Aussie Property at the Precipice

News

|

Posted 16/05/2022

|

12933

Its hard to pick up a paper or read the news without headlines around plummeting auction clearance rates, stalled house sales, predictions of big house price falls, and then late last week we got the ABS stats showing new home and construction finance commitments literally halved from the ‘HomeBuilder’ stimulus February 2021 peak and likewise dwelling approvals down 36% year on year. The combination of removed stimulus and rising rates is weighing heavily and hence no end of promises from both sides of rescue packages in the lead up to the election.

Indeed, if one were to believe the futures markets Aussie rates are rising right up to 2.8% by the end of the year and peaking at 3.5% by mid next year. Off our near zero base that equates to an incredible 10 x 0.25% hikes in just 7 months to years end and another 3 to July 2023, the most aggressive hiking period since 1989. Late last week Bloomberg noted:

“One of the world’s most expensive property markets faces its biggest test in more than 30 years.

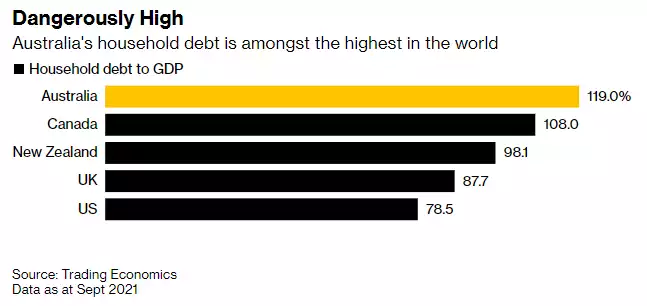

Australia’s A$10 trillion ($7 trillion) residential real estate sector will this year have to absorb the sharpest interest-rate increases since 1989, if bond markets are right. The Reserve Bank last week began its first tightening cycle in 11-1/2 years, shaking the confidence of consumers with some of the world’s highest debt loads.”

““Based on market pricing, Sydney and Melbourne could fall by 20%,” said Diana Mousina, a senior economist at AMP Capital Markets Ltd. “There is potential for steep falls in these markets because the run-up in prices was larger and households in these two cities are also a lot more under leverage.”

But Mousina, like most economists, says the central bank can’t afford to be that aggressive. The last time rate hikes of that speed and magnitude occurred it almost triggered a collapse in the financial system.”

She’s not alone. UBS also said “We expect the RBA hiking cycle to get stopped out earlier than most, and far below market pricing, as we think the latter would likely crash the housing market and cause a recession”.

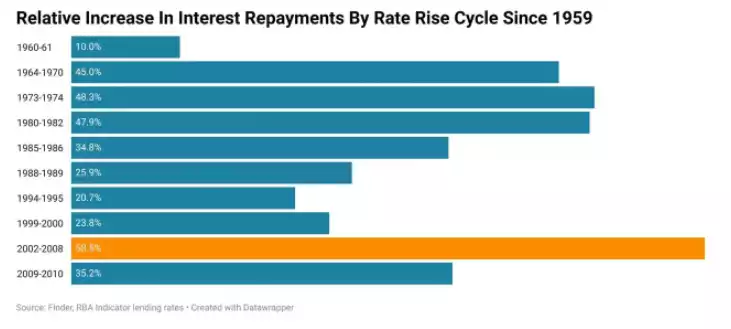

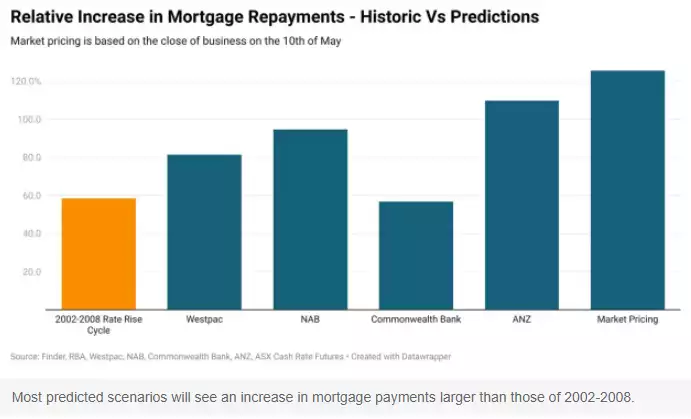

And so we have the same dynamic playing out in our housing market as the US has in its sharemarket. Just how far and brave will the central banks go and be? Tarric Brooker (@AvidCommentator) looked back at Australia’s records and found the most aggressive rate rise cycle ever was 2002-2008 which saw a 58.5% rise ending with the GFC crash. For context, the rises priced in by futures markets currently sits at over 120% increase on current rates…

However the big banks are not buying that (or at least are hoping the markets are wrong) and forecasting as follows:

- CBA: Cash rate to peak at 1.6%

- Westpac: Cash rate to peak at 2.25%

- NAB: Cash rate to peak at 2.6%

- ANZ: Cash rate to peak at 3%

- Futures Market: Cash rate to peak at 3.56%

To put that into perspective against the 2002-2008 previous all time record:

And so only the CBA are calling for less than the record and ANZ nearly as bad as the futures markets. From Brooker:

“In short, Australians have never seen interest repayments on their mortgages rise so much in a single rate rise cycle, making this a truly unprecedented event should any of the big bank scenarios come to pass with the exception of that of the Commonwealth Bank.

There is no doubt that the late 1980s and early 1990s presented a highly challenging environment for mortgage holders, many of us grew up on the tales of the necessity of sacrifice during that time from our parents.

But purely based on the magnitude interest repayments are predicted to increase, the potential upcoming challenge for existing mortgage holders is something else entirely.”

This is not just an Aussie problem. Societe General’s global strategist Albert Edwards believes we have a global problem in property whilst all eyes are on equities.

“I think GMO’s Jeremy Grantham is right. Yahoo News reports that Grantham believes “we’re in the midst of a fifth great bubble of the modern era, following the Wall Street crash of 1929, the Japanese asset bubble of 1989, the dot com blow-up in 2000, and the Global Financial Crisis of 2008.” But Grantham argues the US economy can likely weather dramatic drops in the stock market, as evidenced by the mild recession when tech stocks blew up during the dot com bubble. But when it comes to a housing crisis, he says, the economy is unlikely to come through unscathed. The dot com bubble of “2000 showed you can just about skate through a stock market event, but Japan and 2008 showed you can’t skate through a housing crisis.” Maybe the “day of reckoning” for the US housing market has arrived. Record house price inflation of around 20% yoy has just been smacked by soaring interest rates-30y fixed-rate mortgages rising from 3% at the start of the year to above 5¼% now-their highest levels since 2009. But the residential property bubble is a truly global event, and the US isn’t the worst offender. UBS calculates the bubbles are far worse elsewhere with, somewhat incredibly, Frankfurt being the biggest bubble of all-followed by the usual suspects. Having created an ‘everything’ bubble, we know from 2008 what path we are now headed down. Yes, it is different this time. It is worse!”

As you can see in the chart above, Australia still sits at one of the most overvalued property markets in the world and how this ends is simply unknown. Like the Fed, the RBA is stuck between the ‘rock’ of rising inflation and the ‘hard place’ of raising the cost of servicing an unprecedented debt pile and causing a hard recession.