Australia Continues to Move Backwards

News

|

Posted 07/02/2025

|

6490

As the Department of Government Efficiency (DOGE) critiques reckless U.S. spending, discussion of whether someone should do the same in Australia has arisen. Australia continues to lead the Organisation for Economic Co-operation and Development (OECD) world as we decline in real gross disposable income to 2009 levels (you read that right) as one of the highest taxed countries in the world. National Disability Insurance Scheme (NDIS) has grown so much we are now spending AU$46 billion per year on a program that didn’t exist in 2009. With NDIS growth, the proportion of disabled persons has risen from 18% in 2010 to 21% in 2025, addressing inefficiencies and oversight within the system seems like a good place to start.

We were told the government needed to spend money during COVID-19 to get us through lockdowns. Lockdowns have now been over for years and governments are continuing to spend at COVID-like levels, prompting global rating agency S&P to put Australian state and local governments on notice that failure to rein in this spending will lead to credit downgrades. This in turn would increase spending as interest costs would go up. Yet we have excessive spending, exorbitant taxes, and some of the highest energy costs in the world. As the largest exporter of gas and coal shouldn’t our energy costs be the same or better than the second biggest exporter of gas Saudi Arabia. How has Australia gone so wrong?

S&P Downgrades

This week S&P brought out a report stating that between 2020 and 2023 governments have spent US$212 billion more than what they had forecast, driving budgets further into the red, this is despite an unexpected boom in revenue generating US$146 billion in extra revenue. At the rate we are going S&P estimates that the state's collective debts will be US$780billion, triple pandemic levels.

Despite being told COVID-19 was a one-off crisis, government spending has not declined, and Deloitte’s now estimates it will hit a record 28% of real GDP, with pre-COVID sitting at 22%.

The Royal Bank of Australia (RBA) has warned that excessive government spending has contributed to inflationary pressures, which have delayed potential interest rate reductions. This prolonged inflation cycle has set Australia apart from countries like Canada, which has already implemented multiple rate cuts since overcoming its inflation peak. Canada has seen its 6th drop since the end of their inflation period, Australia has still not seen even one. This is leading to an unprecedented rate of decline in Australian living standards which if continues on this trajectory will only get worse.

Living Standards Going Backwards

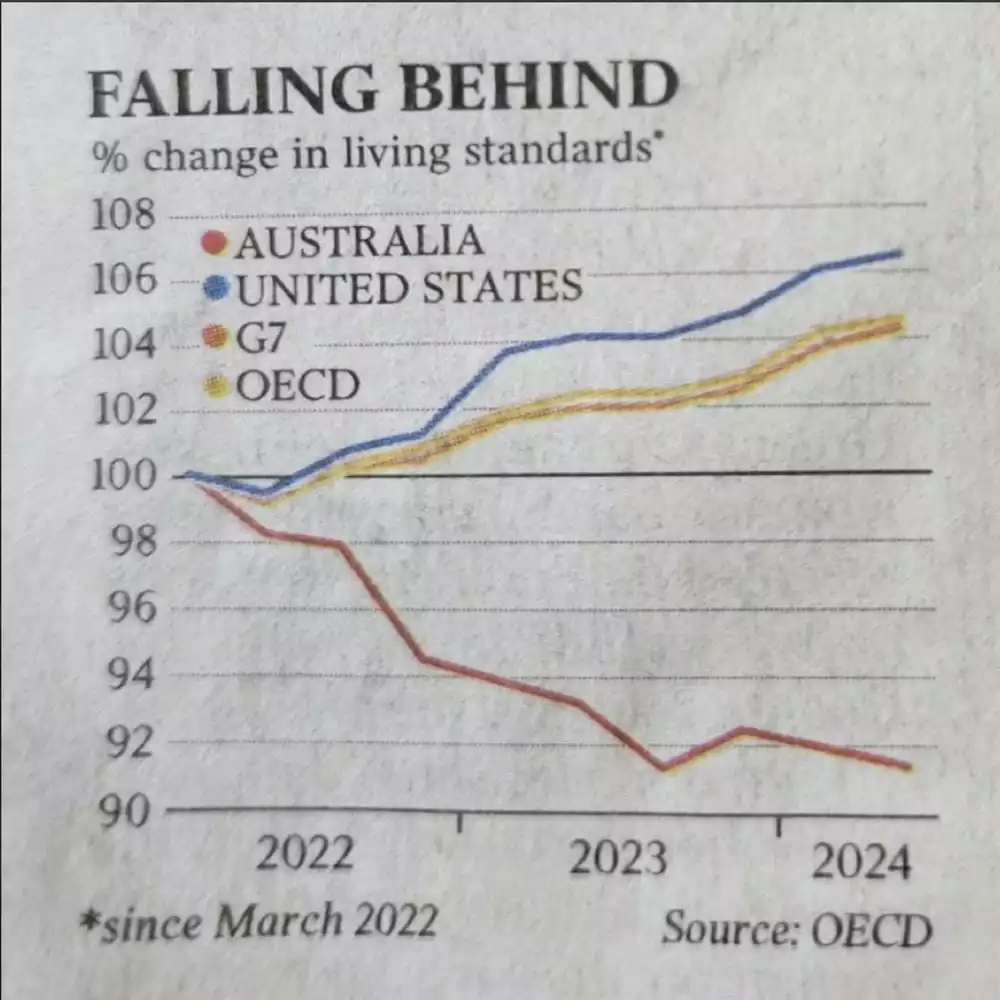

After all that money spent during COVID one would have expected our living standards to have improved. In other OECD countries, this has been the case, with the living standards improving on average 4 points on a March 22 100-point baseline, whereas Australia has gone backwards 9 points. Regarding living standards in 3 years, Australia has gone backwards 13 points compared to the OECD, 16 points compared to the U.S. and 9 points compared to how we were living 3 years ago.

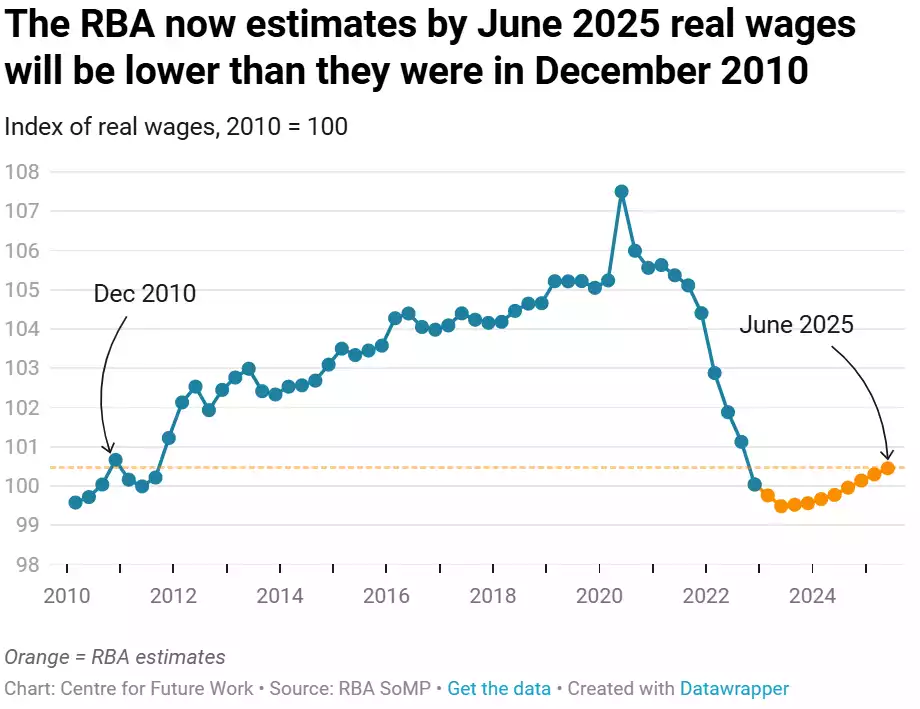

Looking at current real wages recent data shows we are now at December 2010 levels. Since 2021 Australia has gone backwards to 2010 wiping out 11 years of gains in 3 years of losses, the data is simply staggering.

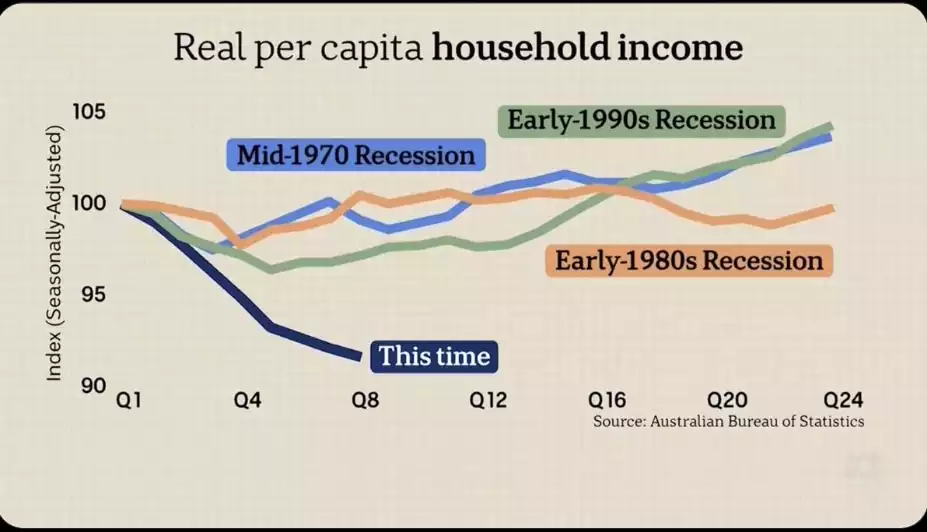

This GDP per capita recession is so bad that over the past three recessions, household income (indexed at 100) declined by between 2 and 4 points over two years. In contrast, we are currently facing a decline of nearly 10 points.

NDIS

It is no wonder Australia is accused of reckless spending (revenues continue to climb as do deficits). Look no further than the well-intentioned but poorly executed NDIS. It has recently become official that in Australia 1 in 5 people are disabled. Were 1 in 5 Australians disabled when NDIS started? From around 2003 to 2012 disability appeared to be stable at around 18.5%, with the introduction of NDIS an additional 3% of the population has claimed disability.

The NDIS is now costing AU$46 billion per year and the list of reckless spending on holidays, $60/hour 24/7 carers, tarot card readers and more, is now costing Australians 25% more than age care and 80% more than child protection services. If we didn’t have enough to worry about with an aging population, we now have 20% of the population being disabled and needing to be looked after.

Unless Australia looks seriously at itself and recognises what S&P has questioned

“We now question whether many states have exceptionally strong financial management on a global scale,”

Australia does not have a revenue problem; it has a management and spending problem. If we cannot find a solution Australia will fast become the Banana Republic everyone feared as we continue to go back to the future with more and more disabled and elderly to support.

In times of economic uncertainty, reckless government spending, and declining living standards, preserving wealth becomes more crucial than ever. Gold and silver have historically served as safe-haven assets, protecting investors from inflation and financial instability. As the nation grapples with economic mismanagement, securing a portion of your wealth in real, tangible assets could provide much-needed financial security for the future.