Australia Barreling Toward “first endogenous shock in 30 years”

News

|

Posted 08/02/2023

|

13175

As expected, the RBA lifted rates by 0.25%, taking the Aussie cash rate to 3.35%, its highest level since September 2012. The balancing act of the RBA in trying to get inflation down whilst not crashing the economy saw them err to the conservative (again) and raise just 0.25% not the 0.4% that the likes of CBA and our own news contributor Alex Hutchinson argued was necessary.

As Alex argued, the RBA has left us dangerously below the rates employed by kin such as NZ and Canada and the mighty USA, in effect opening us up to imported inflation, in stark contrast to the aim of lowering inflation that already sits above most others. The opportunity to correct the abnormal COVID 0.1% by adding another 0.15% was not taken. This in large part is because of the yet to be truly felt impact on Australia’s world leading mortgage holding. Yesterday’s move takes the indicator discount variable mortgage rate to 6.70%, nearly double that of 3.45% in April 2022 and, lets not forget, the rate the RBA said would still be there now and through to 2024 at the time. That is the variable rate. The big hit is yet to be felt by all the fixed interest rate loans ending very shortly.

Variable mortgages have been ‘eased’ into the now average $1000 per month on a $500K mortgage, or $1500 on a $750K mortgage. Their will be no ‘easing’ when fixed term rates start to end.

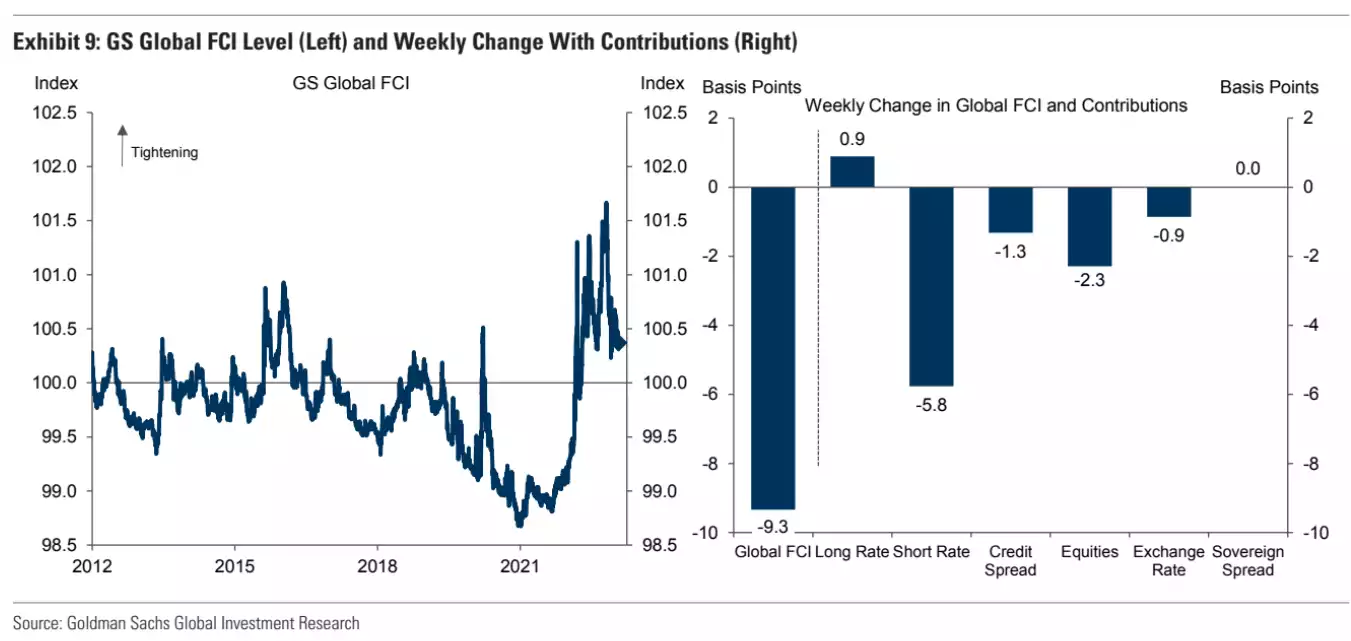

The RBA being late to respond has put us in a precarious position. Whilst the global financial conditions are showing signs of easing, we stand out as one of the worst in tightening. Goldman Sachs’ Financial Conditions Index presents "a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP." It is for many the go to indicator for how loose or tight financial conditions are in an economy.

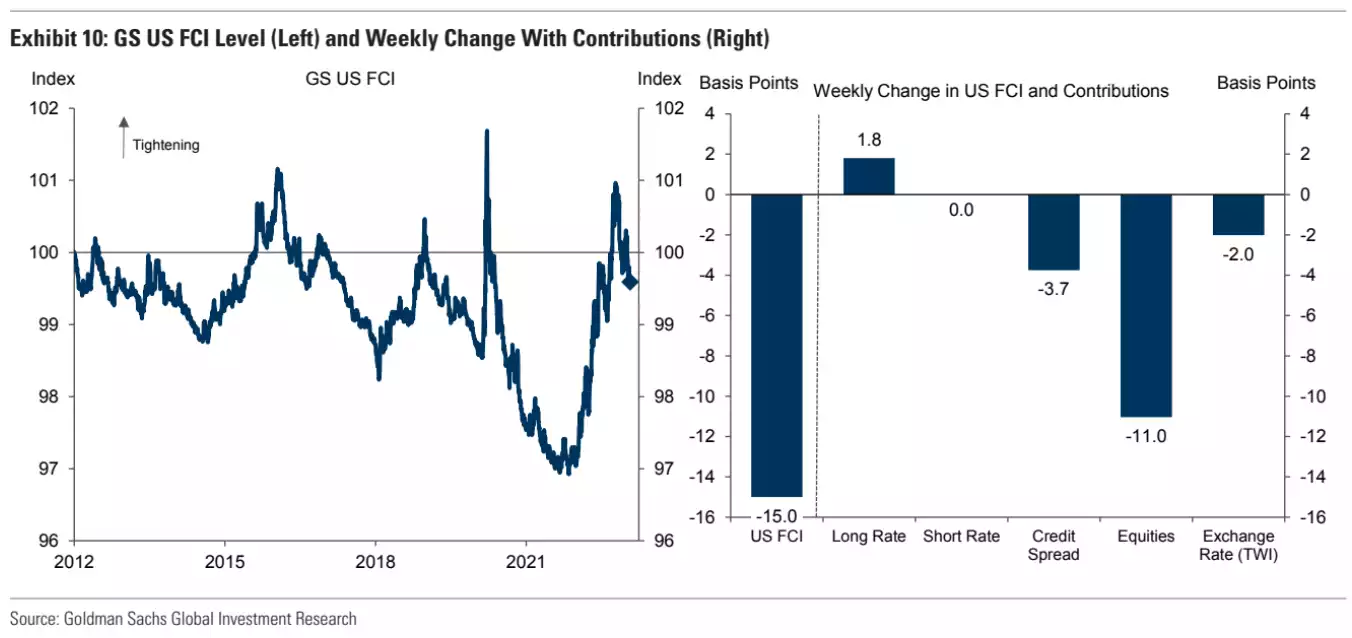

The US is a big weighting and it is leading the loosening play, albeit maybe dealt a blow with Friday night’s NFP print.

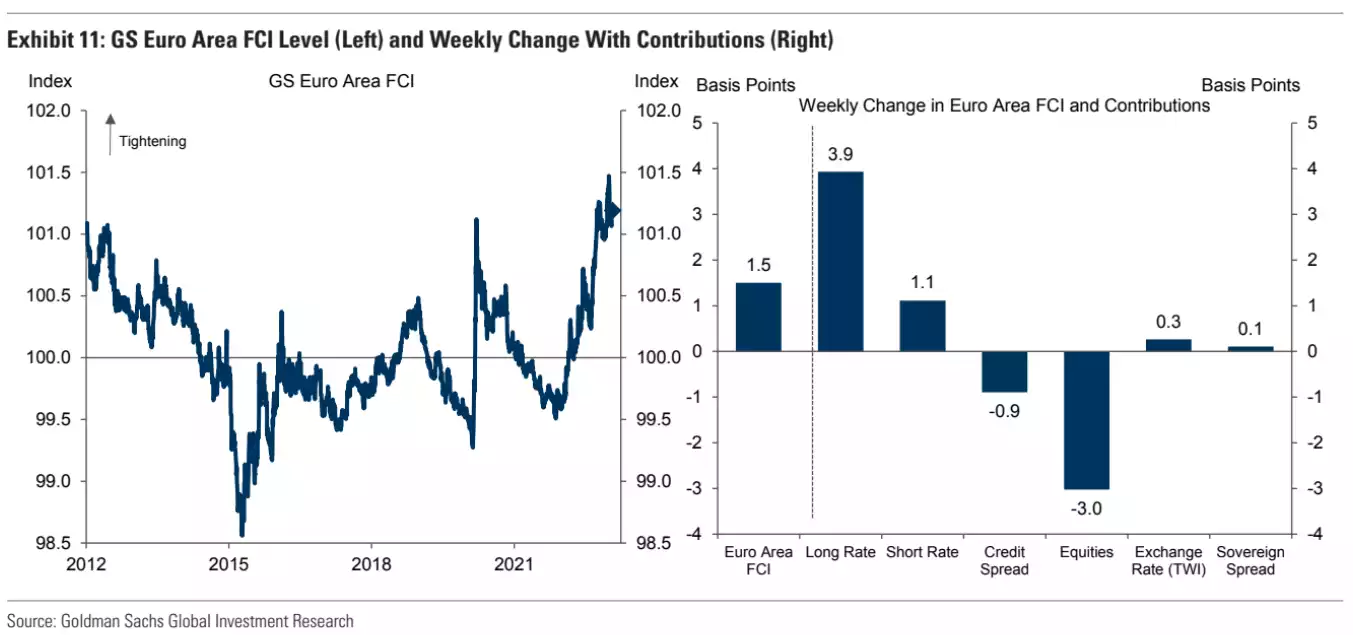

Europe too are late to tightening and still elevated:

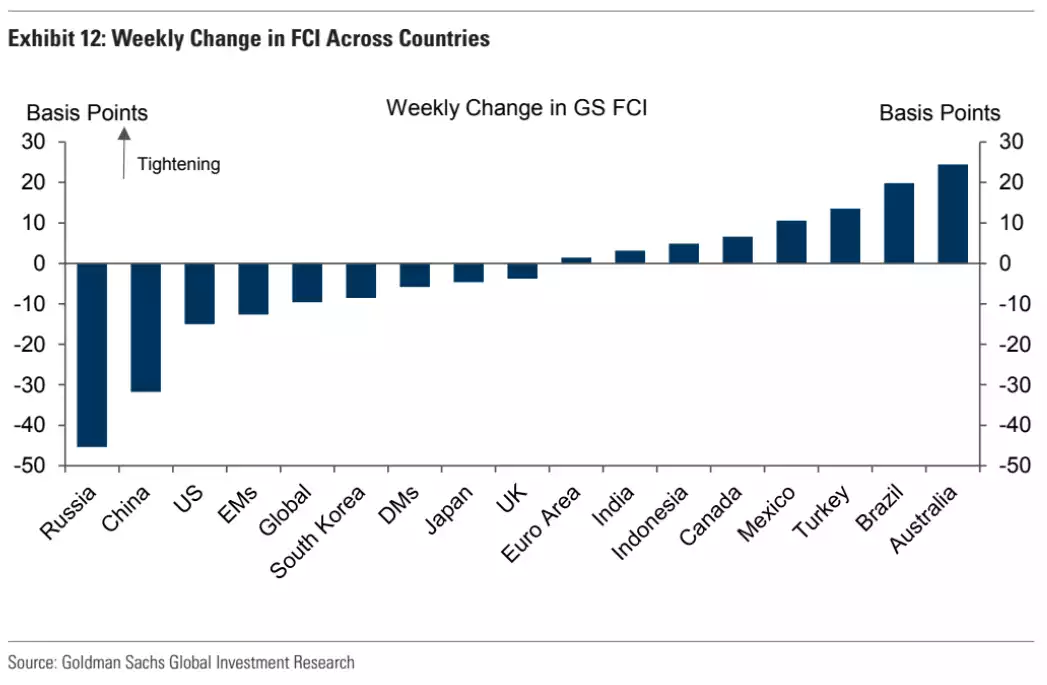

But to put that into perspective against Australia, you can see below we are leading the global pack in tightening conditions:

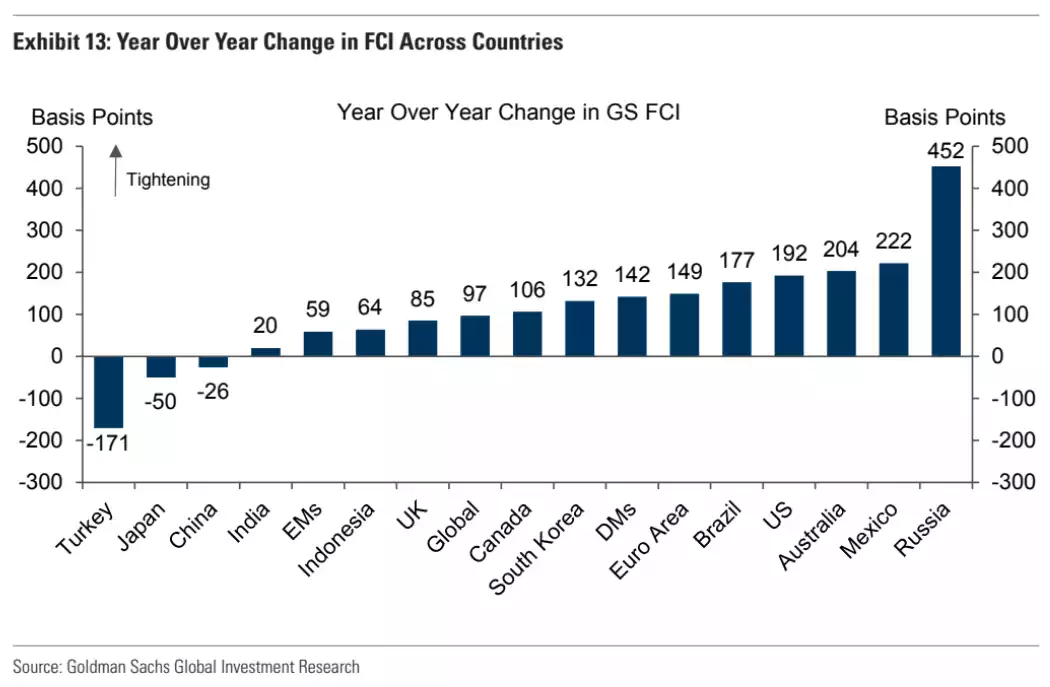

And to put the collective pain felt by such a late start into further perspective the following year long rate of change has us behind only Mexico and Russia in the race for worst off:

Whilst acknowledging the lag of impact of what is now 9 consecutive rate rises on mortgage holders, RBA chief Lowe was undeterred stating “the Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary” and “the Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that”.

Macro Business’s Chief Strategist David Llewellyn-Smith penned today “Australians head for their first endogenous shock in 30 years” in which he talks about our ‘charmed life’ over the last 30 years where we have survived the exogenous shocks of the Asian Financial Crisis, Dot.com, GFC and COVID relatively unscathed compared to the rest of the world. He warns though:

“Today, we face something we have not seen in 30 years, an endogenous shock. An inflation outbreak so strong that the central bank is going to jeopardise the household debt pile.

It is certainly the case that most of that inflation has come from offshore via supply-side problems. We are far less of an economic island than we were in the last endogenous shock of 1990.

But, by the same token, the breadth of inflation now bespeaks the opportunism of lifted price expectations. Our own pandemic stimulus played a key role in this, largely via housing costs, but also via a whipping fiscal fire hose, mass immigration, and the failure to address energy policy.

Thus, the current interest rate spike is as endogenously generated as we have seen in the globalised era.

Does it matter?

In macro terms, yes. It means that the two levers of policy, monetary and fiscal, are now going to extinguish the economy rather than save it, as they do in exogenous shocks. That means the economic fallout will be worse.

In political terms, yes. It means there is a lot more blame to go around which clearly opens the possibility of volatility.”

Aussie’s ‘hard asset de jour’ has always been property. The current setup looks somewhat dire for property, at least in the short to medium term. As we look ahead to volatility and recession there is little wonder we are seeing an influx of money coming into gold directly ex property settlements (many directly via the settlement trust account) as people reassess their hard asset allocation.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************