Asset Performance in Stagflation

News

|

Posted 28/03/2022

|

11927

Each year one of the most eagerly anticipated annuals is the In Gold We Trust report from Switzerland’s Incrementum. As has been the case for a few years now they are pre releasing a teaser chart pack of what’s to come without any written explanation. This week, new news permitting, we will pick a few to discuss pre-emptively. As we noted last week, the set up now with persistent inflation and slowing growth is that dreaded financial bogey-man, stagflation.

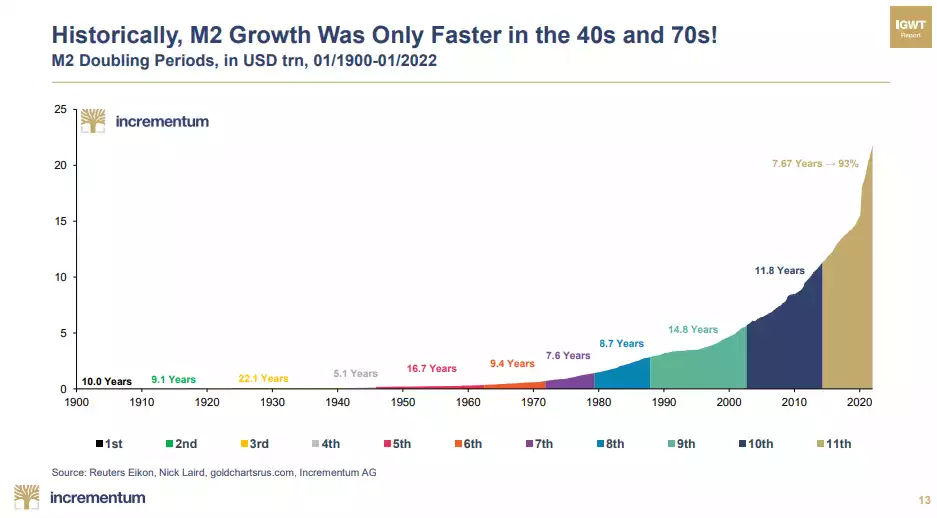

So how did we get to this point? Pretty simple really, the US money supply (measured as M2) has only grown faster at 2 points in over 120 years, the 40’s in response to WW2, and the 70’s with the resulting inflation and economic turmoil that ensued (and a record surge in gold and silver).

As discussed many times, that did not translate to real inflation at the consumer level nor real robust economic growth. The latter, in part, was because of the enormous debt burden that came with it. What did inflate of course, was shares…

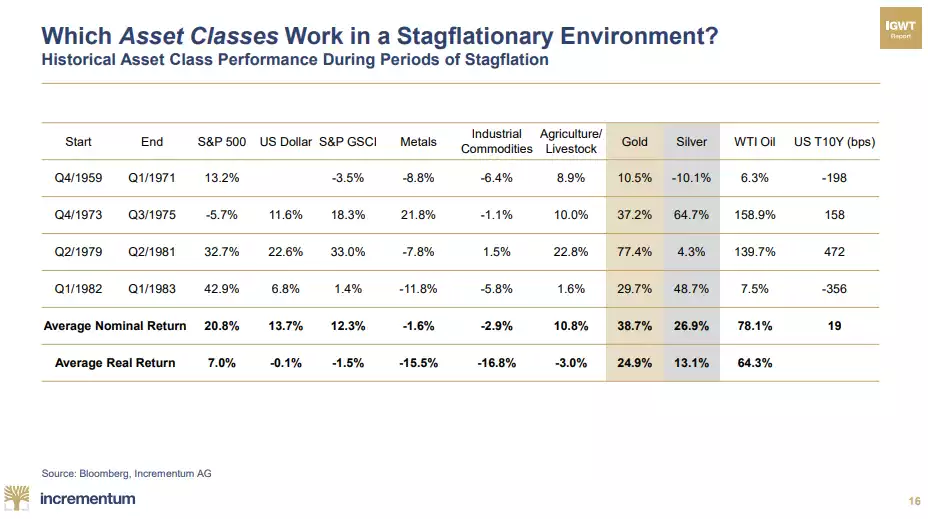

To regular readers, none of this is new news, stagflation appears to be our immediate future. So how do various assets fair in such an environment? The table below shows only oil outperforms gold and silver. Whilst we’ve seen oil surge so far, gold and silver are yet to break out.

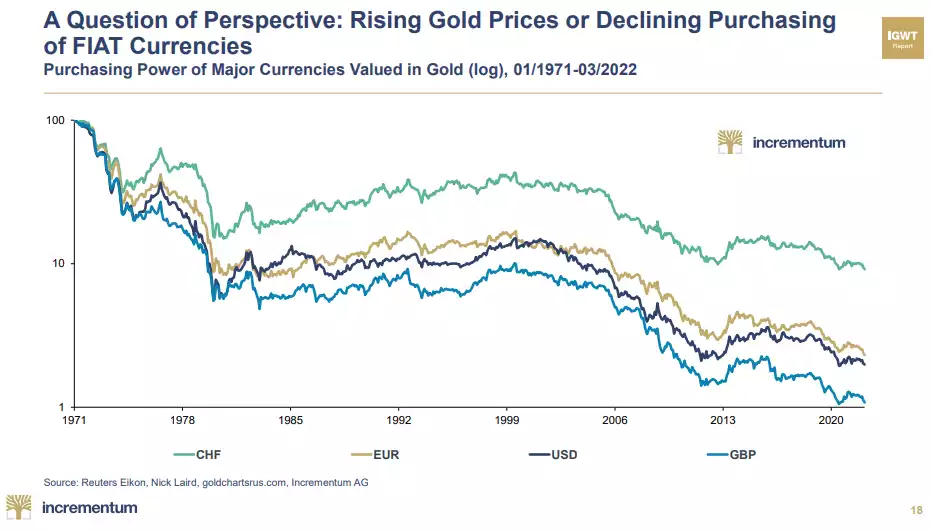

Of course a stagflationary environment is a thief of purchasing power. Put simply you can’t expect to print that much new currency for effectively the same amount of goods, and arguably amid moribund economic output, relatively less again, and not expect to see that.

The chart below is a salient reminder that since we left the gold standard in 1971, depending where you are, the major currencies of the US dollar, Euro and British Pound have lost between 95-100% of their value measured against real money, being gold. We should never forget the difference between Fiat currency and real money.

To date, and particularly since the GFC, if you were clever (brave) enough to ‘not fight the Fed’ and invested in growth shares in the US, you would not be too concerned about that loss of value of the paper money in your wallet. However at this juncture, looking at the Buffet indicator chart above and the historical performance of precious metals in a stagflationary environment, one has to clearly question the longevity of such a position….