response to the GFC saw that explode higher in percentage change terms but still relatively modest in quantum on a global stage given the very low base from which it came.

Whilst not officially a recession in Australia, the GFC certainly saw a reprieve in household borrowing as people reigned in debt until re-joining the binge in 2013. Reaching a peak of nearly 190% of disposable income, nearly tripling in 30 years, household debt has seen a modest decline in 2020 to ‘just’ 185% of disposable income.

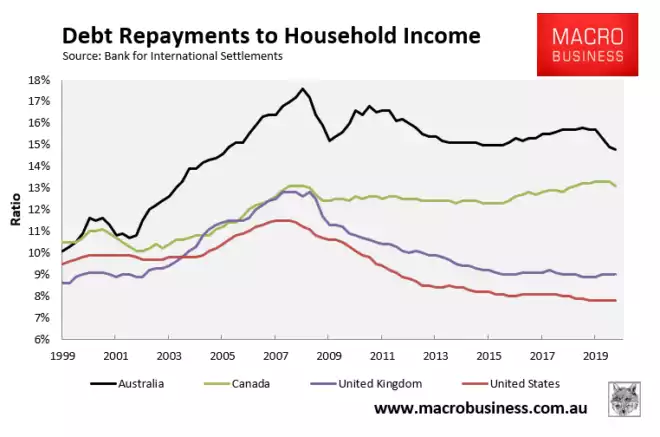

Before we start high fiving lets just remind ourselves just how we stand in the developed, English speaking world measured against GDP… Yep, that’s us way up the top there…

However that decline is ‘just not cricket’ in Australia and so the government has decided to propel our reliance on debt funded property to higher highs by introducing home building grants and more recently abolishing the responsible lending laws brought in during the GFC. As Frydenberg sold it:

"As Australia continues to recover from the COVID-19 pandemic, it is more important than ever that there are no unnecessary barriers to the flow of credit to households and small businesses"

This not only lowers the bar of entry into the housing market it also increases the size of loan for those already eligible. From Canstar:

“Mr Mickenbecker assumed rolling back the requirement to heavily scrutinise living expenses would lead to the assessed level of expenses going down, allowing the average person to get a loan $70,000 larger.”

This ‘sub prime’ lending approach has previously worked brilliantly for the US housing market…

Combined with the prospect of still lower interest rates to come as the RBA is widely tipped to lower rates this year, that dip in the charts above appear likely to head upward again. Despite the huge increase in total debt, the actual repayments have been relatively steady, and indeed since interest rate cuts in 2019, even falling.

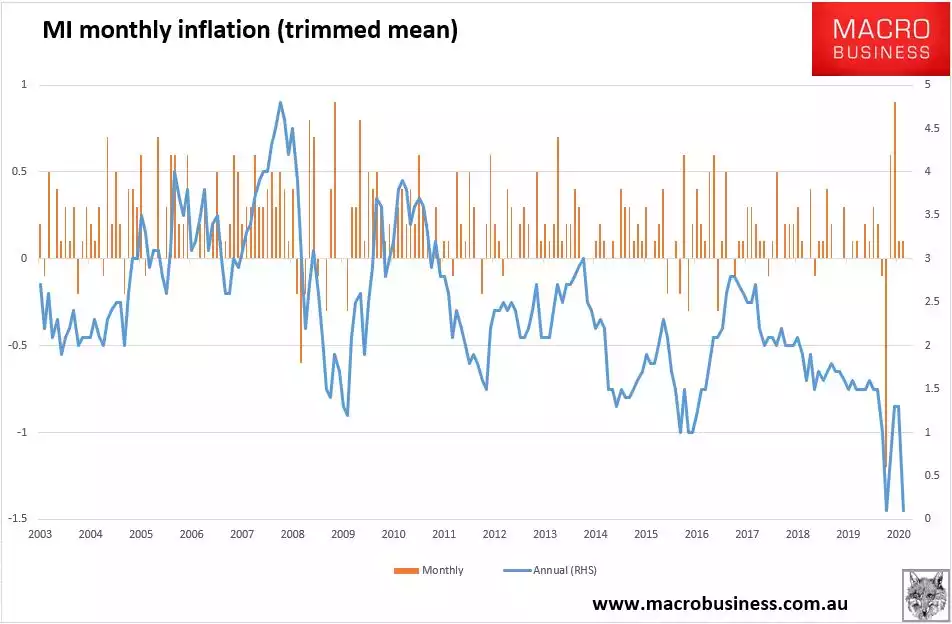

But herein lies the trap. We are in a macro deflationary environment at the moment and the Australian government and central bank, along with every other around the world, can and will throw the kitchen sink at getting us back into real inflation. As we wrote last week, debt + deflation = insolvency. Yesterday we got a reminder on how close we are to deflation with the Melbourne Institute releasing its monthly core inflation rate, hitting just 0.1% for September but also for the year, and the trend heading to zero and beyond:

This week will see the government unleash a record deficit spending budget in a desperate attempt to stimulate the country out of the worst economic contraction since the Great Depression. Deficits of course mean more debt and so we will see the double whammy of more of both public and private debt. Near zero interest rates make that all seem manageable. However the spectre of a flip to inflation, or more critically to stagflation where inflation rises within a weak economy and high unemployment, should prudently be at the front of people’s minds.

History is littered with previous examples of where massive monetary stimulus thrown at a deflationary economic environment ends in a violent and uncontrollable hyper inflationary period that brings that economy down. The alternative is the Japanification model that sees decades long anaemic growth alongside ongoing more and more stimulus amassing nothing but debt.