80 years Post Bretton Woods “Gold Standard”

News

|

Posted 16/01/2024

|

2261

80 years on from Bretton Woods and a key defining moment in the transformation of the global economy to what it is today, led in theories by Maynard Keynes and the influence of Harry Dexter White, American Chief International Economist of the US Treasury at the time – the Bretton Woods agreement saw the establishment of the ‘International Bank for Reconstruction and Development’, later known as the World Bank and the International Monetary Fund or IMF. It was the World Bank’s task to invest in post war economies to help develop world trade and fix the post depression, World War 2 mistakes that were made as well as stabilise currencies. But just like all well intentioned agreements, the influences and biases of countries and individuals saw the Bretton Woods agreement resemble little of what had been hoped by Keynes and arguably countered his economic theories and saw its rapid failure into what America had wanted, the US Reserve Currency through the collapse of the gold standard and the creation of the petrodollar.

Davos 2024

So as the week of Davos begins in 2024, where well intentioned and biased individuals, companies and countries try to work out a new way to manipulate the world economy to their ideals or advantage, we will have a look at what led to the failure of Bretton Woods and Keynesian Economics. 2024 has many similarities to 1944 when Bretton Woods came into existence, countries fall further and further into debt – now $88 trillion (the US representing 39% of this, it was the biggest lender in 1944 and mostly avoided World War 2), the US has an election year and economic policy failures becoming more and more apparent. Let’s have a look at what led to the Bretton Woods failure (a gold standard) and what lessons can be learned from it.

Maynard Keynes – Failed Economist?

Maynard Keynes economic principles focused on fiscal manipulation of economies through government expenditure, not austerity, during times of recessions and depressions. During the 1944 summit, Keynes argued for an International Currency supported by a powerful International Bank to be known as the Clearing Union, backed by gold and all currencies pegged to this Universal Currency. But during the meeting, American Economist, Harry Dexter White who had been keen to usurp the UK power and influence in International Financial Markets, changed the agreement in the last hours of the conference replacing ‘gold’ with ‘gold and US dollars’ as the international medium of exchange. Keynes, it was claimed, was not even aware until after signing of the change. Therefore, arguing the Bretton Woods Agreement as a failure of the gold standard and Keynesian Economics is in fact false.

In principle, along with the Marshall plan of 1948 and 1952, where the US lent European countries $173billion for their postwar recovery and growth, the Bretton Woods agreement led to a ‘Golden Era’ of global economic prosperity whilst the gold standard was not manipulated.

It has been argued that the Bretton Woods was in fact doomed from the outset and the replacement of a gold reserve currency with a gold and USD reserve currency actually led to its demise and much like the any loophole, a loophole was established from its outset with the addition of US dollars, that let to its eventual demise.

The Triffin Paradox

As the loophole began to be exposed, in 1959 economist Robert Triffin identified what became known as the ‘Triffin Paradox’. As countries accumulated large US Reserves they began lending back to the US creating large short term liabilities for the US. As the short term liabilities grew, so did the requirement for the US to increase its gold holdings, as gold was a fixed $35 per ounce. In buying gold, the US would decrease available USD to support international trade, basically by fixing gold to the US dollar, no accommodation for growth in International Trade was accounted for, seeing an increasing amount of US dollars against a decreasing amount of gold.

‘According to the “Triffin dilemma,” the United States could never simultaneously create enough dollars to satisfy trade requirements while ensuring that it could always redeem those dollars for a fixed amount of gold.’

Bretton Woods and its Institutions

In setting up the IMF and World Bank, Keynes and the Bretton Woods agreement had intended to empower these institutions to invest in countries’ postwar economic development through low-interest rate loans, supporting countries going through financial trouble so that the 1930s currency devaluations didn’t occur. Following the introduction of the Petro dollar, election of Thatcher and Regan, the World Bank and IMF changed. They started applying restrictive austerity measures (Anti-Keynesian) encouraging deregulation, privatisation and ultimately more costly and risky loans especially in developing countries.

Despite Bretton Woods agreement collapsing in the 1970s, its influence on World Economics and the influence of the 44 countries that established it, is still apparent within the IMF and World Bank. This influence is still dominated by the countries that set it up, and it is therefore no surprise that the underrepresented countries including Asian, Latin American and Middle Eastern countries are trying to establish their own BRICS currency as they see these Bretton Woods Institutions weighted against them. At a conference in January this year, The AfroAsia Institute for Strategic Studies held a seminar on ‘African Aspirations, Bretton Woods Institutions and Domination by the West’

A True Gold Standard

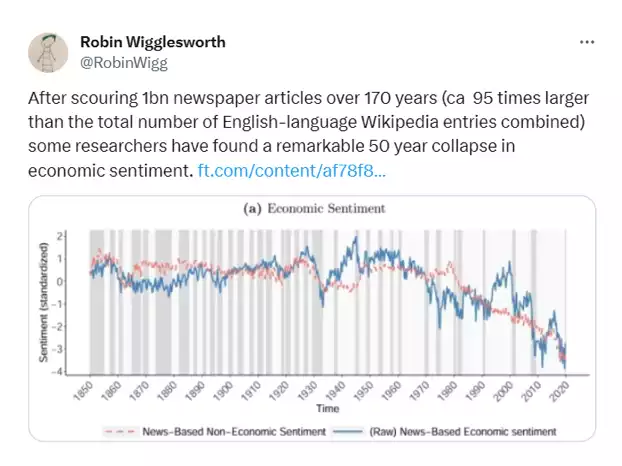

Since the golden age of the post war boom 1945-1970, and since the dissolution of Bretton Woods, economic sentiment has been collapsing with wage share of economic growth also collapsing.

The IMF and World Bank are seen as failed Western Institutions by the developing world. 2023 saw mass destabilization of currencies with an ineffective IMF and World Bank, that had no ability to influence, despite that exact reason for their existence. With America borrowing becoming exponential, countries are again looking for other options, as the world currency regime seems on a tenterhook.

So as the BRICS continue to be disillusioned by the West, will 2024 be the year we see BRICS set up a true gold standard? Or will Davos be able to put individual differences aside and look for a universally better solution, just like in 1944 at Bretton Woods. With half the world’s population going to elect their future leaders this year, we doubt it…..