9,000 U.S. Banks Failed Last Cycle, Is This Time Different?

News

|

Posted 12/12/2024

|

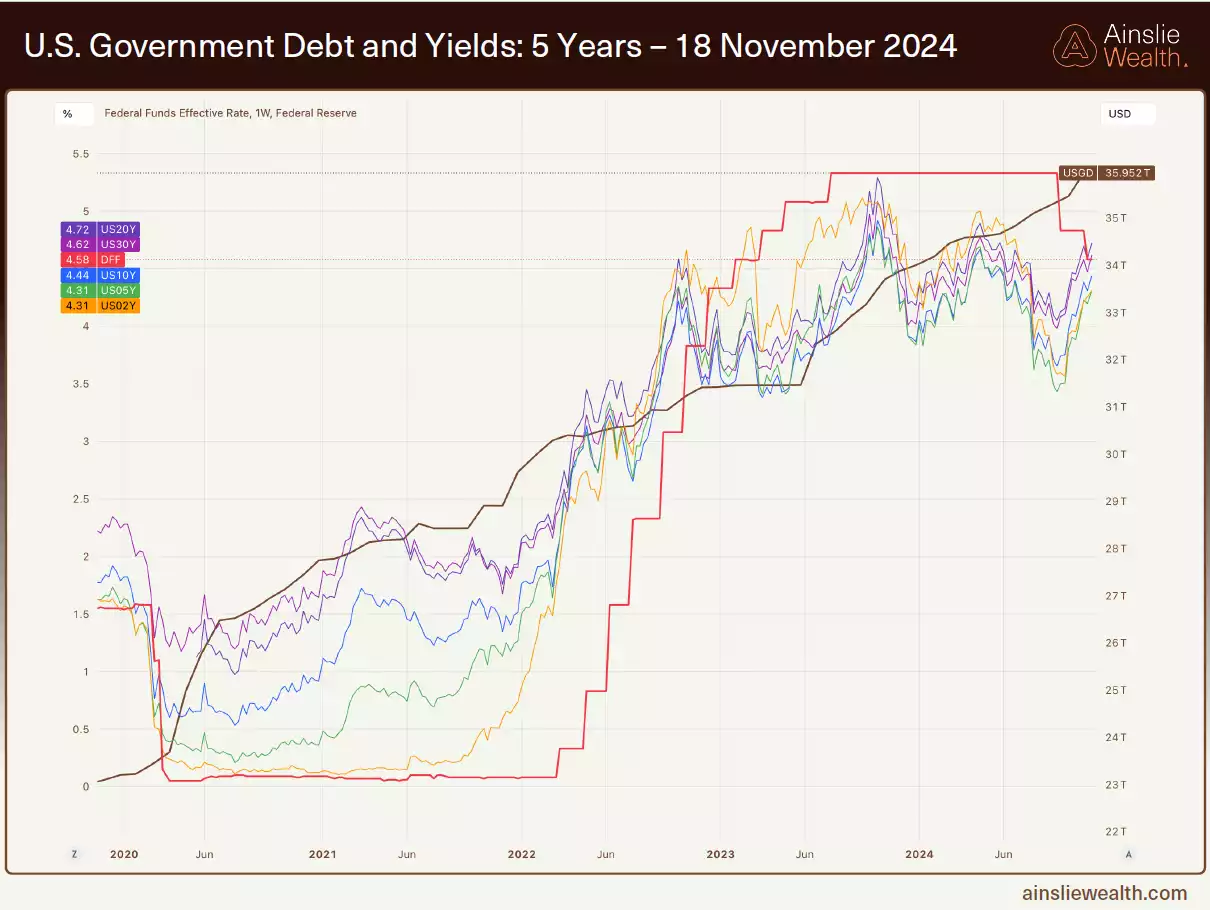

4110

In a stark reminder of how precarious the current global financial system is, we find ourselves in a precarious position once again – as U.S. bond yields have been rising since the U.S. Federal Reserve started cutting interest rates in September. This is because the U.S. bond market has been pricing in another round of inflation in reaction to the Federal Reserve cutting interest rates into a “healthy” economy with low unemployment. With rising bond yields, bond collateral values have been dropping, causing domino effects across global liquidity and most significantly – the U.S. banking sector.

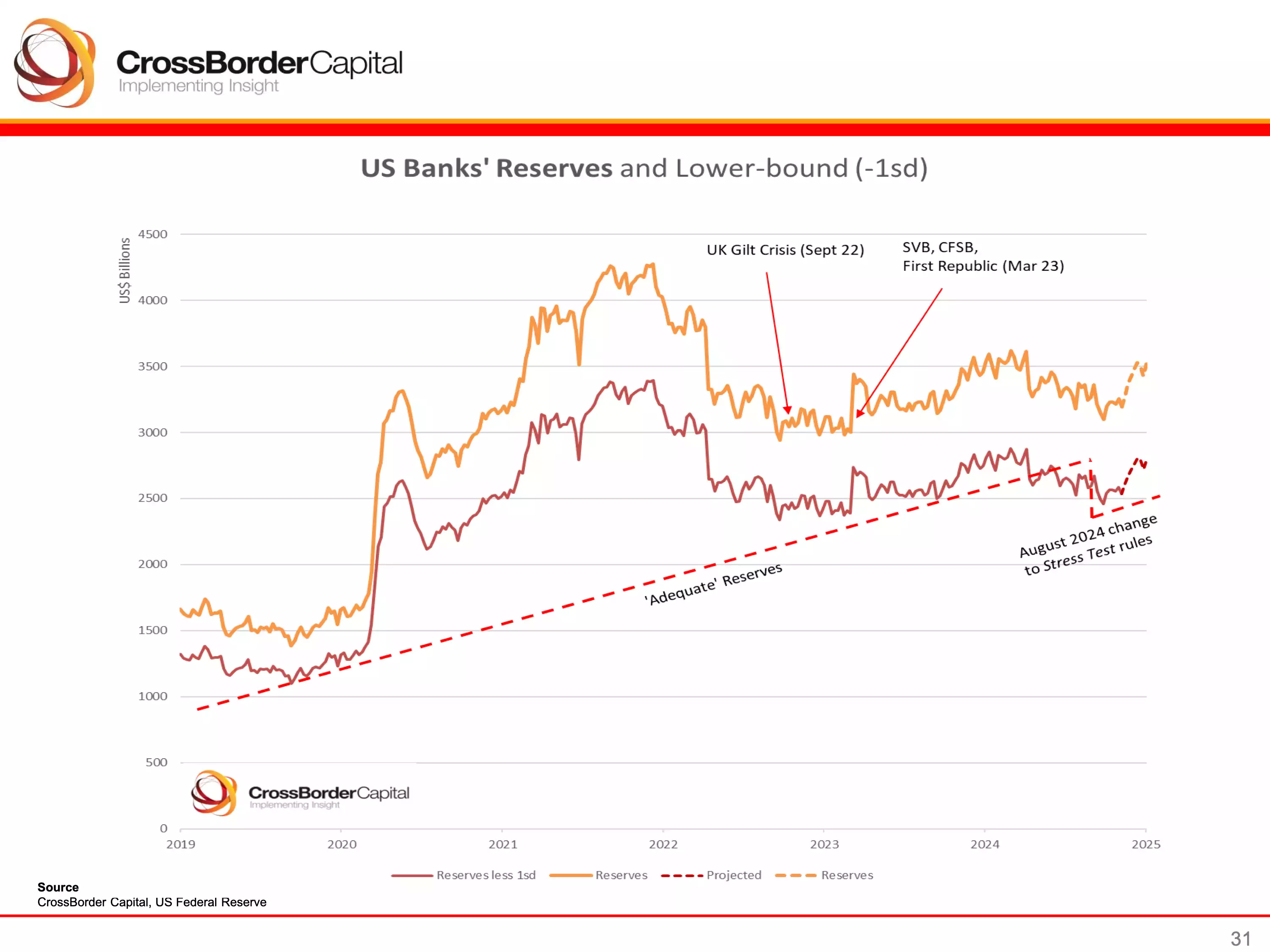

U.S. bonds are the primary blue chip collateral held by U.S. banks, by law. With bond collateral values dropping, the bank reserve levels have taken a hit since September.

Unknown to many, the adequate reserve requirements for banks were reduced in August, in preparation for this rate cutting cycle.

While this allowed the scenario of bond yields rising - to play out without raising any alarms - it has fundamentally weakened the structural integrity of the banking system.

Reducing the adequate reserve requirements is also a clear sign that the Federal reserve is out of options in its bag of tricks to manage the current scenario. Trapped between inflationary and liquidity pressures – it has conceded to the fact that another round of inflation is baked into our future – as well as its consequences.

With a brief drop in bond yields in the short term - giving us some breathing room - we are currently at a crossroads – if bond yields continue dropping, the banking system will hold up for now – however, if the mid-term uptrend in bond yields resumes, the U.S. banking sector is in big trouble.

In this scenario, will the Fed simply reduce the adequate reserve requirements once again?

The current setup reflects the balancing act that is at play to try and hold up our debt based financial system – iterating that the potential for a U.S. banking collapse hinges on central bank monetary policy more than ever.

With something as simple as a rate hiking cycle going on too long, or a rate cutting cycle that is imperfectly timed, potentially having catastrophic consequences - holding up the U.S. banking sector is becoming increasingly precarious - as the Fed’s positioning between a rock and a hard place continues to narrow with each passing year.

The last phase before a systemic collapse. How can we prepare?

While bond yields are likely to continue falling – giving the banking sector desperately needed reprieve - these few months have given us a clear indication of the ramifications of another round of inflation on the U.S. banking sector.

While the current rise in bond yields is most likely a short-term reaction to onset of the Fed’s rate cutting cycle – when inflation genuinely returns, and the bond yields continue rising steadily into a longer term up trend – the writing on the wall is clear – the days of the U.S. banks are numbered.

With most economists agreeing that another round of inflation baked into the cake – which will lead to a steady rise in U.S. bond yields - is there any way the Fed will be able to avoid a broad-based banking collapse? The numbers simply do not add up.

Is a systemic collapse an essential part of a transition from one system to another?

As we find ourselves entering the end of an approximately 80-year socioeconomic cycle called the Fourth Turning (the last one was the great depression, between 1930 and 1933) transitioning into the first turning of the next 80-year cycle– many are on the lookout for systemic collapses. During the previous fourth turning of the Great Depression, roughly 9,000 commercial banks failed in the United States – will this time be different?

The global ramifications on all financial markets of a U.S. banking system failure would be significant, and Australia would not be immune, with shockwaves across the ASX (and consequently the Australian financial landscape) being unavoidable in such a scenario.

At such times, a vehicle which allows individuals and organisations to sidestep the financial system – preserve their wealth and easily re-enter the new financial landscape with liquidity, once the dust has settled- provides an ideal strategy to find shelter from the storm, attain capital growth, and make the most of opportunities, with the chaos.

With a global financial system’s current setup - it is no wonder that veteran U.S. investors are calling for Gold prices to enter the US$10,000 / oz region.