2028: A Pivotal Year? The Shemitah Cycle and Market Convergence

News

|

Posted 27/08/2025

|

4650

The Shemitah year—or “Sabbath of the Land”—is the seventh year in a biblically mandated agricultural cycle, still observed in Judaism. During this year, agricultural activity is paused, allowing the land to rest and regenerate. It's a sustainable practice rooted in the principle of rest on the seventh day of creation.

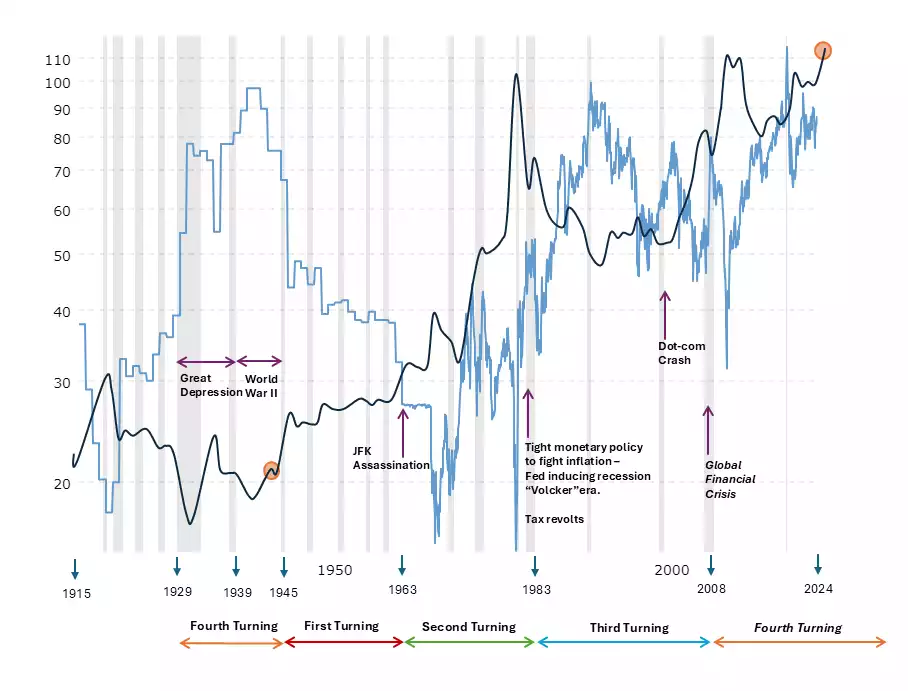

What’s intriguing is the historical correlation between Shemitah years and major economic downturns. Key events such as the 2021 inflation peak, the Dotcom bust, the Global Financial Crisis, the Volcker recession of the 1970s, the 1936 recession, the Great Depression, and the 1916 European-led recession all occurred during Shemitah years. While only 8 of the past 16 Shemitah years marked peaks before crashes, each coincided with a significant economic event.

The next Shemitah year falls in 2028—a year that also marks the upper boundary of the expected window for a peak in the current 18.6-year land cycle. The last major peak occurred during the GFC.

The 18.6-Year Land Cycle

This land cycle is the fourth within a broader 80-year socio-economic cycle—popularised by the "Fourth Turning" thesis—currently nearing its conclusion. The previous conclusion of this longer cycle was marked by the Great Depression. Given the alignment, it’s reasonable to anticipate a longer-than-average land cycle this time around, with a peak towards the later end of its typical band.

The expected window for the land cycle peak spans 2024 to 2028, with the average timing falling around early 2026. A peak in 2028 would align with the longer historic examples and remain consistent with the broader socio-economic cycle.

An early signal of a land cycle peak is often a divergence between land and equity markets—where land prices begin trending downward while equities remain elevated. In the last cycle, this divergence lasted nearly 20 months. A similar divergence is starting to emerge now, though it remains unconfirmed. If land (shown in pink) forms a lower high and rolls over, it would serve as a warning. A break below the Trump-era tariff low would strengthen the signal. Conversely, a new high in land markets would suggest the divergence has not yet begun.

Even without confirmation, the current timing already points to an extended land cycle—reinforcing the potential for a 2028 peak that coincides with the Shemitah year.

Gold’s 8-Year Cycle

Gold’s current 8-year cycle began in 2022, placing its half-cycle low around 2026. A strong move higher from this point would be typical. With the next full cycle expected to start in 2030, we could see a consolidation phase through 2028—once again drawing attention to that year. Precious metals may serve as a non-correlated safe haven amid broader market stress.

The Fourth Turning and the Next Bull Market

If the next 8-year gold cycle begins in 2030, it would coincide with the first stage of a new 80-year cycle. Historically, this phase has delivered strong bull markets for precious metals. Silver, in particular, has outperformed during such periods, with the gold-to-silver ratio falling dramatically—from the 70–90 range to as low as 20–40.

Bitcoin Cycles

Bitcoin’s cycle also adds to the convergence. With a major cycle low projected for 2026 and the next expected in 2030, a sharp peak in 2028 would represent a left-translated cycle top—especially notable after a series of right-translated cycles.

A Year to Watch

With multiple macroeconomic, commodity, and asset cycles converging—land, gold, silver, Bitcoin, and the Shemitah—all pointing to 2028, this year deserves close attention.

For precious metals investors, this wider perspective offers reassurance. While some focus on near-term price action and worry they’ve missed the move, a longer view reveals we are still early in both the 8-year gold cycle and a broader macro narrative—one with significant upside potential for both gold and silver.

Watch the insights video inspired by this article here - https://www.youtube.com/watch?v=2tie3kwdAS4