Are Digital Assets Safe from The Fed?

News

|

Posted 23/08/2022

|

11604

The digital assets market recently experienced a wave of short relief. What can we learn from current on-chain network activity and the late-stage dynamics of the 2018 bear market? Let’s dive in.

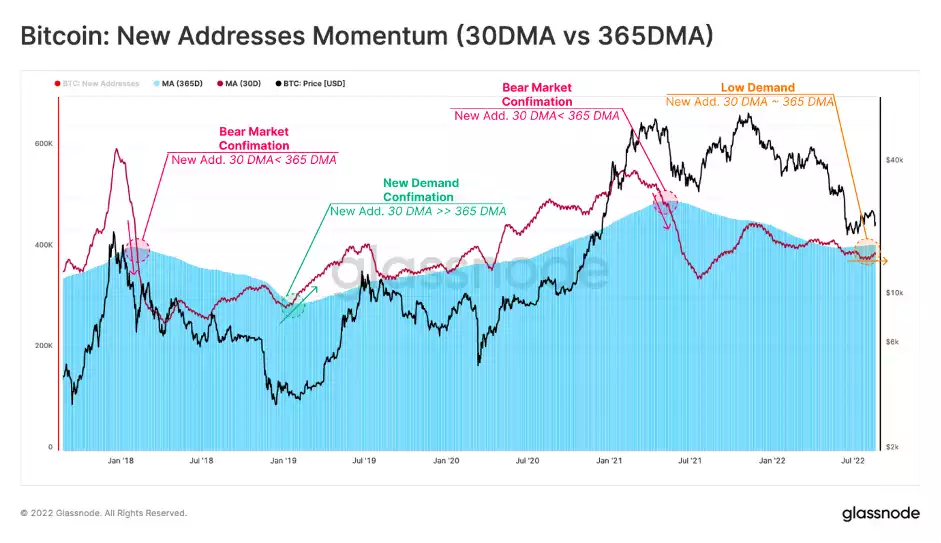

The number of unique New Addresses which appeared for the first time is an effective tool to gauge the activity in the network. Due to intraday volatility in activity, the absolute value of new addresses on any given day can be uninformative. However, the trend of new addresses entering the market can provide a strong signal for network activity.

Examining the recent spot price bounce above realised price shows that the monthly average of New Addresses is still lower than the yearly average.

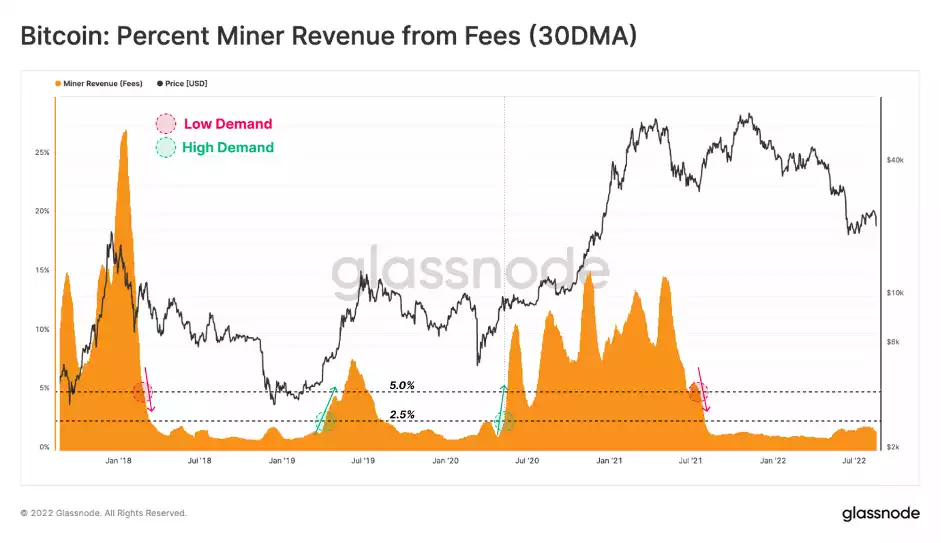

Probing further into the demand side, Miner Revenue from Fees allows for evaluation of the competitiveness of Block space. This can be considered a measurement of network congestion and demand for inclusion in the next block.

The current structure of this metric demonstrates a low but noticeably rising level of demand for block space. Despite its simplicity, measuring the momentum of paid fees for total settled value is an insightful macro indicator for assessing the complex dynamics of increasing network demand.

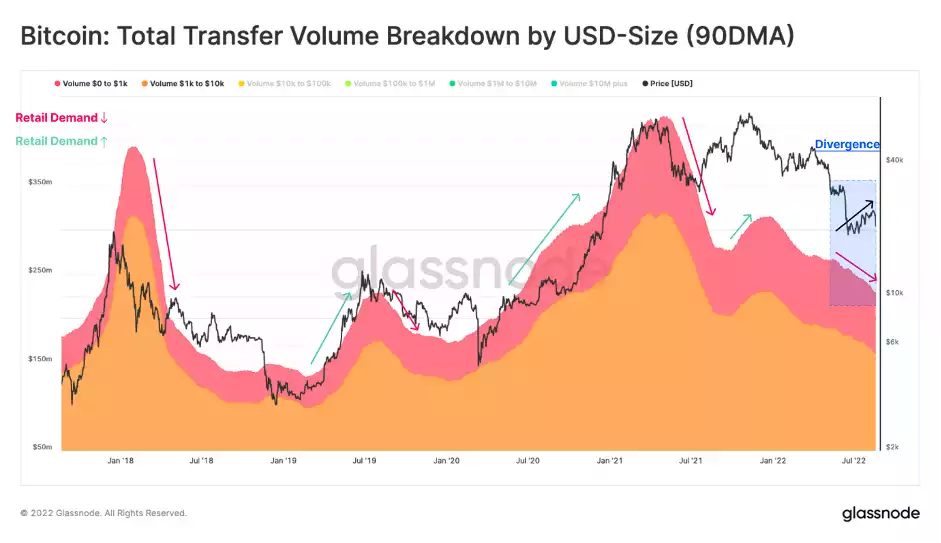

The presence of retail investors in the network can be gauged by analysing the long-term trend of small transactions. The following chart displays the 90D moving average of the total volume of transactions with a USD value of less than $10K.

Assuming small-size transactions are primarily attributed to retail investors, the quarterly smoothed average of this metric can be used to track the dominant sentiment of the market. Interestingly, the recent positive movement towards $24.4k was not accompanied by any shift in retail-sized transfer volume or demand.

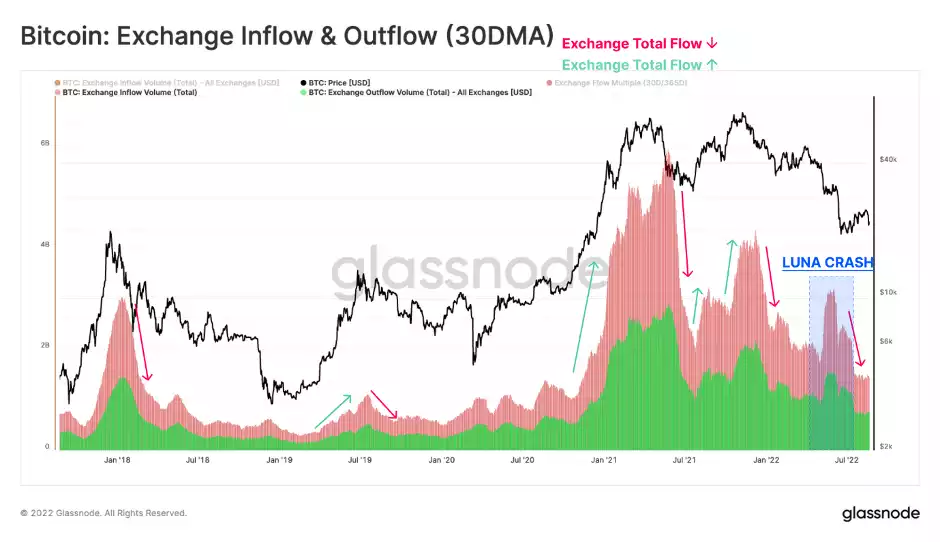

Looking at the stacked Total Inflows & Outflows to All Exchanges (USD value), we can also extract a similar correlation between the cyclical behaviour of Bitcoin prices. Exchange flows have now declined to multi-year lows, returning to late-2020 levels. Similar to the retail investor volumes, this suggests a general lack of speculative interest in the asset persists.

Investors from a variety of wallet-size cohorts decided to distribute during the recent rally above the market average cost basis level.

The recent price uptrend also failed to attract a significant wave of new active users, which is particularly noticeable amongst retail investors and speculators. The monthly momentum of exchange flows is also not suggesting that we are experiencing a robust wave of new investors entering the market yet.

So what does all that tell us?

Well, the current market structure is certainly comparable with the late-2018 bear market. However, it does not yet have the macro trend reversal in profitability and demand inflow seen at the very end of previous bear markets. It’s worth noting that the macro-economic environment of the current crypto bear market is very different to that of 2018.

The crypto market’s correlation to the stock market and other risk-on assets is strong at the moment, with liquidity being the main driving force in the market. As we have discussed in our GSS Insights videos here – the Fed has been removing liquidity from financial markets at an aggressive pace to try to fight the effects on inflation. The run-on effect of their actions is that traditional markets, alongside crypto, have seen a significant drawdown and demand has not picked up.

“Don’t right the fed” - The impact from more or less liquidity of the world’s reserve currency, the US dollar, will flow through to people and asset prices everywhere one way or another. If the data we've looked at today proves to be correct then we are either at or very close to the turning point right now.

**********************************************************************************

This afternoon, the Gold & Silver Standard Insights team will be breaking down the charts and providing technical analysis for the precious metals and crypto markets.

SUBSCRIBE to the YouTube Channel to be notified when the Gold Silver Standard Insights video is live.

**********************************************************************************