400% Increase in Gold Demand from Central Banks Since 2022

News

|

Posted 06/02/2025

|

1699

We are currently facing a generational shortage of physical bullion, with significantly diminished liquidity in the London bullion markets. One factor for this is the flow of bullion from the UK to American LBMA (London Bullion Market Association) vaults — which some speculate is pre-emptive relocation — in case of a Trump tariff on gold imports - which would significantly increase margins on physical bullion sales. While Trump has not specifically mentioned a duty on bullion, this speculation has been widely covered by the mainstream media.

However, a significant factor which the mainstream media has completely ignored is the fact that the flows of physical gold out of London are primarily heading east toward China, via Switzerland.

Switzerland imports about 1 kiloton a year of unrefined London gold, which it refines and redirects to Asian markets — primarily China.

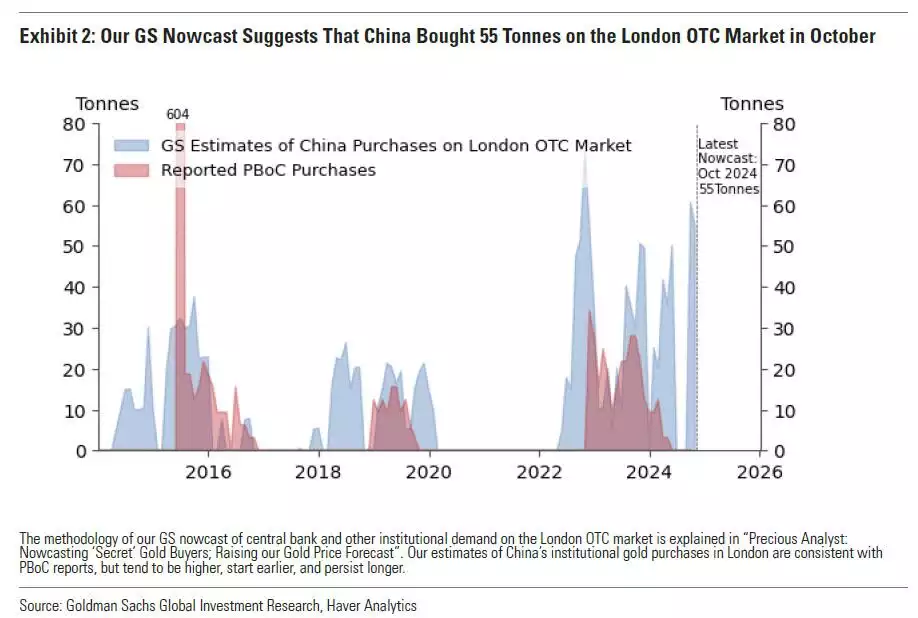

This means that China’s actual gold purchases are much higher than the reported figures in the London Over-the-Counter (OTC) market.

This Goldman Sachs report shows the difference between the estimated real weight of purchases of gold by China from the London OTC market — and the reported purchases — which hit an all-time high late last year.

This is like its purchases of unrefined silver, directly from African miners, which China refines onshore - meaning China’s actual silver purchases are similarly much higher than the reported OTC figures of silver purchases.

However, this stockpiling of gold and silver isn’t unique to China.

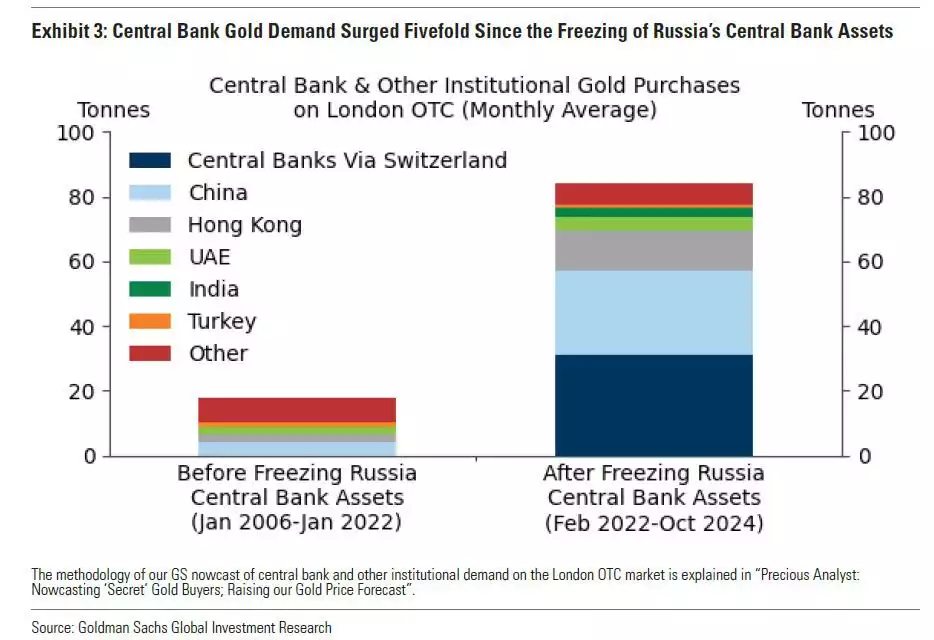

Ever since the US weaponized the US dollar against Russia in 2022, the demand for gold by central banks has seen a 400% increase.

With China being the most aggressive in its gold stockpiling out of all the central banks — and being open about its intention to invade Taiwan this decade — it seems they have learnt a powerful lesson in the aftermath of the Russia-Ukraine conflict.

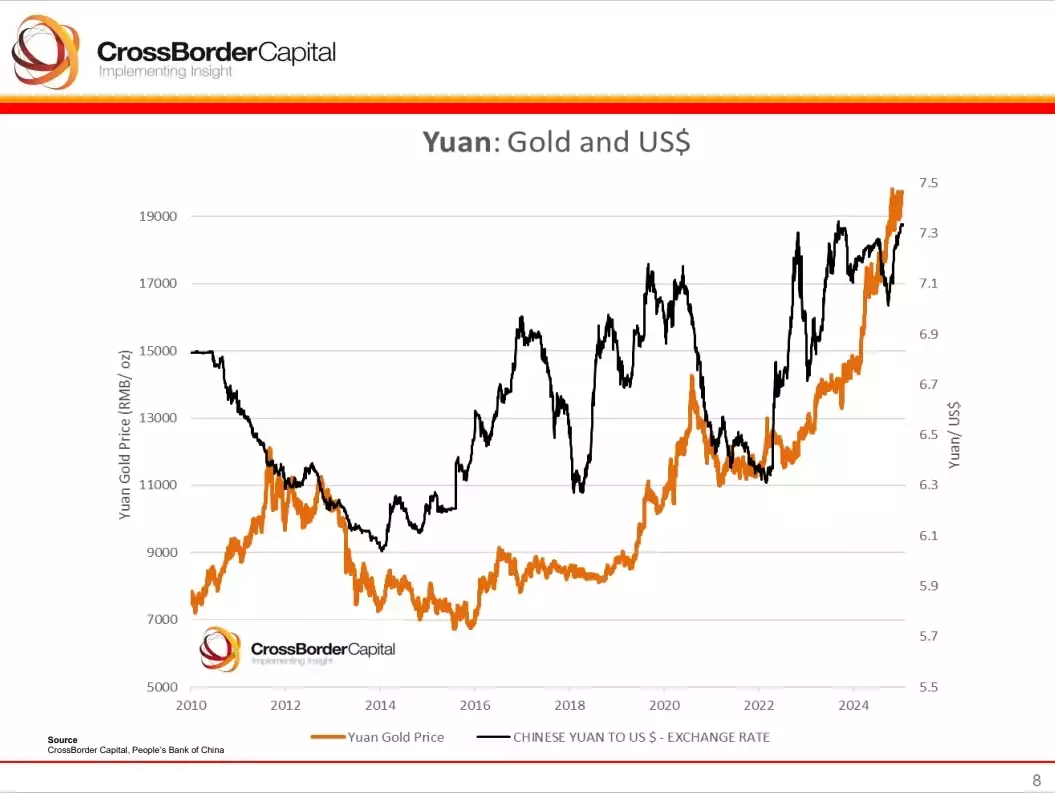

Another factor that is driving China’s stockpiling is its enormous government debt.

There appears to be an active strategy to devalue China’s currency against gold, while simultaneously stockpiling gold. This reduces the real value of their currency-denominated debt — making it serviceable. Gold will rise against the yuan as a result — and China’s balance sheet will look a lot healthier.

China is hesitant to devalue directly against the dollar as this has led to huge capital outflows into U.S. dollars before; however, devaluing against gold helps maintain their position in the FX markets.

As gold rises in value against the yuan, it will also have to rise in value against the dollar due to arbitrage trade opportunities.

Private demand for gold is also very high in China, as residents understand this devaluation of the yuan is taking place. Chinese residents can hold as much gold as they’d like (they simply can't export it) making the gold market more of a free market than the FX market for paper money in China.

While some speculate that this strategy by the Chinese will result in the yuan also losing value against the US dollar - we expect the U.S. dollar lose strength in parallel — with the DXY cyclically due to fall off. This would further help maintain the relative currency stability between U.S. and China.

In addition to the devaluation of the yuan, the U.S. dollar losing strength would further significantly bolster the global price of gold, while also making America’s balance sheet look healthier, as the real value of their debt reduced, in a similar fashion to China’s.

It appears that currency devaluation is the last trick left in the bag of government’s drowning in debt, while everyday hardworking citizens pay the price for it via inflation.

A simple solution to this government strategy is to save in hard assets such as gold instead of the local currency; "...if you can’t beat 'em, join 'em.

Ainslie Saver is a product specifically designed to facilitate consistent saving in gold and silver.

The strategy adopted by governments drowning in debt, of devaluing currency while stockpiling gold, will continue to result in a fundamental revaluation of the gold markets.