A Lost Decade in Stock Markets – While Gold and Silver Outperform

News

|

Posted 21/02/2025

|

2153

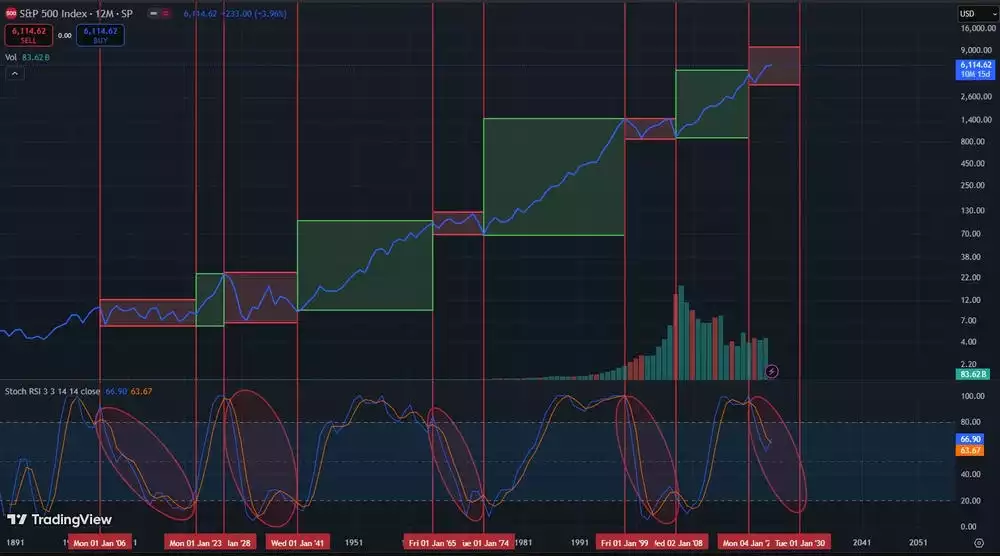

Every 20 years or so, we see major stock markets spend about a decade losing value, while precious metals outperform. This occurred between 1928–1941, 1965–1974, and 1999–2008, as shown in the chart below.

From a technical perspective, this phase is marked by the Stochastic RSI (a technical indicator used to identify overbought and oversold conditions) resetting from overbought to oversold, on the 12-month chart - marked in red. This is the technical phase we are currently in - and lines up from a timing perspective - with the ongoing 18.6-year land cycle and the 80-year socio-economic cycle. This technical indicator is one of many indicators flashing red, in anticipation of an upcoming collapse in stocks.

While the prices on the S&P500 continue to rise in the face of these initially - how long this lasts - being a function of complacency and irrationality - can go on longer than most think – and is typical of the final phase of the 18.6 year land cycle – aptly coined the “winner’s curse” phase – where all markets rise together – leading into a broad based financial collapse.

As we are on the lookout for the final phases of the 4-year liquidity cycle, the 18.6-year land cycle and the 80-year socio-economic cycle - all at once - the upcoming correction will likely be at the scale of - one in a century.

While the final phase of the 18.6-year land cycle involves an exponential increase in liquidity, leverage and greed, followed by a crash and recession - the final phase of the 80-year socio economic cycle involves a collapse of prominent institutions and establishment of new systems which lead into the next 80-year cycle.

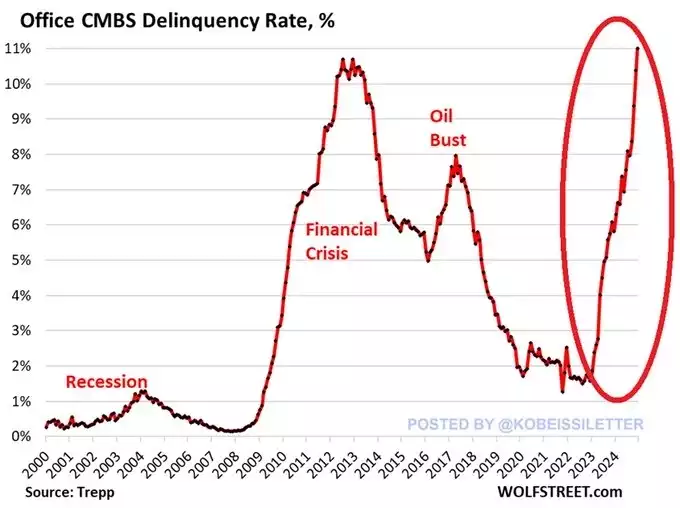

While technical analysis and cycle theory both point in the same direction - economic indicators further reinforce that the current rise in asset prices are in the face of systemic cracks getting concerningly large.

While these indicators are concerning – investors seek assets that can benefit both from the rising liquidity of the ongoing winner’s curse phase – while providing shelter from the storm for the turbulence that follows.

Overlaying the gold price (yellow) on the S&P chart, we can see that during these phases – gold outperforms significantly - providing investors with a vehicle to achieve both capital growth and shelter from the storm simultaneously.

While gold appears to be setting up for the most significant revaluation of the last century, we see the price today front running this upcoming turbulent phase in stock markets - with an expectation of significant outperformance later this decade.

We see a similar pattern with silver in these phases of the stock markets.

With the DXY potentially having put in a cyclical top as well – on schedule to fall off before a sustained move to the upside - all signs are pointing towards an increase in liquidity and asset

prices in the near term – followed by a phase of safe haven assets outperforming – during which most assets struggle to recover.

Zooming out, we can clearly see that the macro bull run for gold and silver are still in their early stages - with them currently setting up to be the standout assets of the upcoming decade.

Central banks know this, as they have been stockpiling gold at 5x their usual pace, since 2022, with no signs of slowing down.

Soaring government debt, also showing no signs of slowing down, will further bolster the precious metals bull run - as governments around the world actively adopt a strategy of devaluing their currencies against gold, to reduce the real value of their debt. This strategy allows governments to continue spending without raising taxes (hence keeping them popular) while hard working citizens foot the bill in the form of inflation.

While the majority continue saving in the form of currency, only to lose purchasing power in the long run, the wealthy continue to hold their savings in hard assets with intrinsic value - outperforming currency debasement.

While many hold their retirement funds in stocks, the astute investor can secure their portfolios with precious metals to navigate the upcoming decade – benefiting from an increase in liquidity, and securing sustained capital growth through the collapse and recovery phase, while most other assets struggle to recover.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=flRyqseU1BU