Americans Struggling More Than Ever to Get Loans: Disturbing Signs from Fed Survey

News

|

Posted 19/07/2023

|

4207

Americans getting rejected for loans has reached a 5 year high, a disturbinng trend for the US credit market to say the least.

Last week we discusssed how the Australian Credit market was crumbling right beneath our feet, while this week we will disect a concerning recent Fed Survey analysing the US consumer credit and lending market.

The latest survey by the Federal Reserve reveals an alarming rejection rate of 21.8% for loan applicants in the twelve months leading up to June. As overall credit applications decline to the lowest level since October 2020, the probability of loan rejections has surged across all loan categories, posing significant challenges for borrowers.

The average reported probability of loan application rejections has witnessed a sharp increase across different types of loans. Auto loans face a rejection rate of 30.7%, credit cards at 32.8%, credit limit increase requests at 42.4%, mortgages at 46.1%, and mortgage refinance applications at 29.6%.

Unsurprisingly, these rejection rates are basically all at all-time highs. This shift in lending dynamics was identified in the previous survey conducted by the Federal Reserve in February, prior to the collapse of Silicon Valley Bank and other lenders, with the loan rejection rate standing only at 17.3% at that time. Of course, it makes perfect sense that the situation has only gotten significantly worse since then.

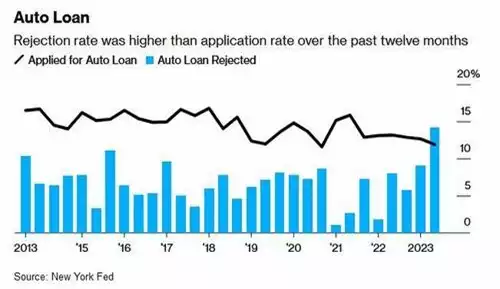

The increase in loan rejections has affected borrowers across all age groups, but it is particularly prevalent amongst individuals with credit scores below 680. The rejection rate for auto loans, which has risen from 9.1% to 14.2%, has surpassed the application rate for the first time since 2013 implying not only that Americans are struggling to be eligible for auto-loans, but more importantly are too strapped for cash to even apply for one.

The consequences of these rising loan rejection rates are beginning to manifest in shifting borrowing behaviour. Application rates for auto loans have declined to 11.9%, while credit card limit increase requests have seen an increase to 24.8%. The application rates for mortgages and mortgage refinancing stand at 6.5% and 5.3%, respectively.

Interestingly, there has been a notable surge in credit applications among individuals with credit scores below 680, suggesting a greater reliance on credit as they face tighter lending standards.

The impact of increased loan rejections is also being reflected in the median reported increase in monthly spending, which has fallen from 7.1% in December to 5.4%. This decline is primarily observed among individuals earning less than $50,000 per year, who face greater challenges in obtaining credit due to the tightening credit environment. As loan rejections rise and borrowing becomes more restricted, a vast majority of consumers are clearly being forced to curtail their spending.

So while the US stock market continues to soar during this uncertain period, it is important to remember that the backbone of the US economy, its citizens, are to some extent in more financial strife than ever.