AI Set to Reshape Employment — Commodities Poised to Outperform

News

|

Posted 19/11/2025

|

1106

As we near the end of the 18.6-year land cycle, early signs suggest a divergence between land and equity markets. This signals a likely period of extended volatility for stocks and tech, with commodities positioned to outperform.

The chart below highlights the US land market breaking down from its 50% retracement of the recovery bounce since the Trump tariff sell-off in April — an early indicator of a broader macro downtrend.

Historically, such downtrends persist for 12–15 months before the S&P 500 peaks, pointing to a potential market top in early 2026. This timing aligns with the expected stock market peak of the current 18.6-year cycle — the last of which preceded the 2007 Global Financial Crisis.

With a major cycle low forecast for stocks and Bitcoin, and half-cycle lows for gold and silver by late 2026, the relative outperformance of metals over equities fits the typical land cycle pattern — where precious metals lead in the post-crash environment.

The chart below shows land (blue) rolling over before equities (pink), with gold and silver outperforming in the subsequent years. The Gold-to-Silver Ratio (green) falls during this phase, indicating silver’s stronger performance.

Turning to the labour market, AI is emerging as a key force in the upcoming transition — contributing to job displacement while aligning with a broader equity correction. Simultaneously, AI's energy demands could accelerate a commodities boom.

This dual dynamic strengthens the case for cyclical outperformance of gold and silver, particularly silver, given its growing industrial role in solar and energy technologies. In an era of effectively infinite digital intelligence, finite resources become increasingly valuable — and commodities, by their scarcity, stand to benefit.

The divergence between the S&P 500 and US job openings since AI's mainstream emergence suggests this disconnect is unsustainable. Historically, such gaps close either through a labour market resurgence or a market correction — with most indicators favouring the latter.

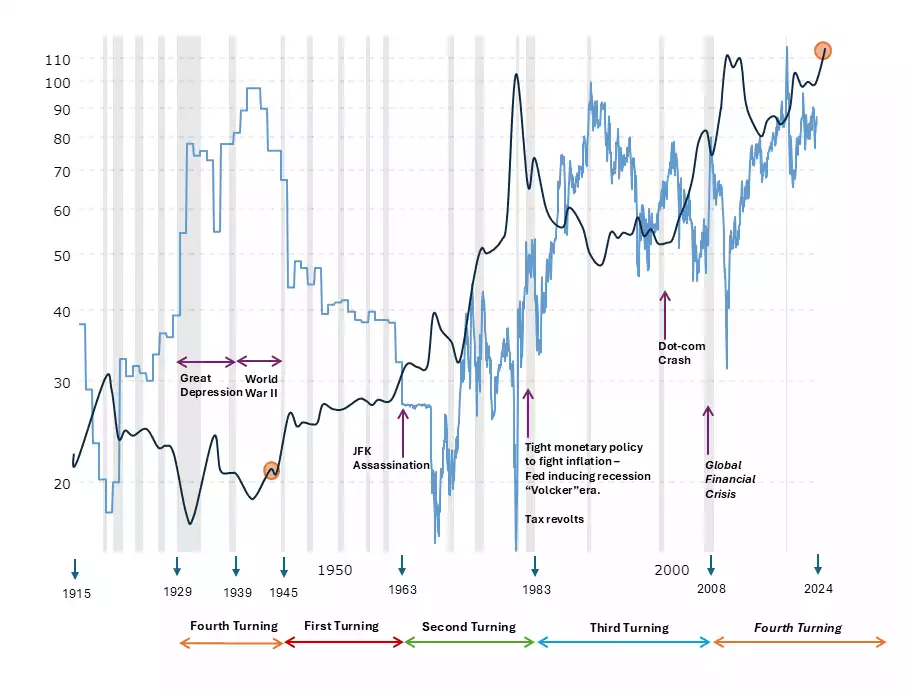

As the global value system shifts, periods of uncertainty often lead to the accumulation of essential resources. This transition fits within the broader framework of the “Fourth Turning” — an 80-year socio-economic cycle — which is now approaching completion. The previous transition ended in the Great Depression, after which gold and silver entered a 35-year bull market. During that time, the Gold-to-Silver Ratio spent decades between 20–40.

Silver now appears positioned to lead again. As an industrial metal critical to energy infrastructure, it’s well-placed for a multi-decade bull run. A sustained period below a 50 Gold-to-Silver Ratio appears likely. The current consolidation in silver and elevated GSR levels closely resemble the conditions seen in the last Fourth Turning.

As the world moves from one socio-economic order to the next, investors continue to return to enduring, tangible stores of value — gold and silver.