50 days – 5 Banks and counting

News

|

Posted 01/05/2023

|

11985

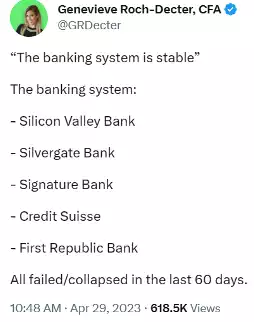

Another weekend and another emergency to contain before markets opened in Asia on Monday morning. March 10th saw the collapse of The Silicon Valley Bank, followed by Silvergate, Signature, Credit Suisse and now First Republic. The FDIC has spent the weekend frantically looking for other banks to buy First Republic – but 2 issues remain unanswered at the time of writing: why would any bank buy First Republic with an unconfirmed negative market capitalization, and if JPMorgan, the most likely suitor, does purchase them, it goes against the US regulations as they hold more than 10% of nationwide deposits. So what will the FDIC need to do to sweeten the deal?

First Republic – background

On Friday, First Republic saw its shares sink to $1.80 and a market capitalization of $650 million. To avoid another Silicon Valley Bank disaster the FDIC has stepped in to ‘auction off’ First Republic, asking banks including JPMorgan and PNC to submit final bids for First Republic Bank by Sunday afternoon US time. We didn’t know who had won at the time of publication, but we can expect to learn the outcome at any moment. Much like its San Francisco fellow bank, SVB – First Republic has a balance sheet of low interest loans and little else remaining in the way of deposits and an unreported negative market cap. So the logical question becomes who will buy them above market value?

Is this contagion?

In the not-too-distant past you may remember business leaders, the Treasury Secretary, and even the President assuring consumers that after the collapse of SVB and Signature Bank the potential for ‘contagion’ throughout the financial system is now slim. Yet this weekend, less than 50 days after the collapse of SVB and backstopping of all deposits, we are seeing this ‘contagion’ take its 5th victim in a row. So when consumers remove their money from ‘risky uninsured banks’ and transfer it to less risky, higher returning government debt, is it contagion or common sense?

Understand this one question…

As the Federal Reserve lifts rates and banks collapse – what would you do?

- Keep more than $250,000 in the bank, earning sub 1% interest and be left uninsured and exposed

- Buy Government debt where the interest return keeps rising, increasing the value of your ‘deposit’ and giving you an increasing return?

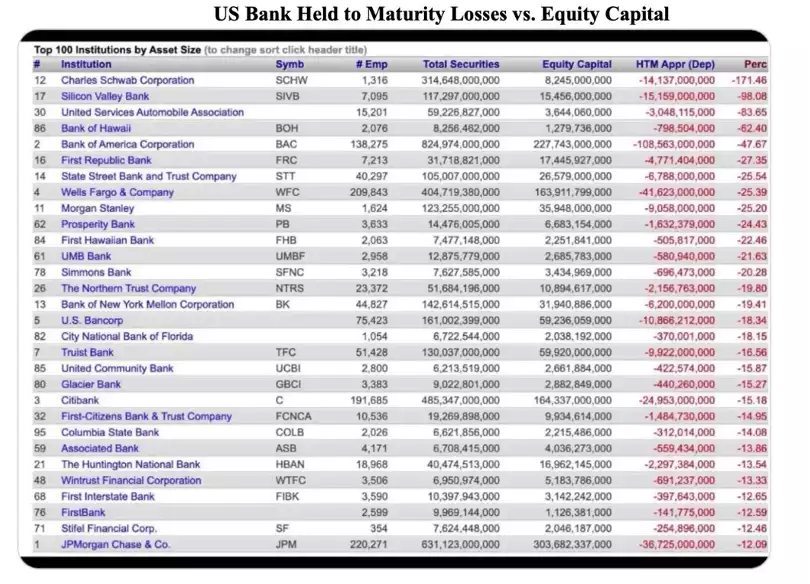

Asking yourself this question, may help you understand what is going on in the US (and the world) and why there’s been 5 banks collapse in 50 days. Furthermore you begin to understand that without the Fed pivoting to start easing, this completely logical deposit flight continues and there will be more bank failures. As the Fed keeps raising interest rates, the mark to market losses continue to increase and the incentive for depositors to shift their funds becomes even greater.

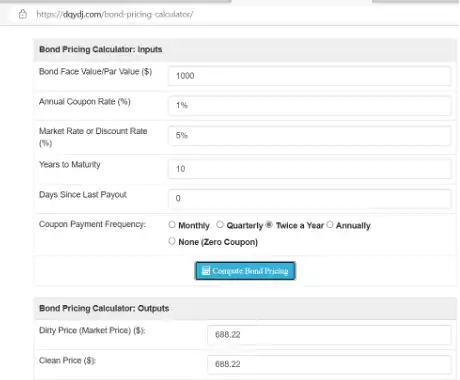

First Republic Bank has seen its valuation fall from $220 a share in November 2021, with a market cap of $40 billion, to $1.80 on Friday, and a market cap of $650 million. During the process over the weekend as the FDIC has stepped in and started the sale, bank sources now say it actually has a market cap of -$14 billion. With $70 billion in withdrawals in the last 6 months, which is the source of 1% ‘debt’ that needs to be converted to 5% ‘debt’, seeing an equivalent mark to market loss on 10 year debt of 32.2% or $22.5 billion in realized losses.

To understand this we encourage you to look at a bond calculator such as Bond Price Calculator – Present Value of Future Cashflows - DQYDJ input a 5% discount rate (or Fed rate) with a 1% coupon (or COVID equivalent rate). So as $70 billion in deposits left First Republic, they had to replace it with 5% debt – leading to estimated losses of $22.5 billion just on these deposits.

These mark to market losses, even though they remain unrealized in banks that haven’t had a run, are estimated now at $1.7 trillion. The issue is that this is calculated on $17 trillion in deposits and equates to an equivalent 3-year average term on debt in the US, which due to the 30-year mortgage loans available, looks very optimistic. If the average debt term were 5 years, these losses would be closer to $3 trillion…

Is this the trigger for a Fed Pivot?

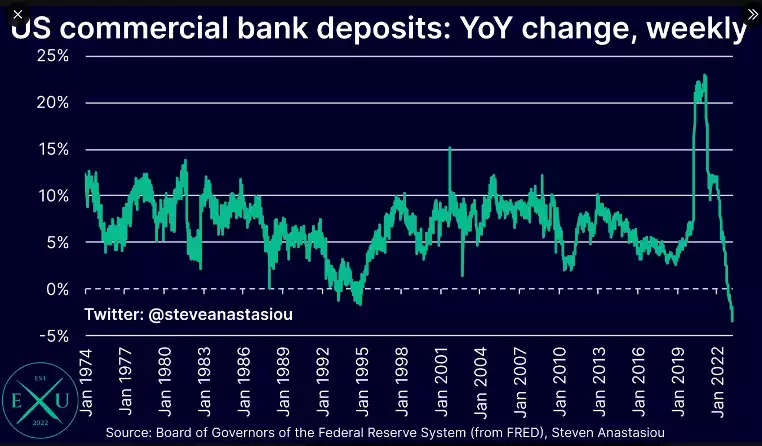

If interest rates continue to rise and banks continue to fail the reasons for moving money out of the banking system become more compelling. In a chart tweeted by Steven Anastasiou, this trend is supportive of the reality – with money supply dropping the most since the 1960s.

He says ‘US Commercial bank deposits are declining at the fastest pace ever recorded in the Fed’s current data series.’

So the Fed is now faced with an almost impossible decision at its meeting this week – raise rates and the ‘contagion’ will continue to snowball with unrealized losses growing to the point of no return with no plausible backstop, or pivot and allow for potentially higher than comfortable levels of inflation to continue but give some time to allow the banking system to catch up with the fastest interest rate increases in the past 100 years. Whatever they decide we can expect further volatility ahead.