Are Miner’s The Last Sellers?

News

|

Posted 04/10/2022

|

11859

Global equity and bond markets continue to walk on a knifes edge, with growing evidence of stress developing in sovereign debt and currency markets this week. Of particular note was the dislocation experienced in the United Kingdom Gilt market, where bond yields soared, the British pound fell to all-time lows against the US Dollar, and the Bank of England re-established quantitative easing to re-liquify markets – an extreme measure.

Amidst such extremes, Bitcoin prices have remained notably stable, consolidating within an increasingly narrow range between US$19,921 and $20,239. Such quiet periods are very uncommon for Bitcoin, with semblance to both pre-crash November 2018, but equally to pre-rally March 2019.

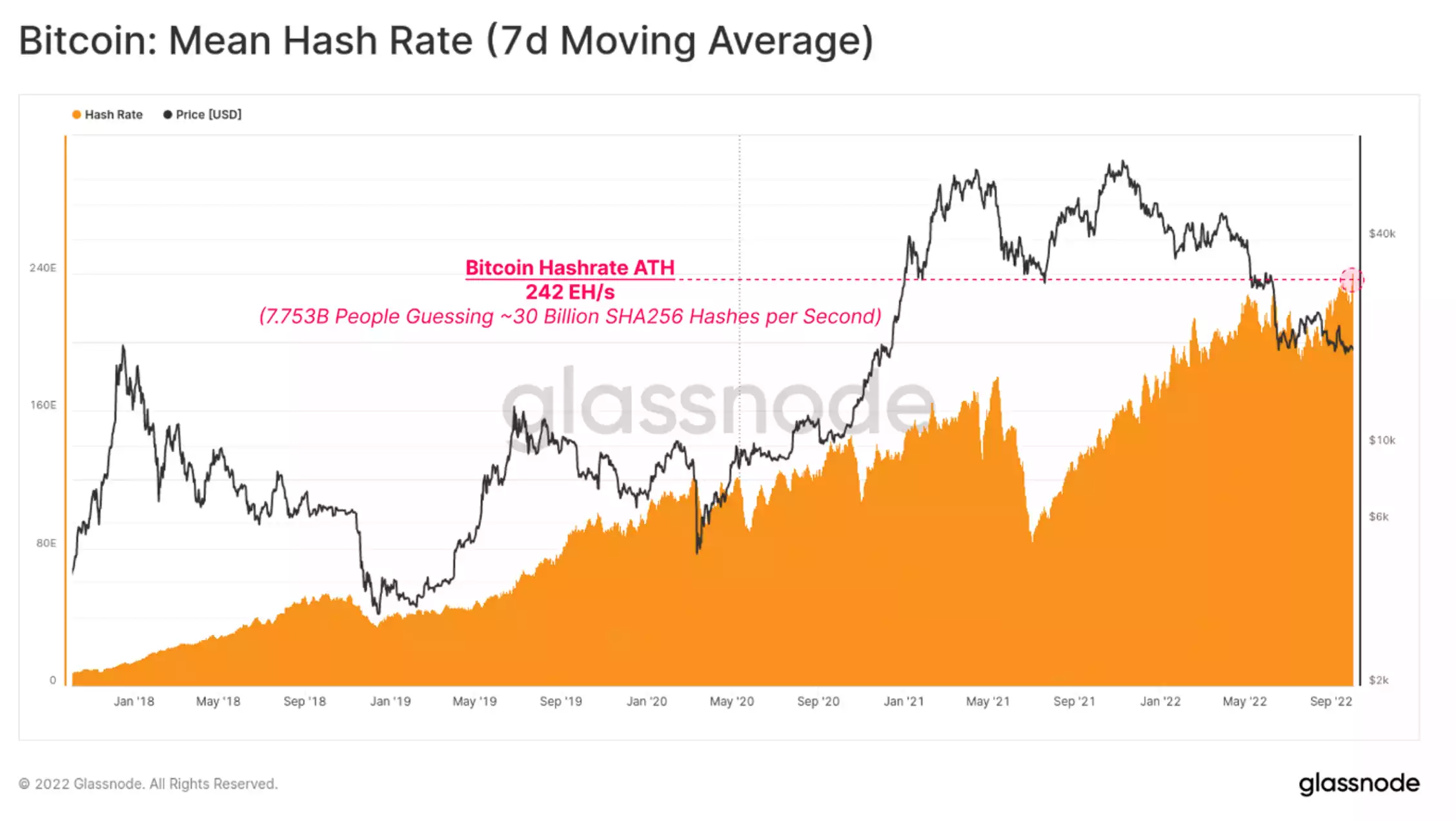

Despite severe price drawdowns and global macro turmoil, the Bitcoin hash rate has pushed to yet another all-time high this week, remarkably. The BTC mining sector is therefore recovering extremely well despite macroeconomic stresses (affecting the related energy costs of BTC mining), a signal which has historically been constructive in the months that followed.

As the global bear market rages on, the Bitcoin hash rate has reached a new all-time high of 242 per second – an extraordinarily large number for the network.

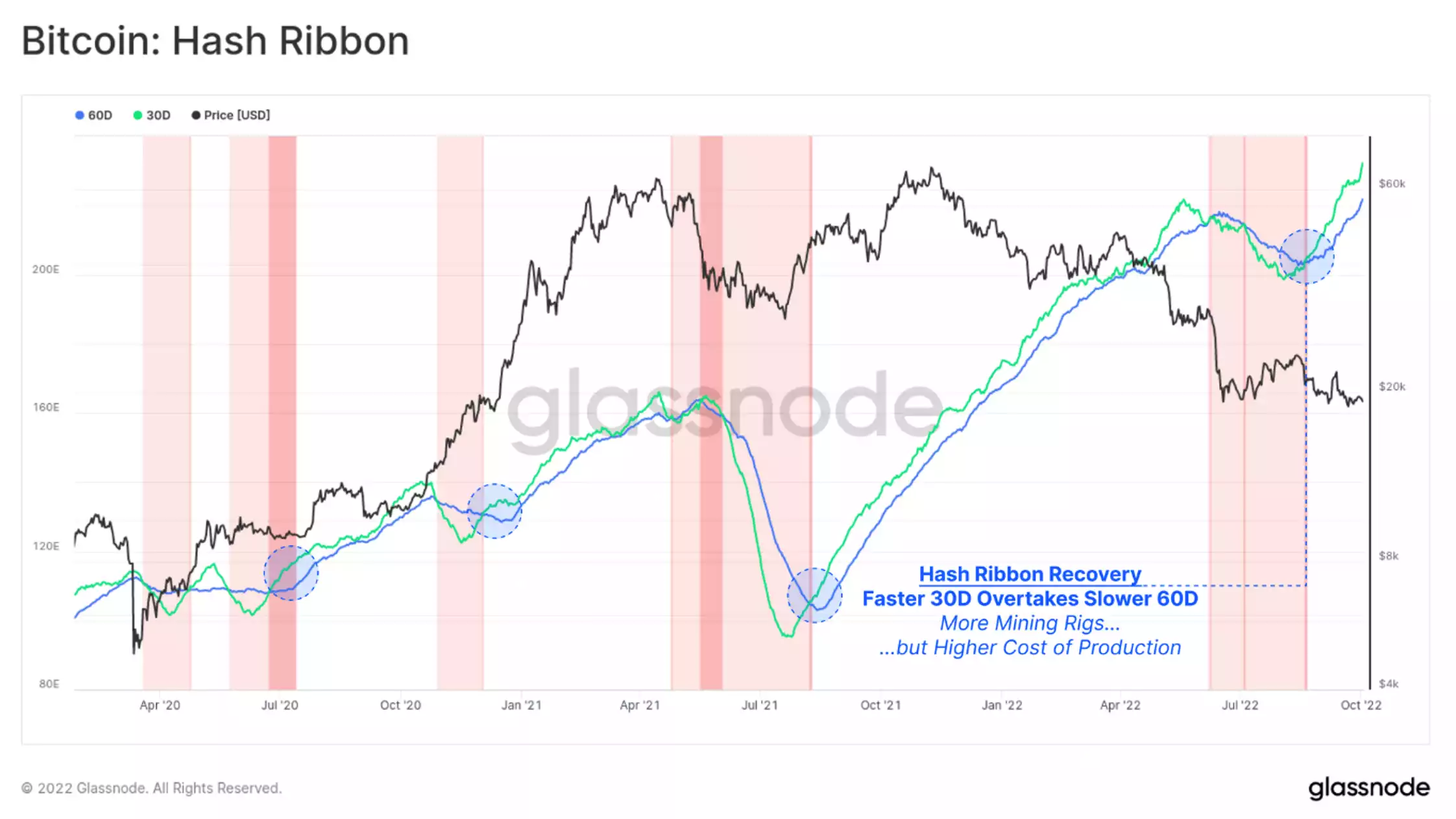

The Bitcoin hash-ribbons commenced an unwind in late August, indicating that mining conditions have been improving, and the hash rate was coming back online. Interestingly, the current environment has not yet seen prices recover, signalling this hash rate rise is due to more efficient mining hardware coming online and/or miners with superior balance sheets having a larger share of the hash power network.

Almost all historical hash-ribbon unwinds have preceded the beginning of a longer-term bull market in the months that followed.

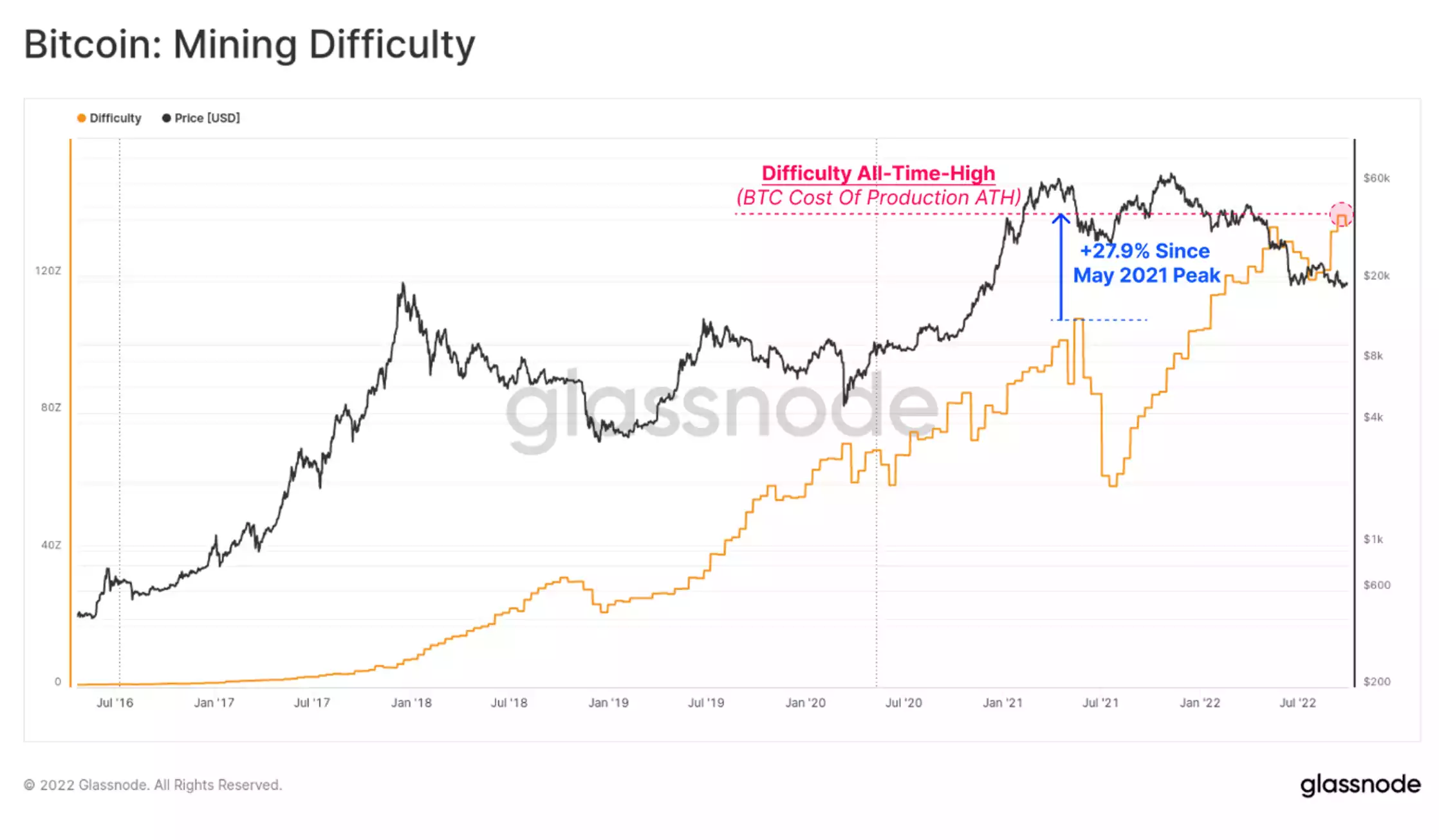

Higher protocol difficulty implies an increasing cost of production per unit of BTC as more hash power competition enters the network. This is occurring at a time when miner revenues are already stressed due to lower coin prices and increased energy costs, which should, in theory, create elevated income stress on the mining industry.

Numerous models have been proposed to evaluate, and estimate the network-wide cost of production for BTC, many of which consider Difficulty as an essential input parameter. Difficulty effectively represents a protocol-defined measure of the all-in-hurdle-rate to solve the next block and win the reward.

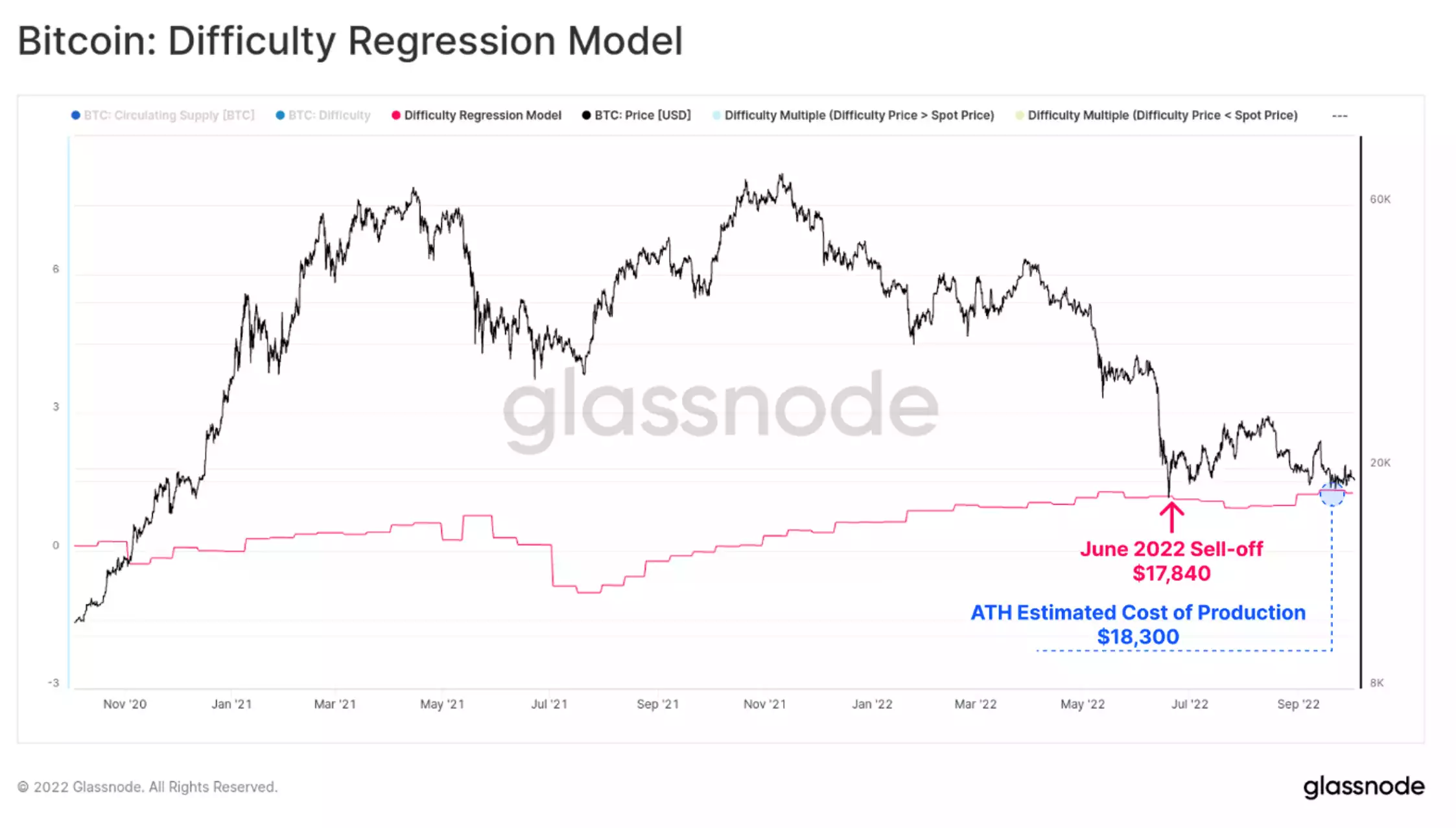

The Difficulty Regression model is a fairly simple interpretation of this, calculated as a log-log regression between Difficulty and Market Cap, sporting an exceptionally high R2 coefficient of 0.944. This model last intersected spot prices around $17,840, at the lows of the June 2022 sell-off. It is currently hovering around $18,300, which is just below last week's lows.

This would indicate that miners are somewhat on the cusp of acute income stress.

Amidst global chaos in traditional markets, Bitcoin prices remain remarkably stable, in a multi-month consolidation between $18k and $20k. It is extremely rare for BTC prices to stay so stationary for long, suggesting heightened probabilities of volatility on the horizon. This comes at a time where global central banks appear to be turning the printer back on – something which sent BTC prices to all-time highs previously.