Another month, another rate rise, as the RBA’s madness unsurprisingly continues

News

|

Posted 07/06/2023

|

8743

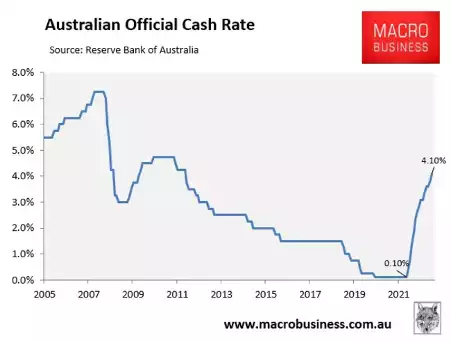

Yesterday it was announced that the RBA is yet again increasing interest rates by 0.25%, making the current cash rate (4.1%) the highest we have seen since April 2012.

And don’t expect a rate cut anytime soon, as Governor Lowe yesterday was clear about what the future most likely holds.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will depend upon how the economy and inflation evolve”.

Perhaps the most baffling aspect of the current interest rate crisis, is the simultaneous admission by Lowe that these measures rates won’t control the core inflation problem, while also attempting to use them to control the core inflation problem.

More specifically, Dr Philip Lowe said that he expected rent inflation to stay high for a long-time given Australia’s population growth and the current supply/demand dynamics of the rental market.

“[The rental market rate of price increases] is accelerating rapidly due to rock-bottom vacancy rates and will likely hit 10 per cent, which would be its highest rate since June 1989.”

Additionally, he noted that “services price inflation is still very high and is proving to be very persistent overseas.”

Of course, RBA rate rises cannot control the two biggest contributors to Australia’s current inflation crisis - Residential rents and energy prices – which are also are the two largest components of the Consumer Price Index (CPI).

The only thing these rate hikes are truly controlling now, is how much you’re paying for your mortgage.

Once this most recent rate hike is officially passed on to lenders, Australian variable mortgage holders will now be paying roughly 50% more in monthly repayments before the rate hikes began in April 2022.

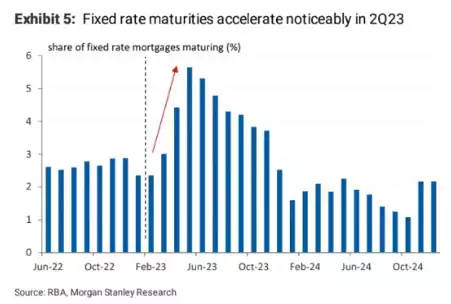

Furthermore, 500,000 fixed rate mortgages are set to expire by the end of the year, most of which will reset from extremely cheap rates around 2% to 6%.

Betashares chief economist David Bassanese told The Australian in April that “the higher than usual expiry of fixed-rate mortgages over the coming two years will result in de facto policy tightening (at least on the mortgage sector) equivalent to around one third of the policy tightening already seen over the past year”.

That’s the equivalent of at least 1 per cent of rate hikes that are still to flow through to mortgage holders once the fixed rate mortgage reset runs its course.

In fact, during its April review the RBA itself projected scheduled mortage repayments to reach an all-time high share of household income by 2024. Most notably, their projections were based on a 3.6% cash rate, which given the current state of events would appear increasigly unlikely.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Learn all about investing in bullion in this live, interactive presentation! Get your burning questions answered by our experts in the Q&A session at the end! Don't miss out! 🔔 Subscribe to the Ainslie channel, click "Notify Me" and turn on your notifications! Share this exclusive event with your friends and family! https://www.youtube.com/watch?v=jGWVjbLlb3c