‘Are we there yet’ - Peak Inflation? Pre GFC Cliff?

News

|

Posted 14/12/2022

|

12008

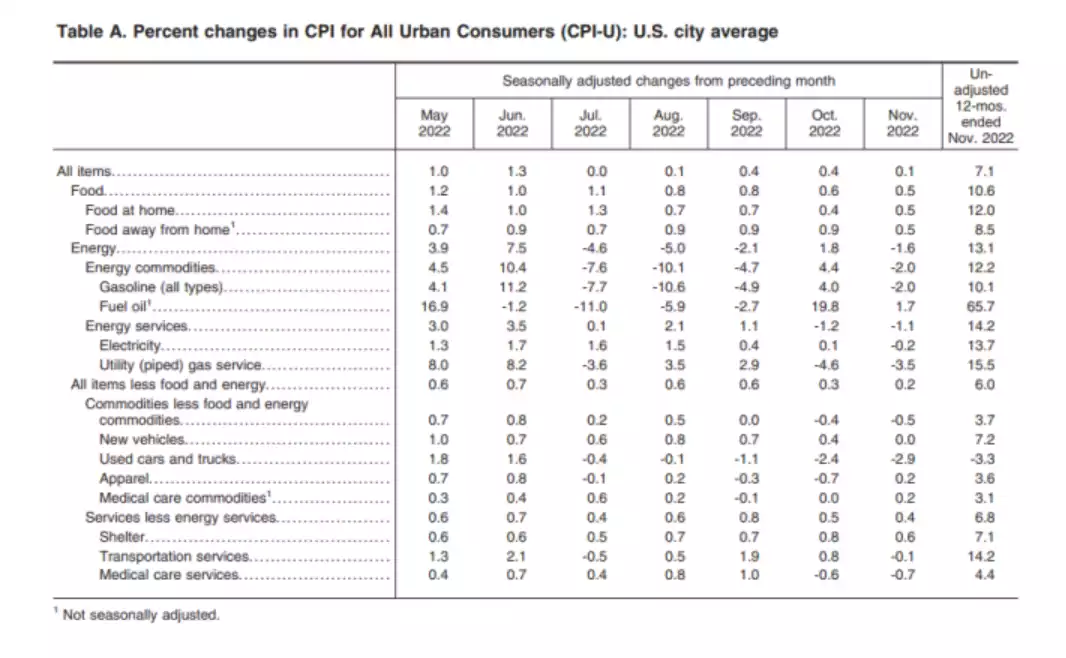

Last night the USD sank against its peers on the back of a weaker than expected CPI figure (7.1% vs 7.3%) while core prices have dropped even further from 6.3% to 6%. With most countries targeting 2-3% inflation and a lag effect between interest rate rises and inflation readings the question needs to be asked ‘Are we there yet?’ Moreover its looking a lot like the pre GFC final leg down setup.

Peaked inflation party

The US is starting to look like their inflation rates have peaked, with last nights inflation figures coming in well below expectations and the lowest they have been since December 2021. The USD dropped sharply, with the DXY seeing its largest daily drop this year. This led to a stockmarket rally overnight, with the Dow Jones Industrial Average S&P and the Nasdaq 100 gaining 0.3%, 0.7% and 1.1% respectively. Metals and commodities also rallied strongly with gold climbing 1.5% off the news, but in Australian dollar terms were muted by the gains in the AUD.

USD 10 year Treasuries drop

As we’ve seen and all felt with increased mortgage payments the world banks have embarked on one of the fastest monetary policy tightening regimes in the last 40 years, led strongly by the US. Tonight it is anticipated that the US will increase rates by another 50Bp to climb to 4.25%. Before the next RBA decision the US will have another decision on rates, and the likelihood of another 50Bp rise are dropping quickly, with Morgan Stanley now saying only 1 more 25Bp rise in February.

As you can see on the 10 year Treasury rate graph interest rates forecast have been coming off quickly, from a peak of around 4.2% its now sitting at 3.5%

Inputs are dropping but wages will keep rising

As previously spoken about, the aging population and reducing participation rate are going to continue to drive wages higher. Demographically, unless there is a major recession, nothing is going to help those numbers. But as the economies cool after the covid 21/22 bump shipping prices, input costs and energy prices continue to drop. Additionally looking at the US Fed numbers one of the larger CPI contributing numbers has come from the basket ‘Shelter’ at 0.6% which can be argued is directly being contributed by higher mortgage payments from interest rate rises needing to be passed on.

The other driving inputs are still food and energy prices – which we have been arguing are uncontrollable supply shocks (Ukraine war, flooding, droughts) but even these appear to have peaked and are starting to pull back. Regarding food, interestingly ‘full service meals’ as opposed to limited service meals and food at home, is running at 9% year on year compared to 6.7% showing that there is a greater impact from wage rises in the numbers.

So are we there yet?

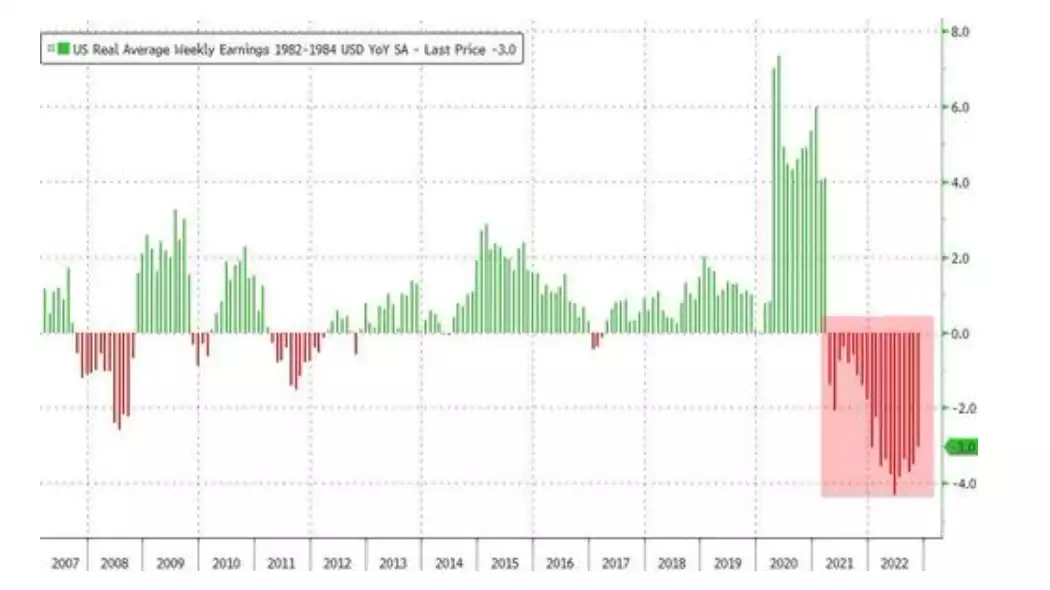

It certainly appears we have reached the peak inflation cycle, from here the Fed will be looking at the last hurdle which will be driving wages back to a manageable level, however the fact that wages inputs are still strong will make this inflation stickier for longer and out of the Fed and other Central banks control. For critical context, the chart below still shows 20 consecutive months of wages not keeping up with inflation…

Governments that can target policies towards immigration, participation rate growth and labour productivity will see peak interest rates met faster and even decreases in interest rates going forward sooner and the possible avoidance of a recession.

The US government which has not changed their immigration policy since 1986 and now with a Republican/Democrat House/Senate split will not be able to initiate these changes, which is likely to lead to sticker inflation. The only thing Central banks can do about this is to drive interest rates higher driving economies to a recession to reduce labour demand, increase unemployment and therefore reducing wages.

Even if inflation has peaked the last hurdle will be harder to reduce and may lead to a longer period of higher interest rates.

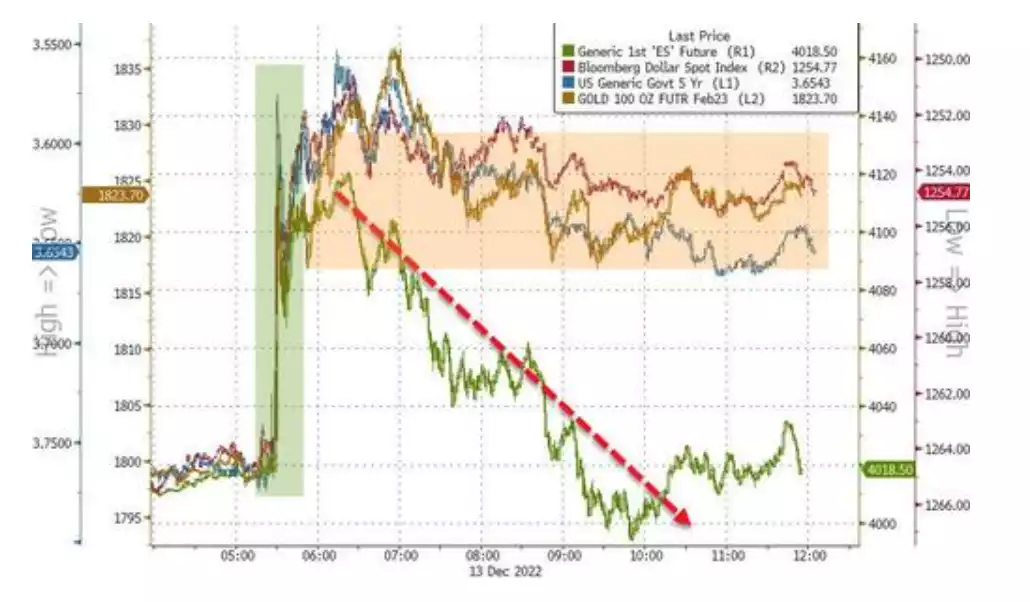

Observing the market action last night was very telling. If you look at the chart below you can see that shares, bonds, and gold all surged and the USD (blue line is inverted) and bond yields fell sharply on the news. But then look at what the green line S&P500 did for the rest of the session. Whilst literally no one expects anything less than a 50bps rise tonight from the Fed, nor them pausing from there, a recession is almost certain as they ALWAYS keep tightening into weakness and 7% is still 7% not their ‘target’ 2-3%. That is bad news for shares (as earnings tank) and hence the ‘realisation sell off’ after the news sank in. Gold, on the other hand, knows that lower real rates and sharemarket turmoil ahead are its sweet spot, surged back over $1800 and held.

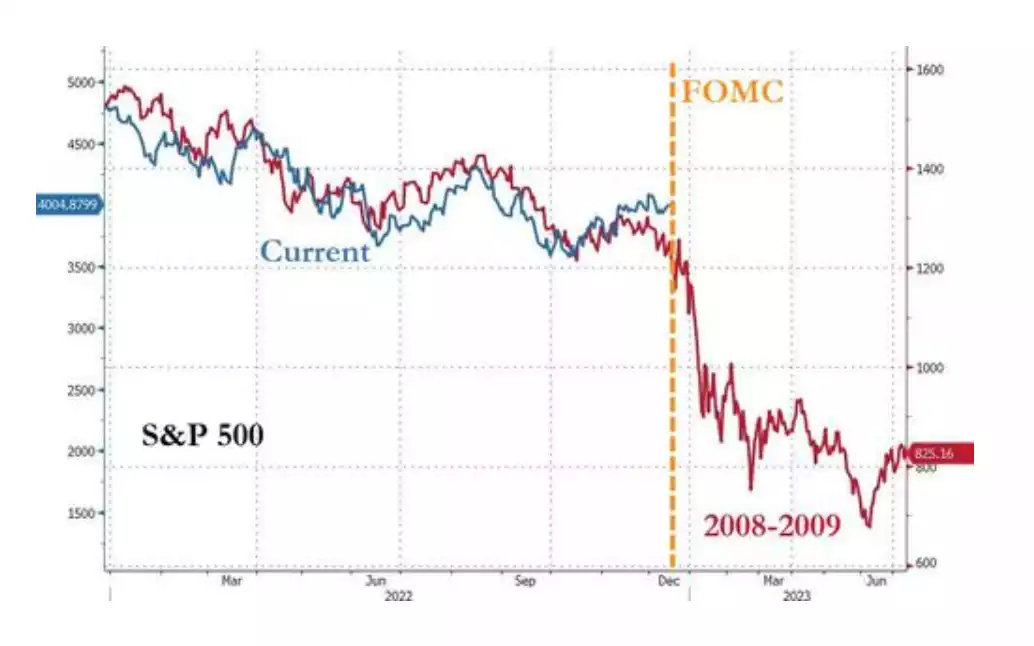

We’ve seen this play out before … So in terms of ‘are we there yet’ on peak inflation, the bigger question is ‘are we there yet’ on the chart below where the sharemarket crashes into a recession when the worst felt like it was behind us. History tells us we are only just beginning.