Australia Clinches Silver Medal for Debt

News

|

Posted 29/07/2019

|

9287

Whilst the Australian housing correction has seen some easing of the metrics around price to income and price to rent, a recent study has shown we are still the second most personally indebted nation on earth. And so doing the math, our debt (largely mortgages) is still sky high but the value of the asset securing it has come off… That’s not a good mix.

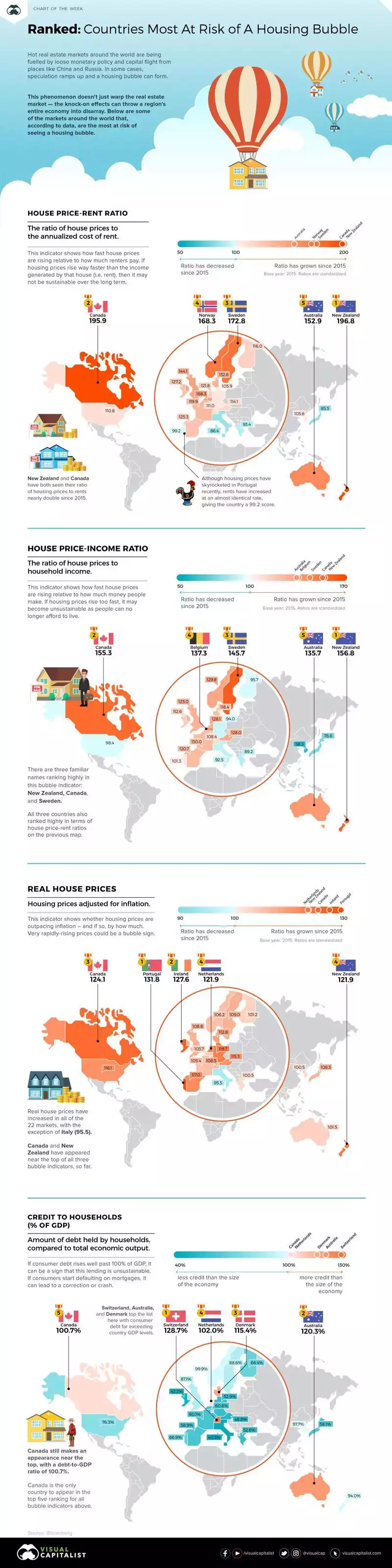

The info graphic below (courtesy of VisualCapitalist) and titled “Mapped: The Countries With the Highest Housing Bubble Risks” shows the results of a study comparing 2015 numbers to now. It certainly does not paint a great picture for ‘the lucky country’ with a top 5 finish in both house price to income and house price to rent, and a second placing for household debt to GDP after Switzerland. Unfortunately our close neighbour and (up until the Rugby World Cup) friend New Zealand is now the worst in the world for housing affordability.

These results are arguably all largely courtesy of China. Be it buying our property and forcing up prices or buying our commodities and services and emboldening us to take on more and more debt as we bucked the global trend of slowing growth and making us feel bullet proof. Combined of course with our government desperately trying to keep us buying property with more and more debt, signs of our property bubble bursting should not be a surprise. No amount of lowering rates by the RBA or grants from the government will save us if China tanks as we discussed on Friday. Topically, that latest bank we discussed has since been bailed out by Chinese state controlled financial institutions. They may well run out of fingers to plug this dyke….

In light of recent sporting headlines, China may well be the performance enhancing substance securing our medals but it may well soon be withdrawn.

You can click on the image if you have trouble viewing it.