25/50 Decision Day

News

|

Posted 18/09/2024

|

1447

With tonight’s Federal Reserve decision widely anticipated that the U.S. will drop interest rates, the markets have become particularly bullish on bigger and bigger drops. So much so that the market is now pricing a 67% chance of a 50-bp drop. But why would the Federal Reserve do that – with data showing inflation still above their 2% target and unemployment still defying gravity, what has changed or what data is the market looking at that they see a necessary 50-bp drop? The problem the Fed now has is a 25-point drop was probably their original intention, but due to the market now pricing in a high chance of a 50-point drop, the stock market, USD, and oil have now ‘bought the rumour’. As it goes, if a 25-point drop is now all they do the ‘sell the news’ rhetoric is the likely outcome, dropping back these markets, with particular emphasis on oil, which in the last year has been the greatest deflationary pressure in the U.S. economy, letting its price fall more could increase deflation.

Powell and The Fed

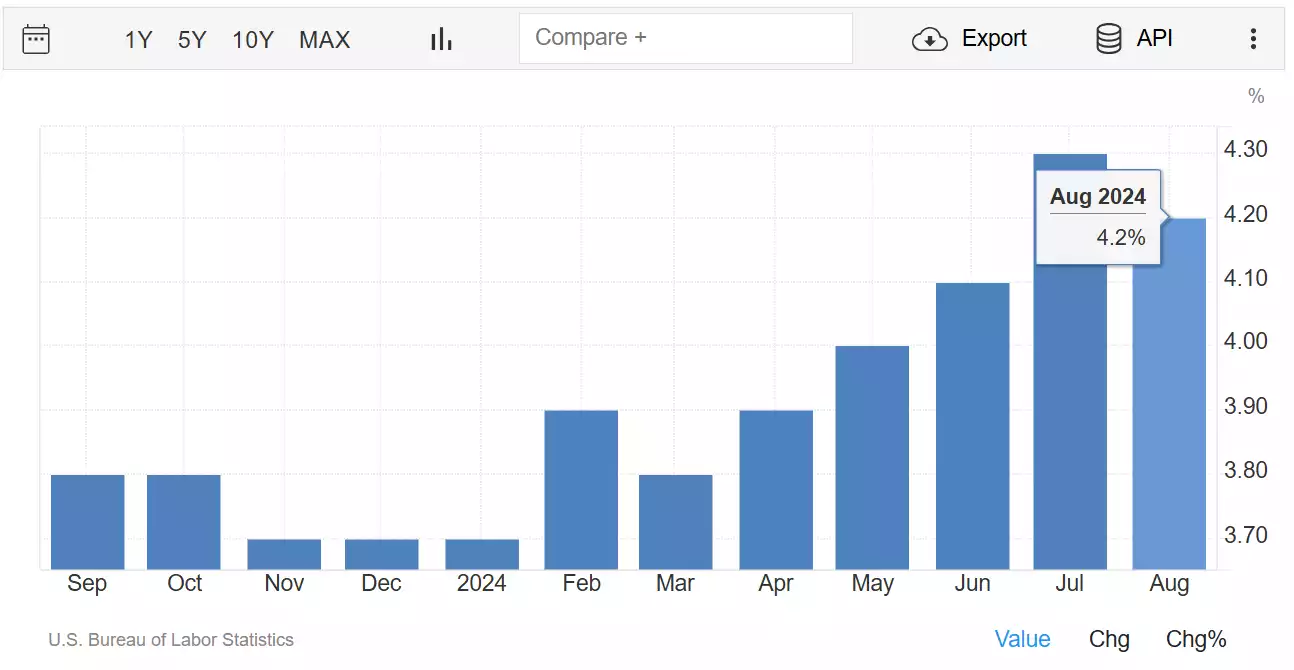

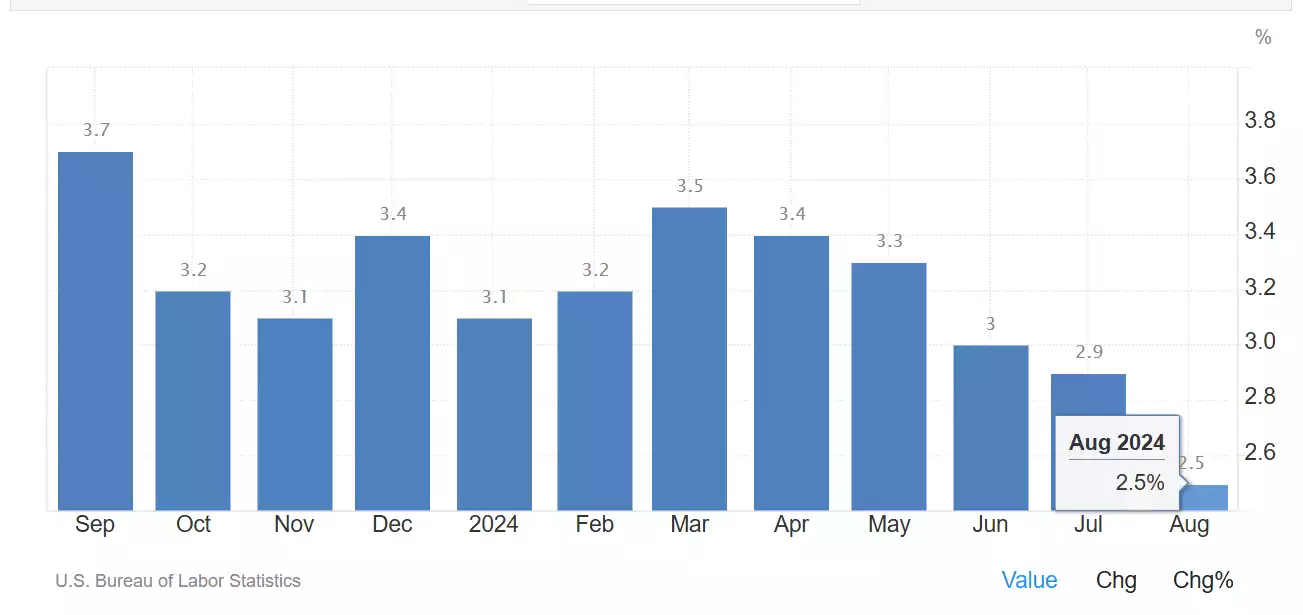

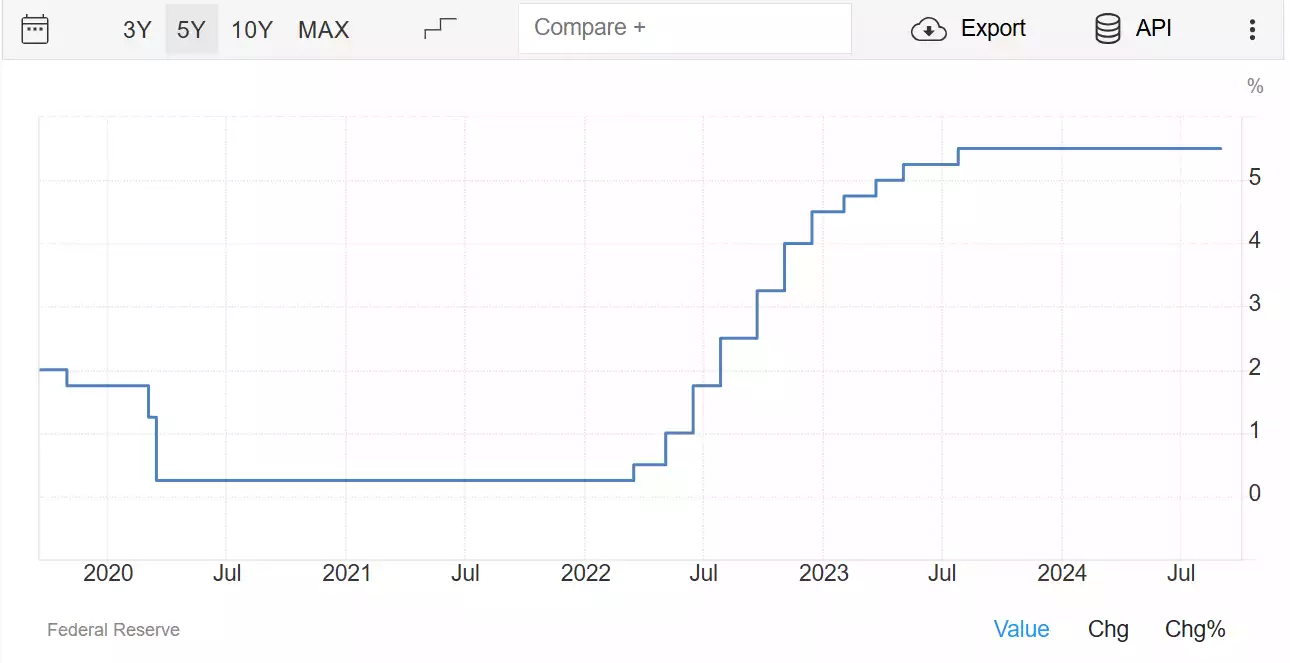

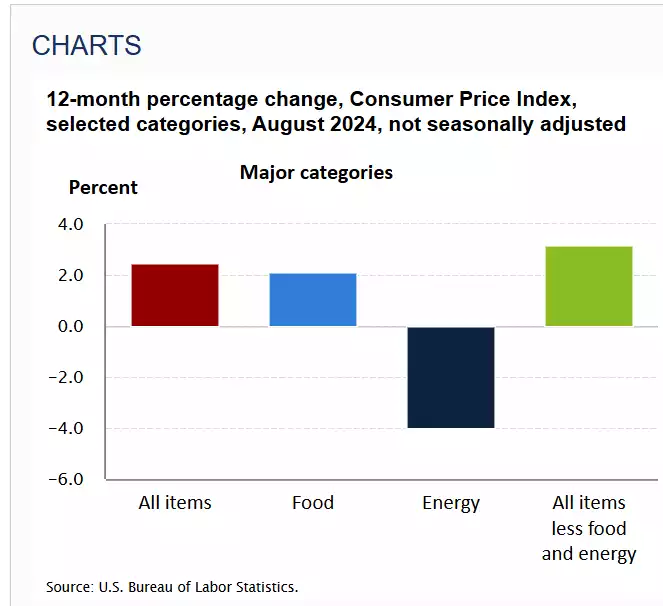

So how do we know they are dropping rates? In August, following the Jackson Hole conference, Powell noted in his speech that inflation had cooled, and unemployment had started lifting, to avoid further weakening, Powell stated that the Fed would look at starting to reduce interest rates.

‘The upside risks to inflation have diminished. And the downside risks to employment have increased’.

‘The time has come for policy to adjust’.

*U.S. unemployment rate

*U.S. Inflation rate

Powell cautioned that the timing and speed of interest rate cuts would depend on how the economy performed, but with market exuberance, the market is now pricing a 60% chance of a drop.

This will be the first cut since 2020 amid COVID-19, setting off the beginnings of worldwide, non-transitory inflation. After which they began raising rates to battle their own goal inflation in February 2022. The last rate rise occurred in July 2023, 15 months ago.

But the case for a 50-point drop considering non-core inflation is still elevated seems.

In fact, since the 1980s a 50point drop has only occurred twice at the start of a cutting cycle, in January 2001 during the dot-com bubble and September 2007 at the start of the GFC.

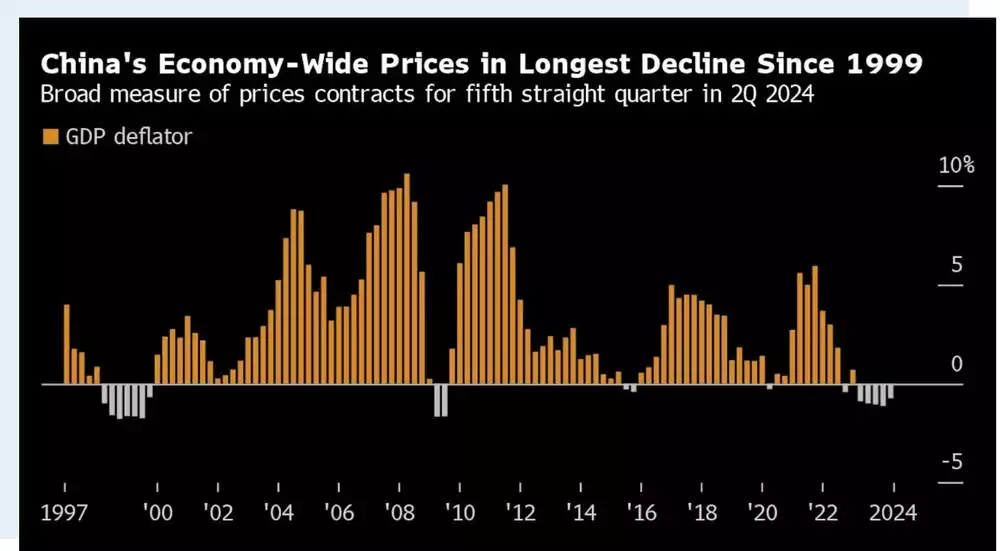

China & Oil Deflation

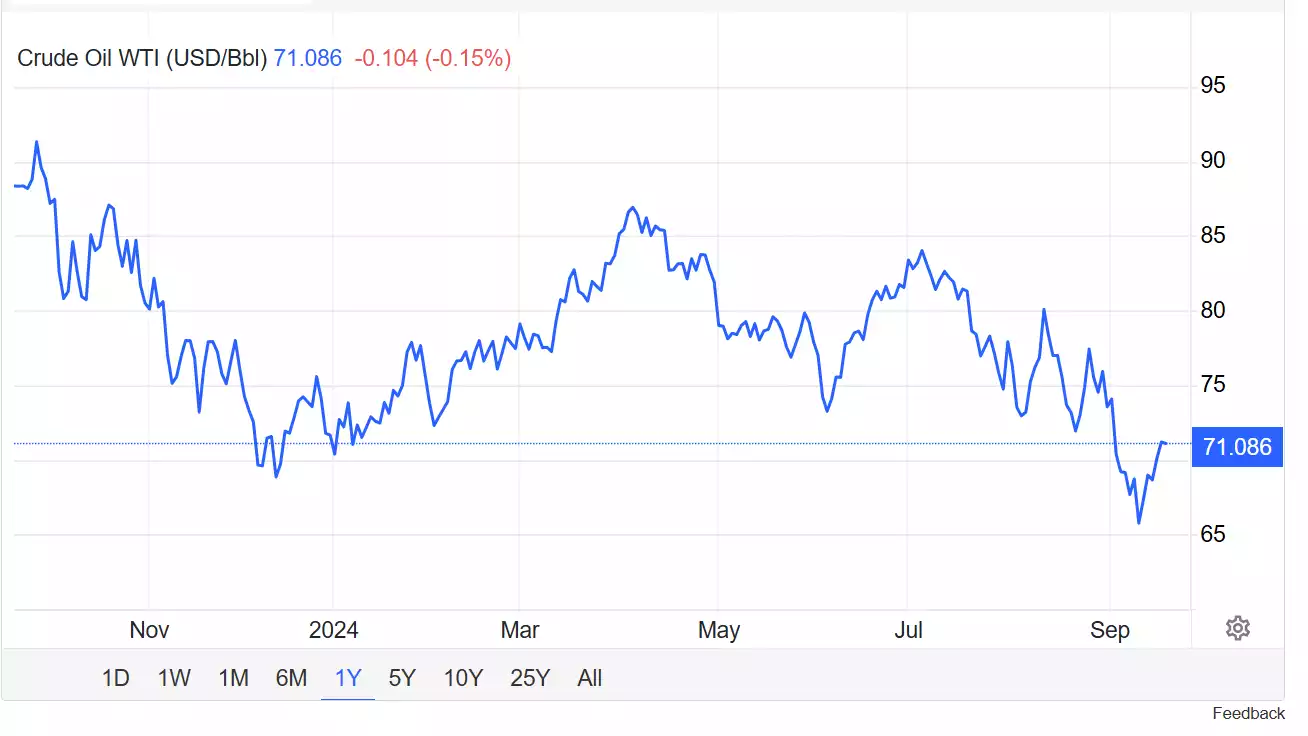

Crude oil prices have been falling on the back of weak demand from China, where deflation has set in and is currently being exported around the world through the weakening Yuan and weakening manufactured goods. The current Chinese deflation and renewable energy push has led to a reduced demand for oil, with OPEC forecasting world oil demand would rise by 2.03 million barrels per day in 2024, down from growth of 2.11 million barrels expected last month.

In Australia, petrol prices have started to come down rapidly, with the price being paid at the bowser now around $1.50 well down from $2 a couple of months ago. The price of oil has been dropping through most of the year with the price of oil dropping to around $65 per barrel last week. As expectations have grown of a greater Federal Reserve interest rate drop, oil has bounced, if they reduce by only 25 points, the price of oil is likely to continue South.

*Crude oil price USD

Dammed if you do, dammed if you don’t

Tonight’s Federal Reserve decision is the most anticipated of the year, with markets buying the rumour, get ready for some big moves across markets when the news is in.