40 Year High CPI is only the headline – What this really means for gold

News

|

Posted 11/11/2021

|

11395

Gold, silver and platinum all had very strong nights last night up 1.8%, 2.3% and 1.4% respectively as October’s US Consumer Price Index (CPI) print came in at a red hot 40 year high 6.2% and the Core CPI at 4.6%, its highest since 1990. This of course comes off the back of yesterday’s roaring PPI print as well as a 26 year high Chinese PPI print of an eye watering 13.5%. And again the US sharemarket saw falls across the board, particularly tech and growth shares buoyed but the free money game that looks to be about to meet its inflation lead tightening nemesis. The USD rose again, pushing the AUD down further and adding icing to the gold gains in our local currency.

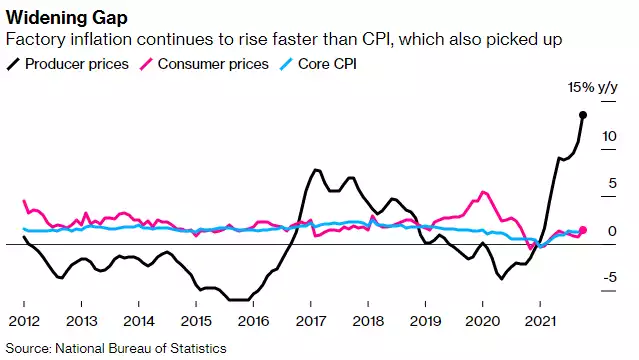

The ‘transitory’ narrative is being very sorely tested when we look at PPI (at the factory) and CPI (at the consumer) together both in the US and China. The fact remains that the gap is enormous for both which implies either the consumer is about to pay more or the businesses have to cut margins to the bone.

In the US we are now at a point where the gap is at a near half century high.

In China the gap is even worse with CPI at 1.5% and PPI at 13.5%!

And remember inflation by itself is not necessarily fatal but the CPI print last night showed that wages aren’t keeping up, with year on year real weekly earnings down 1.6%.

The market reacted by fully pricing in a rate hike now in July next year, well in advance of the Fed’s forecast. The bond market is pricing in a rude shock as well.

The ‘Fed Dilemma’ just continues to go from bad to worse. What the above is telling us, and please let us remember the fact we all know that CPI be it here or the US is well under what we are really experiencing, is that the central bank policies of easy money are creating a bigger and bigger social divide. Tighten and they crash markets addicted to easy money and the biggest losers are the higher end of town. Lets call them the ‘mates’. Keep it easy and they are robbing the 90% through inflation. Lets call them the ‘collateral damage’.

This is clearly seen in the chart below where we now have the wealth held by the bottom 90% equal to just the top 0.1% just as it was just before the Great Depression.

The Fed’s hand will be forced. They will need to tighten into an economy not able to handle that from both a fundamental strength perspective nor debt burden servicing perspective. That will inevitably see the central banks reopen the liquidity flood gates. If you think the lead up to that point is hugely supportive of gold, just wait to see what happens when their hand is forced to ease again. “Loss of faith” will take on new meaning.

Anyone can own precious metals bullion. From $40 to any upper limit you care to nominate, you can easily can buy these highly liquid, highly divisible (try selling a little bit of our property quickly), proven hard assets now. As Crescat’s Otavio Costa last night said:

“If economic growth continues to decelerate while inflation remains historically elevated, what will the Fed do?

The set of monetary and fiscal policies needed to fix one problem would worsen the other.

None of us own enough hard assets.”