At Last, the RBA Pauses Rate Hikes – Is the Pain Finally Over?

News

|

Posted 05/04/2023

|

11909

In a somewhat surprising move, and for the first time in almost a year, yesterday the RBA announced a pause to its interest rate increases, preventing an 11th consecutive increase for Australian homeowners.

The market expectation coming into Tuesday was heavily divided. A recent survey from Bloomberg had 19/30 economists believing a pause was the most likely outcome for April’s meeting, while 11/30 expected a continuation of the successive rate hikes.

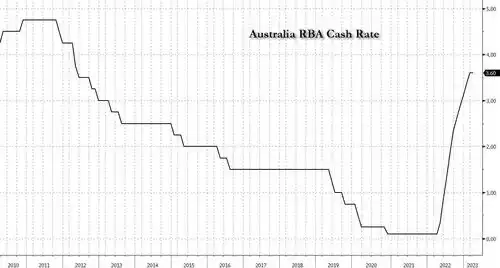

Over the past 10 months, the RBA has raised interest rates from a record low of 0.1% to 3.6% to combat skyrocketing inflation.

While on the surface this may be a step in the right direction, the RBA remained consistent in their messaging that this specific decision was much more of a temporary pause than anything else.

“The decision to hold interest rates steady this month provides the board with more time to assess the state of the economy in an environment of considerable uncertainty,” RBA governor Philip Lowe said on Tuesday.

“The board remains resolute that in its determination to return inflation to target and will do what is necessary to achieve that.”

Lowe went on to say that he expects a further continuation of monetary tightening to achieve this.

“The board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target.”

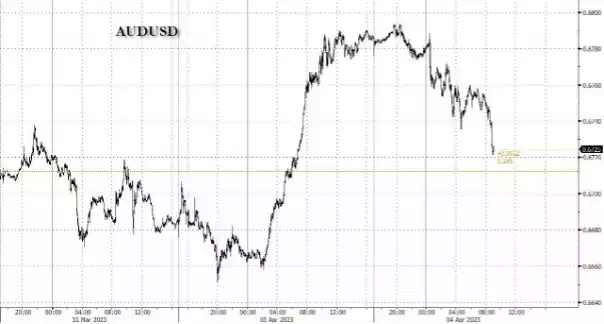

In response to the Reserve Bank of Australia’s decision, the ASX rebounded back into the green, and the Australian dollar fell 0.9%.

Major investment bank Goldman Sachs believes this decision was an overall positive move for the Australian economy moving forward.

“While today’s decision was always a close call, we viewed the pause as revealing a somewhat more dovish reaction function than we had anticipated, particular given ongoing upside risks to wages growth and inflation in Australia.”

Sean Langcake, head of Macroeconomic Forecasting for BIS Oxford Economics said the main motivation for this decision was the to buy the RBA some time.

“The release of the quarter one consumer price index data ahead of the May meeting will be a pivotal piece of information. Inflation remains uncomfortably high, and the very tight labour and rental markets have the potential to provide an upside surprise on inflation.”

While Langcake is clearly correct about the buying time aspect, the pause is more likely to have occurred due to the systematic banking fears, and the need for more information around that potential fallout, than the inflation data alone.

The RBA is likely hesitant to continue increasing this month in fear of Australian banks and financial institutions being impacted by the SVB and Credit Suisse chaos, as well as wanting to align themselves with the global trends that will emerge as a direct consequence of those collapses, i.e. more bank bailouts/quantitative easing in the US.

In an ironic twist of fate, the greed of bankers and collapsing financial institutions is what is now providing regular homeowners with some short-term financial relief.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

****************************************************