Are People Front Running The First Rate Cut?

News

|

Posted 13/12/2023

|

1859

The ‘Bad News is Good News’ sentiment has been the markets’ prevailing sentiment recently as the global economic data worsens, but is there any historical precedent and what will be the end result if everyone is already betting on a pre-emptive Fed policy change?

In October, the financial markets experienced a 10% decline from their peak in July, accompanied by bond yields reaching 5%, and widespread discussions about an impending recession.

The conventional wisdom on Wall Street often advises to "sell the last Fed rate hike." This is because, historically, when the Federal Reserve begins reducing interest rates, it signals a period of re-evaluation in the markets, reflecting lower expectations for earnings growth and profitability.

As Michael Lebowitz noted previously in “Federal Reserve Pivots Are Not Bullish:”

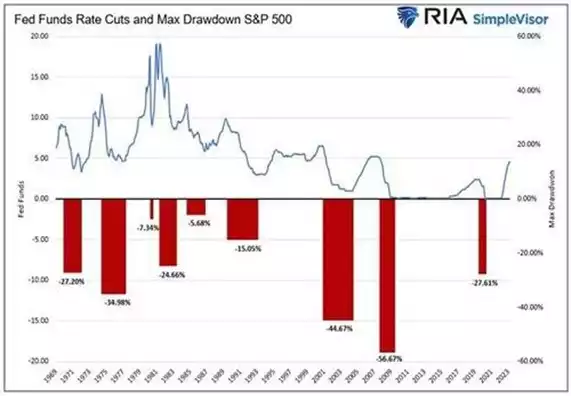

“Since 1970, there have been nine instances in which the Fed significantly cut the Fed Funds rate. The average maximum drawdown from the start of each rate reduction period to the market trough was 27.25%.

The three most recent episodes saw larger-than-average drawdowns. Of the six other experiences, only one, 1974-1977, saw a drawdown worse than the average.”

Despite this historical perspective, an unusual trend has emerged, (which we discussed last week on insights here), where the markets rally significantly, driven by anticipation of the Fed cutting interest rates in the first quarter of 2024.

Curiously, the worse the economic data becomes, the more optimistic investors grow, anticipating a policy reversal by the Fed. This phenomenon has commonly been termed "Bad News is Good News."

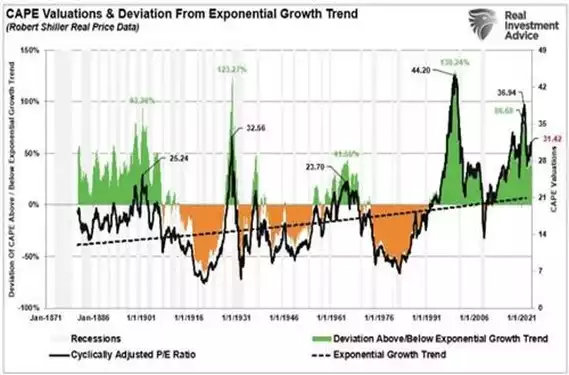

However, the current optimistic outlook seems disconnected from the economic reality, as lower economic growth and reduced inflation, typically associated with a rate-cutting cycle, do not align with the prevailing positive earnings estimates and elevated valuations.

The deviation in valuations can be attributed to over $43 trillion in monetary interventions since 2008, conditioning investors to overlook fundamental factors. Much like Pavlov's classical conditioning experiment, where a neutral stimulus becomes associated with a potent stimulus, the introduction of each round of Quantitative Easing by the Fed coincided with a rise in the stock market, reinforcing the idea that monetary policy changes lead to favourable market conditions.

Before 2008, there was a clear pattern of markets repricing lower when the Fed initiated a rate-cutting cycle due to the acknowledgment of a financial event. However, post-2008, the Fed's consistent response to any market-threatening event with rate cuts and accommodative policies has trained investors to expect support in challenging times, as witnessed during the pandemic-era shutdown.

A considerable portion of current investors has not experienced a true "bear market," and their market participation has been marked by continuous interventions by the Federal Reserve. Consequently, there is a prevalent fear of missing out on the next round of Fed support, indicating that investors might be front-running the Fed's actions.

Despite indicators suggesting a possible recession, it has yet to materialize, and economic growth persists in the face of tight monetary policy. Investors now speculate that a recession will be averted, the Fed will cut rates, and stocks will rise. The market's rise since November has bolstered consumer confidence, potentially preventing the expected decline associated with a Fed rate-hiking cycle.

Considering the possibilities for 2024, scenarios range from the Fed successfully navigating a soft landing and supporting market growth to economic activity picking up, leading to the Fed remaining cautious due to inflation concerns. Conversely, there is a risk of a financial event and recession, even with aggressive rate cuts, resulting in a market repricing lower due to a decline in earnings growth.

While historical indicators suggest a more bearish outlook for 2024, the decade-long conditioning of investors to react positively to monetary policy changes introduces an element of uncertainty. The markets are most definitely pre-emptively responding to the anticipated actions of the Fed, even if it defies conventional logic and fundamentals.

Gold loves new liquidity and also thrives in a recession/market crash, so it appears to be an each way bet right now.