Air BnBubble – Property Market Bubble Pin?

News

|

Posted 17/10/2023

|

2113

As housing continues to climb dizzying heights despite months of consecutive rate rises around the world, a trend has emerged worldwide with a crack down on short term rental sites such as AirBnB. Housing price appreciation and higher mortgage payments have led to continued housing inflation above average inflation. With crackdowns on short term rentals starting to happen worldwide to alleviate housing shortages and housing inflation, is AirBnB to blame for the developed world housing crisis and will the recent crackdowns lead to a housing crash?

Housing Inflation

In the September inflation report out of the US, housing was the largest contributor to inflation at 7.2% year on year, with inflation at 3.7% In Australia this trend is also apparent, with core CPI at 5.2% and housing at 6.6%. Yellen recently stated that in the US, "We do definitely believe that's coming down over time,"

AirBnB Regulation around the world

Last week in Victoria, the Labour government added another tax, to the increasingly overtaxed Victorian property sector, a 7.5% levy for short term rentals from 2025. This is following a worldwide trend to restrict in some way AirBnB style rentals. Aside from licenses, such as those imposed in New York with some 3,800 applications and so far only 300 accepted, restrictions on stays are different across countries and cities, some of these restrictions are listed below

Austria – renting capped at 90 days per year

Paris – renting capped at 120 days per year

Berlin – recently lifted their ban allowing for 1 house to be rented unlimited but 2nd houses capped at 90 days

Amsterdam - renting capped at 30 days per year

Barcelona – renting restricted to 31 day minimums

Hawaii – renting restricted to 90 day minimums

New York – has a de facto ban with hosts required to live with their guests for stays less than 30 days

San Francisco - renting restricted to 90 day minimums

Montreal – has banned all new short term rentals

Singapore – Minimum 3 month rentals

Sydney – renting capped at 180 days per year

AirBnB Led Housing Crash

Last week in Victoria, the Labour government added another tax, to the increasingly overtaxed Victorian property sector, a 7.5% levy for short term rentals from 2025. With the Short-stay accommodation sector encompassing 16,200 homes to apartments in Melbourne and housing 22.5 million guests a year this levy should be a huge windfall for the Victorian government. However, with rising interest rates, and falling revenues it is likely that the availability of AirBnB housing will either turn into long term rentals or end up for sale allowing for the possibility of a ‘AirBnB housing crash’ as touted by Robert Kiyosaki (Rich Dad Poor Dad)

Income collapsing

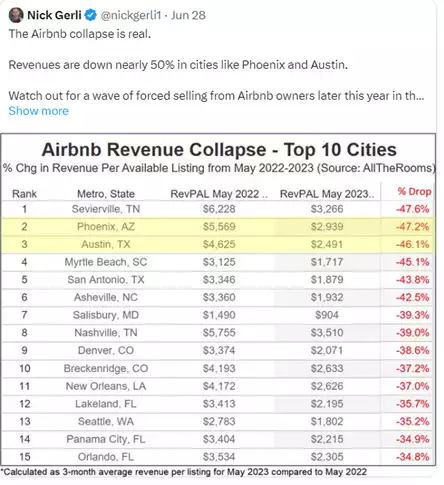

In May this year, AirBnBs shares plummeted 11% with the company forecasting that it expected fewer bookings and lower average daily rates compared to a year earlier. In a viral tweet following this Nick Gerli claimed AirBnB revenue could be down 40%.

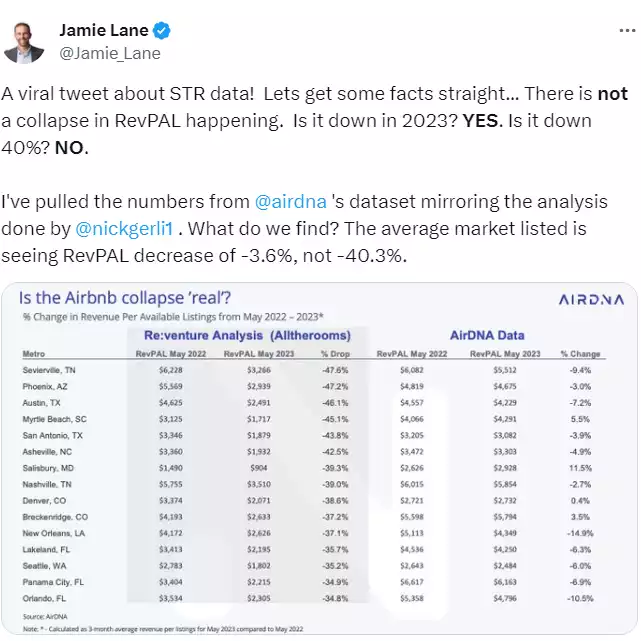

Although this was contested by Jamie Lane claiming revenues are actually only down 3%.

Either way there is a decrease in income and with mortgage payments on an average mortgage of $585,000 in Australia up $1415 per month and with mortgage rates in the US climbing above 8% on a 30 year loan, income decreases, increased taxes and increased regulation are likely to lead to a short-stay housing squeeze. Many owners may pull their houses from the market and either reassign to long term rentals or sell and finally easing housing inflation. So could this AirBnBubble finally lead to a housing crash?

The “bargain” Kiyosaki referred to is property afterwards…