Analysing the Momentum Behind Digital Assets Astounding Rally

News

|

Posted 21/03/2023

|

10467

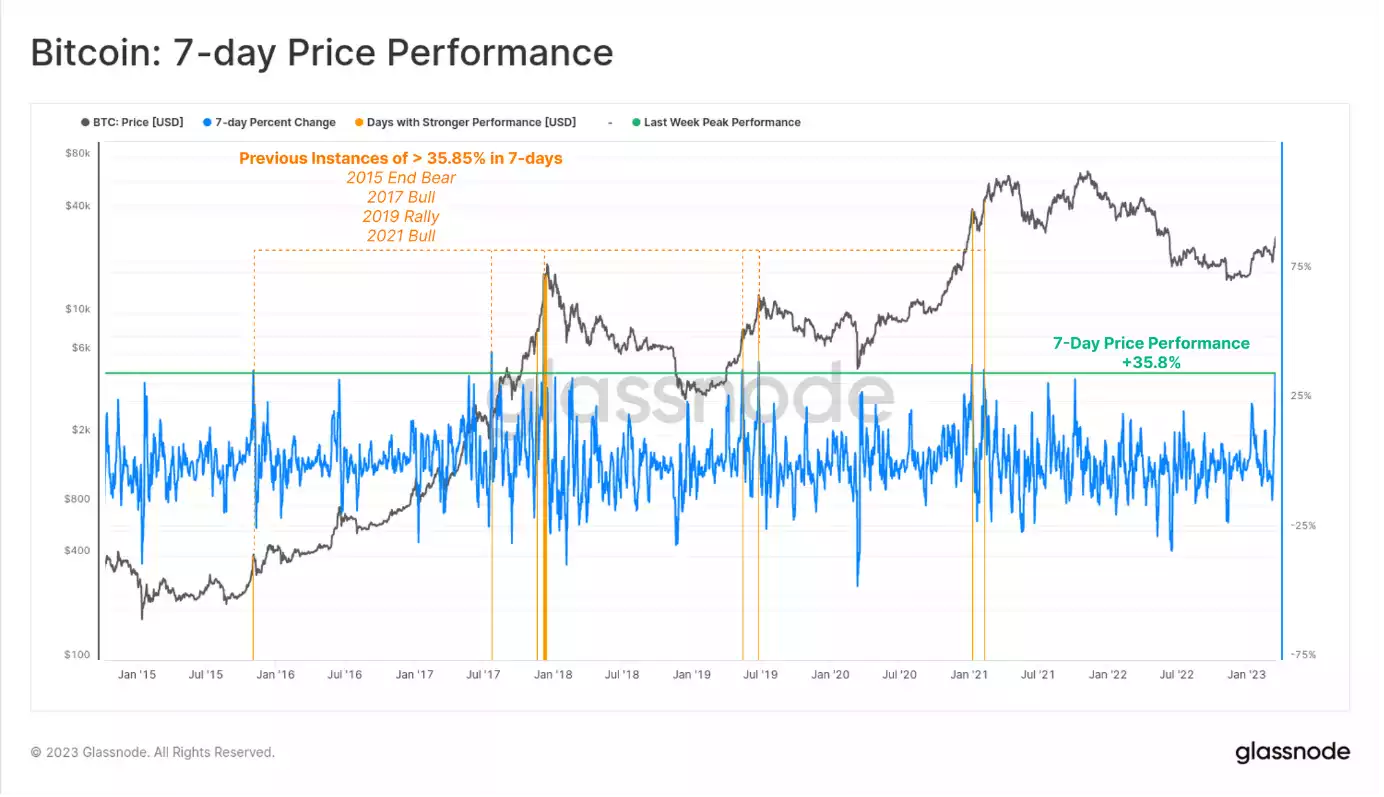

Bitcoin has experienced a phenomenal week, surging by 35.8% in value - one of the largest 7-day upside rallies in its history. In fact, only 124 trading days have seen a larger rally, with a mere 16 of these instances occurring since 2015, which highlights the rarity of such an event. Typically, these kinds of rallies transpire during bull market trends, often towards their later stages.

The impressive performance of Bitcoin comes at a challenging time for the traditional financial system. Smaller banks are increasingly vulnerable to digital bank runs, prompting the establishment of new liquidity funding facilities to alleviate this risk. In response, investors are actively engaging on-chain, with several metrics indicating a robust expansion of network usage.

The Bitcoin ecosystem has witnessed a surge in on-chain activity, demonstrating increased adoption, amplified network effects, and heightened investor engagement. This growth aligns with the fundamental principle that "more is better" in the realm of on-chain activity, as a higher level of interaction and transactions within the Bitcoin economy typically correlates with periods of expansion and market optimism.

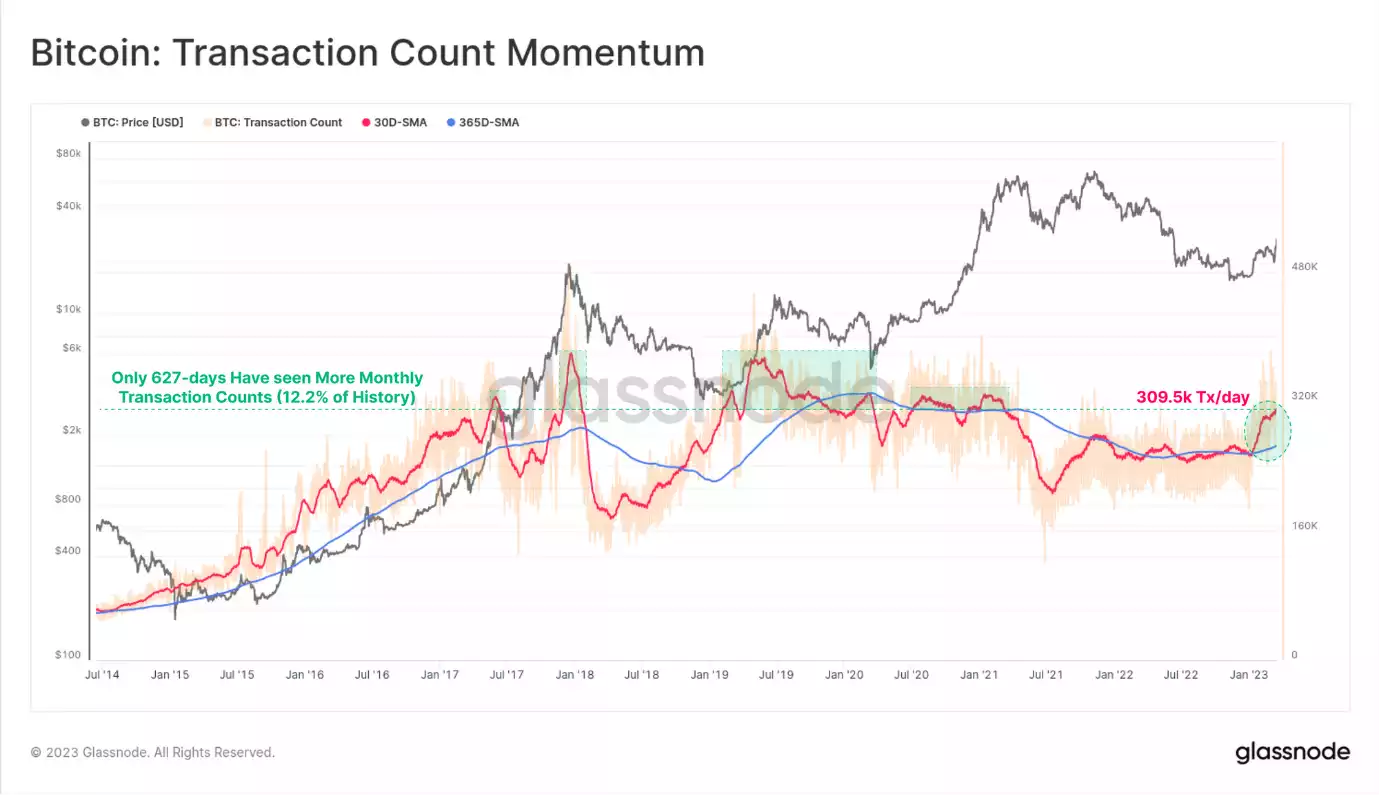

Significantly, the monthly average of transaction counts for Bitcoin has reached an impressive 309.5k/day this week, marking the highest level since April 2021. This milestone not only indicates a robust break above the yearly average but also showcases the sustained momentum propelling the digital asset space forward.

Furthermore, it's worth noting that only 12.2% of all recorded days have seen more transaction activity for Bitcoin, underlining the health and vibrancy of the market.

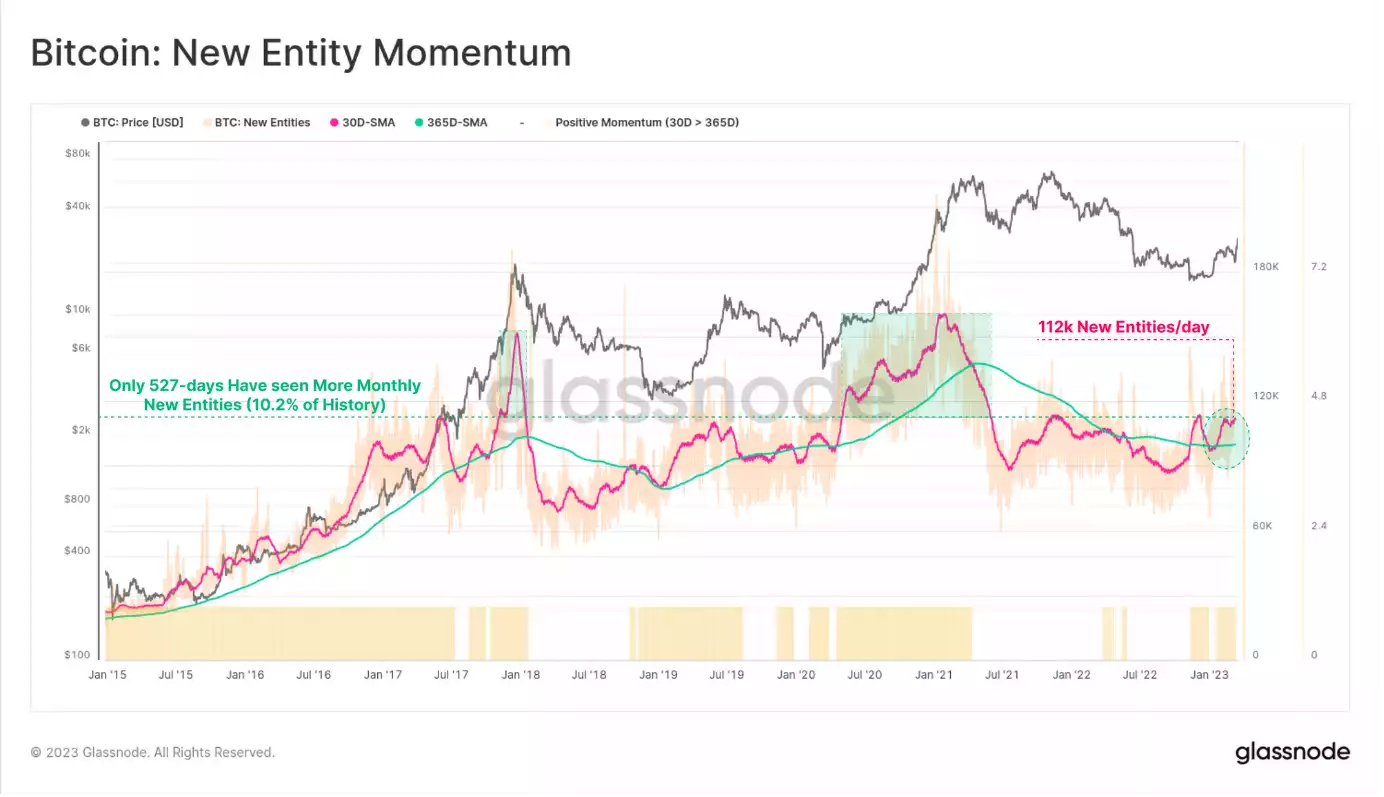

It is crucial to highlight the importance of unique new entities operating on-chain as a key metric for estimating new user adoption in the rapidly evolving world of blockchain technology. Recently, the daily rate of unique new entities has reached an impressive 122,000, signalling a significant surge in the adoption of blockchain technology across various industries and applications.

Notably, only 10.2% of days have witnessed higher new user adoption rates, which primarily occurred during the peak of 2017 and the remarkable bull run of 2020-21. This fascinating trend points to a growing interest in blockchain and its potential applications, suggesting that we are on the cusp of an even more significant expansion in the usage of this groundbreaking technology.

As the trend towards greater adoption of blockchain technology continues to gather momentum, it is expected that the coming years will bring even more innovation and new applications. This data underscores the importance of blockchain technology as a transformative force in a range of industries, from finance and supply chain management to data security and beyond.

We are also witnessing a notable increase in network congestion. This has led to a surge in transaction fees, which in turn has generated a positive impact on miner revenues. The new demand from emerging applications such as Ordinals and Inscriptions is contributing significantly to this growth – we wrote about this extensively here. Elevated fee pressure can be interpreted as a sign of potentially more favourable markets, as it often indicates a growing interest in digital assets. Additionally, increasing demand for block space typically accompanies new waves of adoption, further bolstering the market's potential.

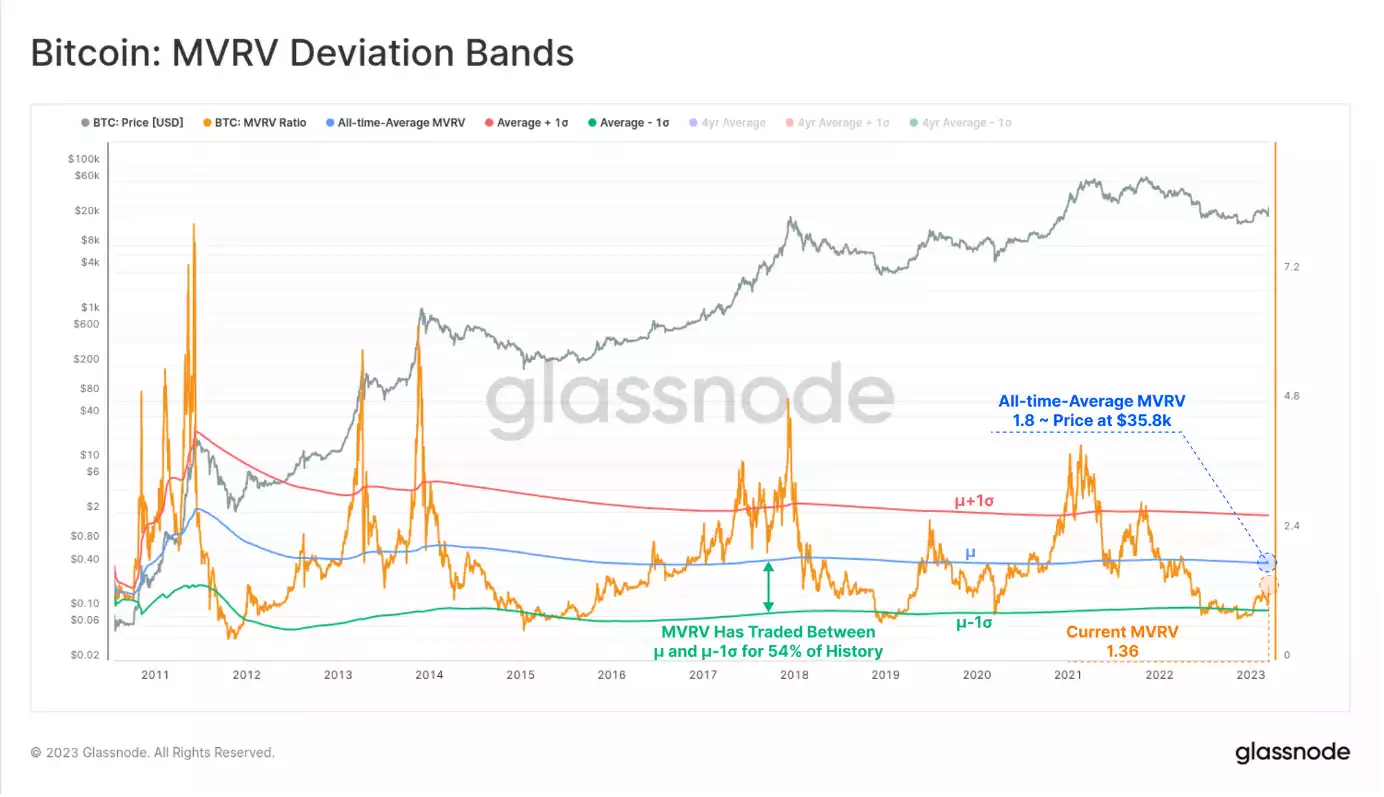

Another on-chain indicator signalling a transition from deep bear market conditions to neutral and constructive territory is the MVRV, which models the unrealised profit multiple held within the coin supply. Currently, the MVRV has traded up to 1.36, which lies between the all-time average of 1.82 and the 'oversold' -1 standard deviation level. It is worth noting that Bitcoin has historically traded within this middle-ground band for 54% of all trading days.

This middle ground band has been observed during both late-stage bear markets and early bull market recoveries, suggesting that we may be on the cusp of a bullish market trend.

Importantly, the market has now entered a neutral zone, trading within ±0.5 standard deviations from the long-term mean. This suggests that we are currently in a state of equilibrium where the market is efficiently pricing Bitcoin.

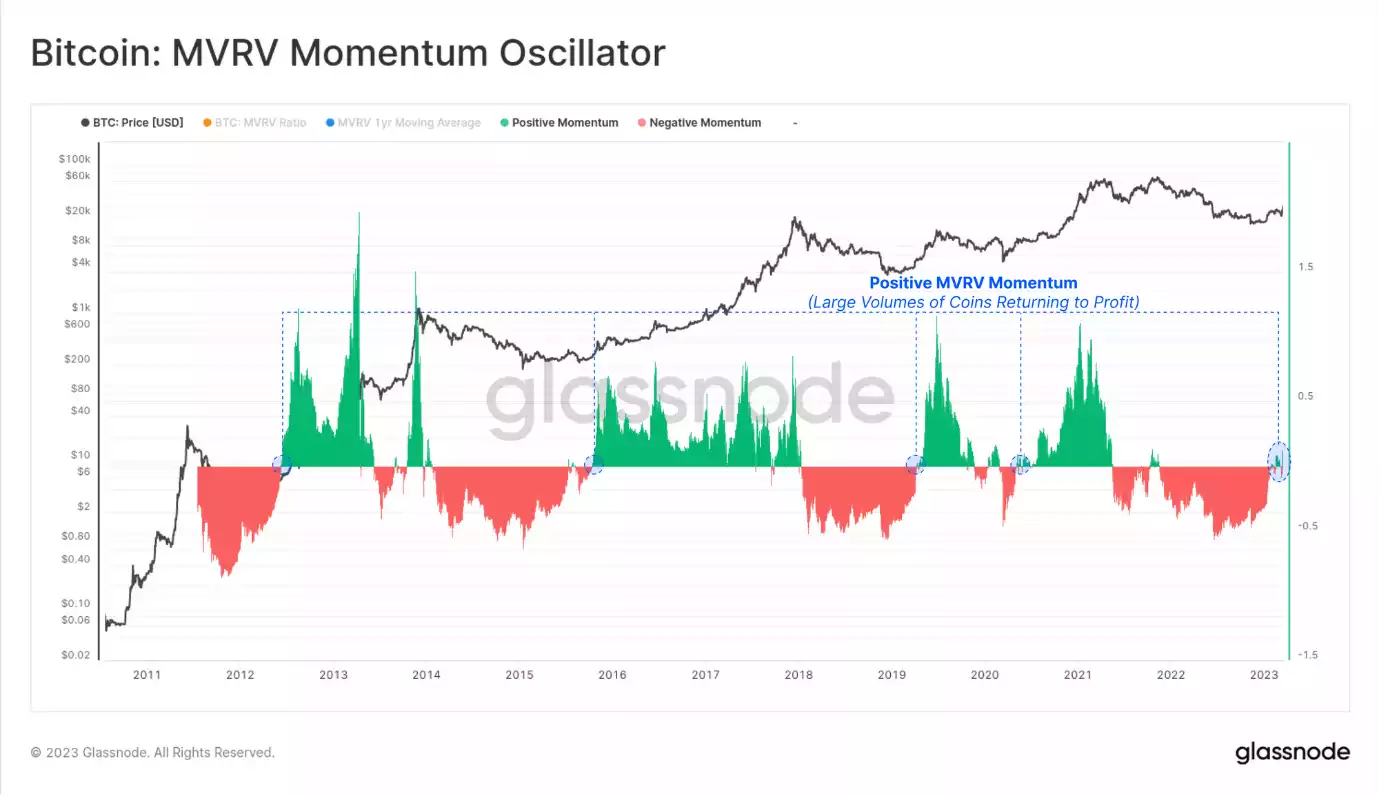

The MVRV Momentum Oscillator's (another type of MVRV indicator) exceptional responsiveness to events where large proportions of a coin's supply are acquired above or below the spot price allows it to quickly revert to holding an unrealised loss or profit near cycle inflection points. This unique ability positions it as a valuable tool for accurately tracking market sentiment and anticipating price trends.

Recently, the MVRV Momentum Oscillator has flipped positive, which is indicative of a significant proportion of the coin supply having been acquired below the current price, and now being in profit. This shift towards positive momentum is crucial, as it not only highlights a strengthening market sentiment but also hints at increased profitability for coin holders.

Historically, positive flips in the MVRV Momentum Oscillator have been closely correlated with upticks in network adoption and on-chain activity, showcasing the importance of monitoring this powerful indicator. As the cryptocurrency landscape evolves, staying ahead of the curve by keeping a close eye on the MVRV Momentum Oscillator can provide critical insights into emerging trends and opportunities in the market.

In conclusion, Bitcoin investors have recently witnessed one of the most remarkable one-week gains in the cryptocurrency's history, driven by a confluence of factors, including stress in the global banking system, consolidation, and liquidity injections. This extraordinary performance highlights the resilience and adaptability of Bitcoin in the face of global financial uncertainty.

As we observe the Bitcoin market transitioning from conditions that typically accompany deep bear markets, it is evident that the future looks increasingly promising for this digital asset. On-chain adoption, a crucial indicator of the network's health, is accelerating at an impressive pace. Furthermore, the vast majority of Bitcoin holders have demonstrated their unwavering commitment by weathering market volatility for over five months, maintaining a firm-handed approach to their investments.

Remarkably, few long-term investors have taken profits during this rally, which serves as a testament to their belief in Bitcoin's pivotal role in the future of the global financial system. This conviction underscores the growing recognition of Bitcoin as not only a store of value but also a viable alternative to traditional financial instruments. As we move forward, the steadfast dedication of the Bitcoin community and the increasing on-chain adoption bodes well for the continued growth and maturation of this pioneering digital asset.

For Ainslie customers, staying informed about these developments and trends will be essential in navigating the ever-evolving landscape of cryptocurrency investment. As your trusted partner in the world of digital assets, we are committed to providing you with the knowledge, resources, and security you need to make informed decisions and capitalise on the exciting opportunities ahead.