98% of CEOs are planning for a further recession

News

|

Posted 20/10/2022

|

13087

Rarely can you get American business leaders to agree on anything, unless it apparently pertains to an impending economic crisis, where a recent survey conducted by The Conference Board Measure of CEO Confidence found that 98% of CEOs expect a recession in the next 12-18 months.

85% of those CEOs are planning for the recession to be ‘brief and shallow,’ while the remaining 13% are preparing themselves for ‘material global spillover.’ Either way, the broader business community is clearly planning for a significant economic downturn and aligning their actions as such.

81% of the 130 business leaders (surveyed between September 9th and October 3rd) went on to say that economic conditions had gotten worse in the past 6 months.

If 98% was not a high enough figure of certainty, Bloomberg economists recently updated their recession forecast from a 65% chance of a recession over the next year to 100%. The change was predicated on the worsening of many of their 13 macroeconomic and financial indicators included in their model, as well as more qualitative aspects such as the FEDs rampant hawkishness, which all of their economists agreed greatly contributed to the likelihood of a future recession.

This hawkishness is now expected to increase even more, as the Federal Reserve Bank of St Louis president James Bullard left the door open for a 75-basis point increase in each of the next two meetings, even though the market has only been anticipating a combined rise of 125.

During the 2008 recession, the FED could at least decrease interest rates in an attempt to lower the mortgage burden on households. If we a see a similar trough in 2022-2023, it is unlikely the FED will be able to the same, which will only result in a worsened financial state for homeowners.

The current state of the housing market is the sector that best exemplifies a likely impending economic downturn and the extreme impact of the FEDs contracting monetary policy.

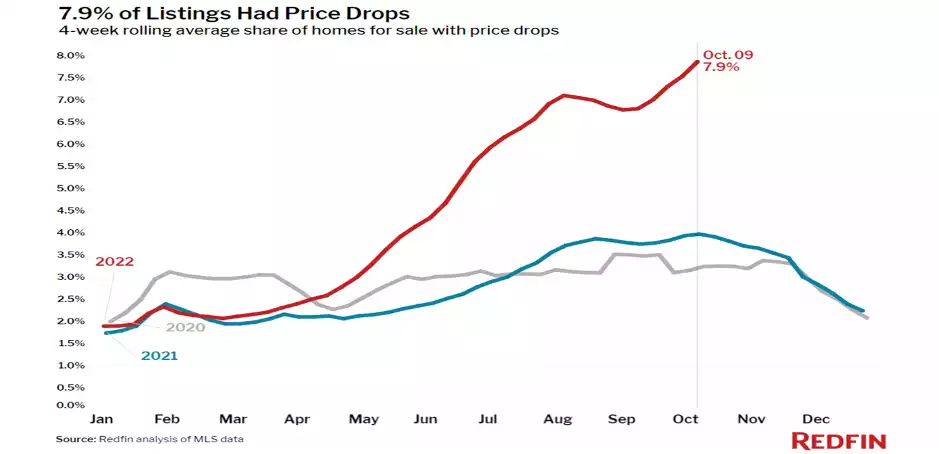

Just under 8% of home listings reported price decreases over the past 4 weeks, according to Redfin.

Additionally, mortgage payments are up 51% compared to this time last year. The median US house price fell by 0.77% from June to July, the largest such decrease since January 2011.

If these trends continue, individuals, particularly homeowners could be faced with extremely difficult circumstances in the near term.

Hence, maybe it’s time for us to all take a page out the CEO playbook, and start planning our own personal finances for the so-called highly likely recession to come.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************