AUD Gold near All Time High as Bank Contagion Spreads – SVB Canary in the Mine?

News

|

Posted 13/03/2023

|

19415

AUD Gold near All Time High as Bank Contagion Spreads – SVB Canary in the Mine?

Today as any astute gold bug will see, gold in AUD missed its all time August 2020 high by $7/oz, climbing to $2869/oz. Friday saw the US NFP report another strong job number with 311,000 jobs gained, but the participation rate gains saw the unemployment rate gain to 3.6% and wage growth slow. We had been predicting this based on increased consumer costs meaning more individuals will enter the employment market again. This saw the USD come off slightly and gold bounce. But it was the news of the collapse of the Silicon Valley Bank (SVB) that saw gold really shoot and the DXY drop.

SVB Canary in the American Bank Coal mine

Let’s be clear here, when looking at SVB deposits held against its banking debt risks, was acting incredibly conservatively. In fact unlike other banks, SVB had deposits held of $173 billion with loans of only $73 billion. That is very conservative in terms of the fractional lending that is allowed and followed in the rest of the banking sector. And even before the US government stepped in to guarantee the SVB depositors early this morning, people were stating minimum 98% of deposits would be returned due to the low risk profile of this bank. What collapsed the bank, was actually their long matured debt holdings, as well as their mismanagement of the interest rate risk.

During the liquid times of Covid the shares and industry that benefited most was the Tech industry. So it seems fairly logical that in an inflationary, illiquidity cycle this industry would suffer the most. In 2022 the Nasdaq slumped 36% which saw the tech industry, which relies heavily on equity injections to fund both growth and development, contract in their ability to raise capital. SVB’s concentration of customers in this industry therefore saw the net inflows of cash reverse. But not slowly. In 2022 SVB saw its deposit base reduce from $198 billion to $173 billion – a 13% reduction in a year. On Thursday when the contagion had spread, depositors tried to remove another $42 billion in funds. This saw SVB having to sell their long matured debt at a loss of approximately $2 billion and then ultimately on Friday saw the collapse. Rising rates have seen bond prices fall and hence the loss.

As bank shares fall worldwide, the real contagion has not yet hit the US market. Despite Yellen claiming Sunday the US Government would not protect deposit holders, only to about turn at 9:15am Australian time today to say they would, the damage has been done. Investors are scouring Bank balance sheets to see which other banks may have these mark to market losses. Due to maturity these ‘in the red’ bonds may have not been disclosed but may be sitting as an equity risk on the bank balance sheets.

Risk across industries – Tech the start

Asset prices are collapsing – not just tech shares but other asset classes such as real estate and equities. In the US, we have spoken about the interest rate hikes hurting businesses and governments more so than consumers in Australia. This appears to be the start of this risk revaluation. Quantitative tightening is and will continue to strip liquidity from the market, whilst interest rate rises and debt serving strips equity and cash from businesses. Tech shares and the tech industry will be hit first, but looking at the next likely industry – real estate may follow shortly.

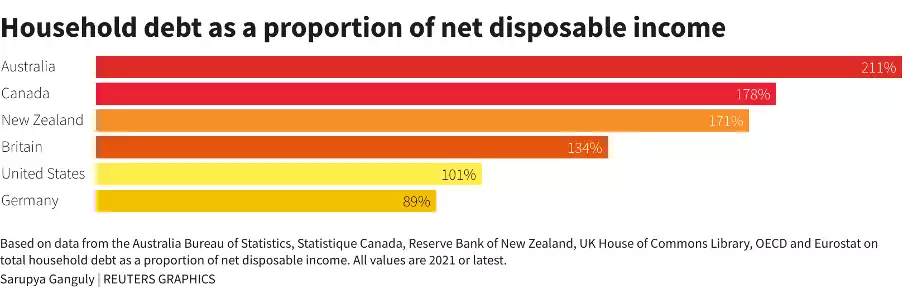

Again, looking at the above, Australia has the highest household debt to disposable income, but the US has property taxes which raises the unaffordability of housing in that market, which are starting to filter through to house prices. In the Tech reliant city of San Francisco – house prices have already fallen 10.4% and appear to be accelerating.

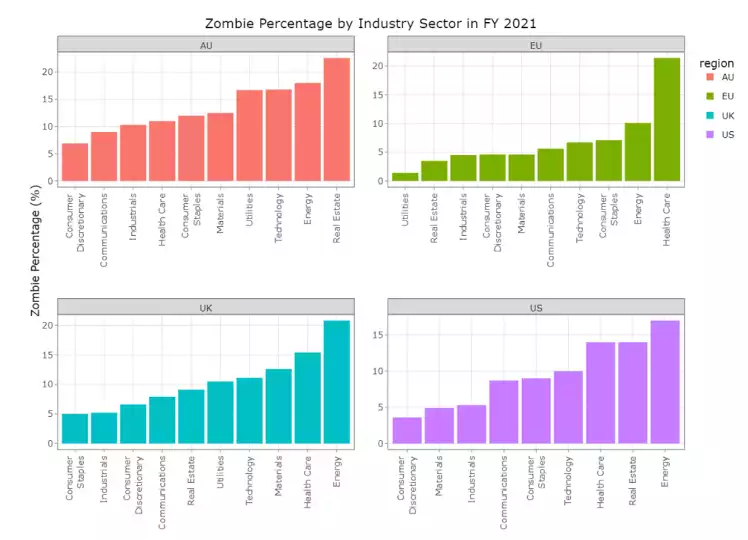

The trend across other industries was identified today by Christopher Joye, for Live wire markets identifying other risk industries stating “Higher interest rates will claim many other casualties: we have been forecasting a big default cycle since late 2021. We have been particularly focussed on "zombie" companies that are not earning enough profits to pay the interest bill on their debts.”

Australia like the US has a high exposure to these rises in interest rates, but as Lowe begins to offer glimpses of a pause, Powell powers on putting both the equities and bank sector under increased pressure.

*Source Why Silicon Valley Bank Died (UPDATED 2)... - Christopher Joye | Livewire (livewiremarkets.com)

Illiquidity Crisis

Let’s put this another way. Banks lend money from deposits and fractional banking. During quantitative tightening the money is removed from banks as the liquidity pool shrinks. But this is occurring as the Fed raises rates at a record rate and companies use more cash and equity to service their debt, reducing deposits in banks. This therefore means, like with the case of SVB, the deposits reduce, requiring the banking industry to sell their assets to allow for redemption of deposits. If as in the case of SVB this debt is long matured, and due to falling bond prices, the bank sells these bonds early at a loss, requiring equity to be raised to bridge the gap.

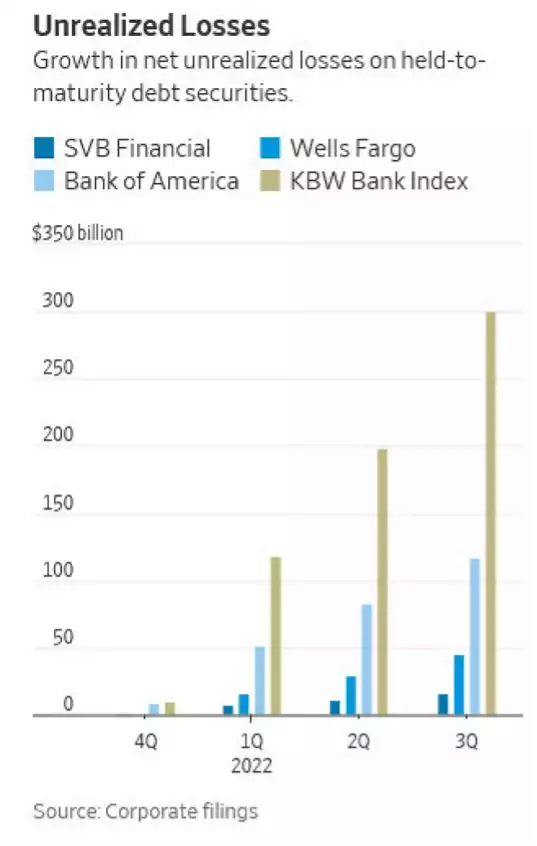

In November 2022, the Wall St Journal identified this risk “For the 24 Big US lenders in the KBW Bank Index, the combined balance-sheet value of held-to-maturity bonds was $2.21 trillion in September 30”. At that time the market value was $1.91 trillion (less 14%) which as of September 30 10-year T-Notes were similarly priced as of today (a huge drop over the weekend which would actually have saved SVB if it had sold as of today not Thursday).

To put it in perspective, for Bank of America, with a market cap of $242 billion as of today, if it was forced to sell its held-to-maturity bonds of $644 billion, with a book value of $524 billion, it would require an equity raise of 60% of its market cap to cover these losses.

Source: “Held to maturity” bonds are about to be a big problem | Forexlive

Fed Stepped in but don’t underestimate the squeeze

So as the Fed steps in this morning – don’t underestimate the corporate debt squeeze in America and potential mark-to-market losses that may follow in the US banking industry. In other words, the Fed may have saved depositors but what happens tonight (on US market open) to bank shares? They are trumpeting that equity holders will lose everything … Which puts pressure on small banks to raise more capital … and we end up back here again? The SVB ‘canary in the coal mine’ may not be over yet.