ASX Continues to Fly High Despite the Struggling Economy

News

|

Posted 12/09/2024

|

1341

Analysts warn against optimism in the share market as Australia's economy chalks out its slowest growth in decades and indications of potential interest rate cuts remain.

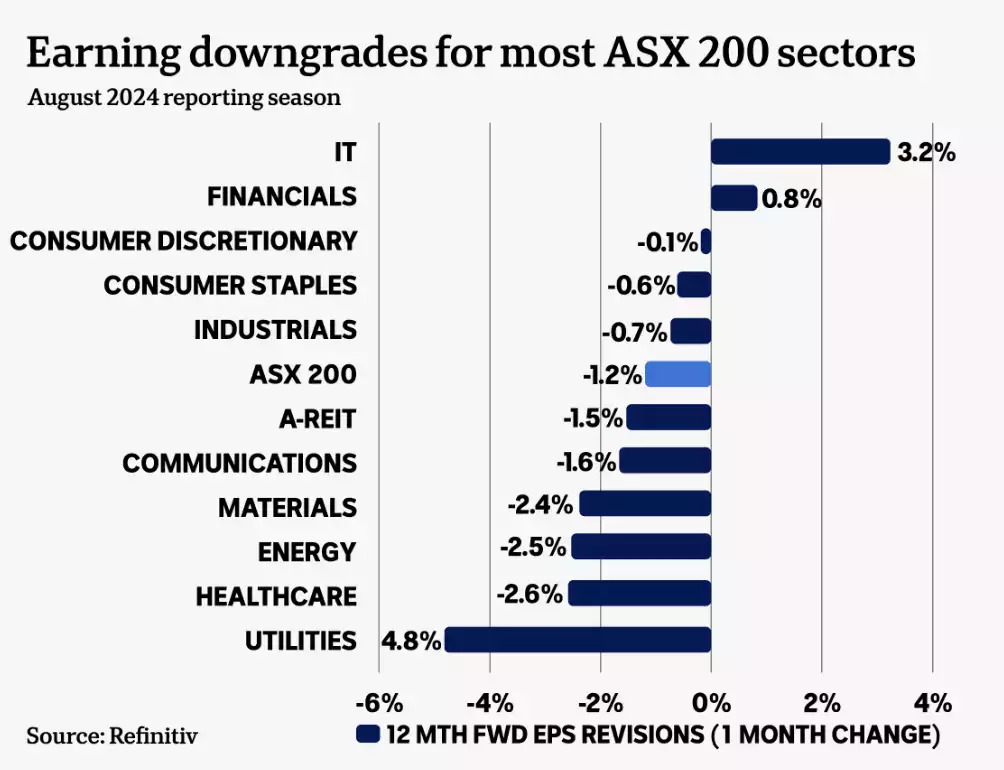

The Australian share market lost more than $100 billion last month in the global sell-off sparked by fears of a possible U.S. recession. But the ASX 200 rebounded from its initial drop and is now closing in on record highs despite disappointing results from the corporate reporting season, as shown below.

As hundreds of companies unveiled their finances, the bigger picture for the corporate sector and the overall economy snapped into sharp focus. The Reserve Bank of Australia is poised to cut interest rates before the end of this year amid the Australian economy's weakest growth since the early 1990s, challenges from its largest trading partner China, and the prospect of a global economic slowdown.

Recent GDP data had confirmed sharp economic slowdowns, with consumers being squeezed by high inflation and a "per capita recession." Yet the close-to-record highs of the ASX reflect investor hopes of deep interest rate cuts by central banks in the coming months. While the European Central Bank and the U.S. Federal Reserve are expected to cut rates, with higher inflation than most other nations, the RBA must wait for substantial slowing of consumer prices before following suit.

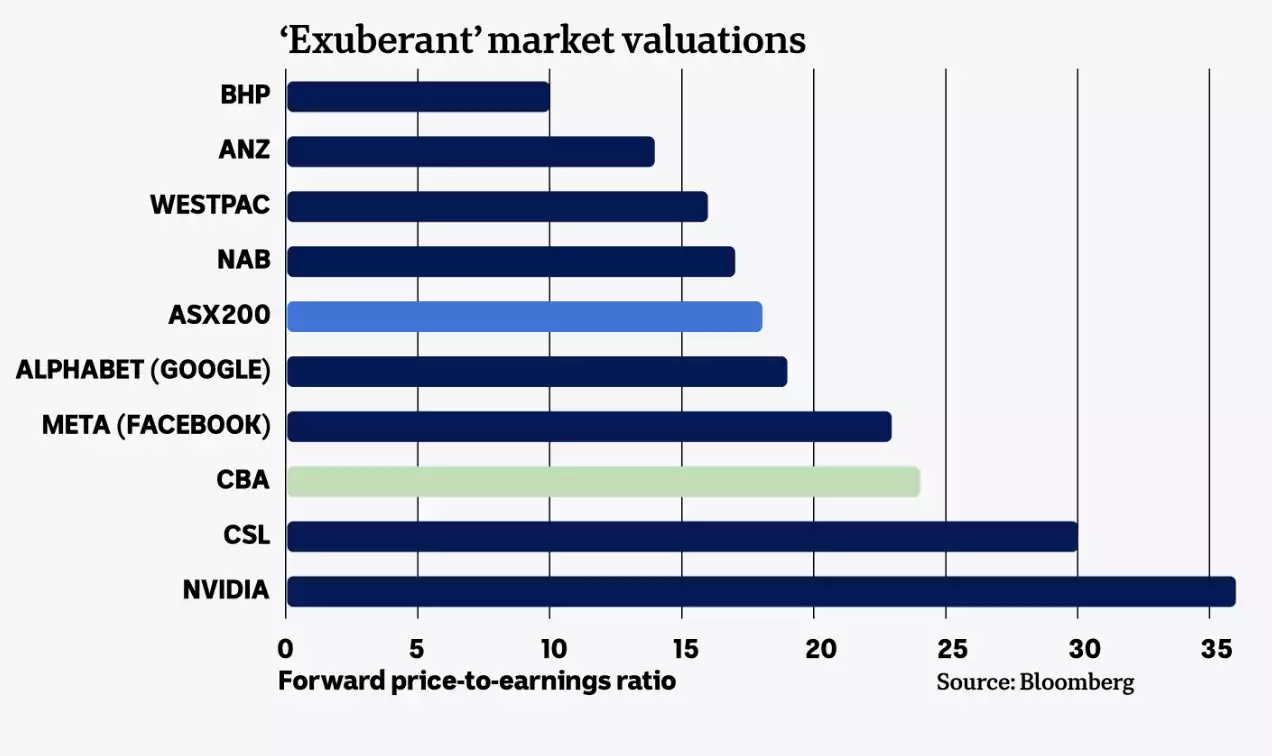

Money markets expect the RBA to start cutting rates from February, but those forecasts have frequently proved wrong. Global stock markets - including Australia's - have held near record levels through a rocky period last month, and UBS analyst Richard Schellbach observes that ASX 200 valuations look lofty despite a mediocre corporate reporting season.

"We think the elevated levels are justified because our base case remains that a soft landing is engineered here in the Australian economy," Schellbach told the ABC.

These valuations, he said, reflect the quality of the Australian companies and their resilience to the economic cycles. Sectors like mining were hurt due to lower demand from China, impacting Australian exports of commodities such as coal and iron ore.

"Certainly what we're seeing — and this fits in with the winner-takes-it-all cycle that we're in — the best retailers, the best banks, the best industrial companies are weathering the storm so much better," he said.

"They are gaining market share, and we expect this to continue into the future."

This has favoured the large and more dominant companies, which are better equipped to weather this storm compared to the smaller and medium-sized businesses battling with cost management and struggling market share. That would fall specifically on the fact that the share price of Commonwealth Bank is up 40 per cent in the last year alone, trading not far from all-time highs.

However, despite the net profit sliding 6% to $9.5 billion, the CBA's valuation remains high; therefore, overvaluation comes forth in its price-to-earnings ratio of 24, corresponding more to those technology companies that develop at a fast pace rather than safe traditional blue chip typical Australian banking stocks.

Partly, the high valuation reflects investors holding on to shares to avoid capital gains taxes, while CBA's significant weighting in the ASX 200 drives money institutional investment strategies.

Looking ahead, the major sectors of Australian finance and resources face risks from possible rate cuts and volatile commodity prices. Jame Hannah, deputy head of investments and capital markets at VanEck, says the risks are high from current peak market levels, although some sectors may be better positioned for investors.

"The risks are still high because of where the market is, at all-time highs," Mr Hannah said.

"But gold equities, some infrastructure, assets and property, if we avoid a recession, are some of the strongest areas for investors to be looking at."