2018 – AUD, USD and Gold

News

|

Posted 16/01/2018

|

8237

The beginning of every year has economists polishing their crystal balls, intently peering in to determine what is ahead for us mere mortals.

One of the hot topics is the Aussie dollar which appears to be at the mercy of two conflicting macro forces. On one hand we have weak inflation, record low wage growth and, at this stage, a continuing weak commodities market. This means the RBA is unlikely to hike our interest rates any time soon. Set that against the backdrop of the US Fed widely expected to raise rates at least 2 times, when Australia and the US are both already on parity now at 1.5%, and you can see the problem before the AUD. The ‘big money’ would normally go for the safety of the US over Australia for the same ‘return’. To date the AUD has enjoyed the support of one of the highest interest rates in the developed world attracting foreign investment. Big brother is crashing that party….

On the other hand, however, we are witnessing the USD sliding ever since the Fed last hiked rates in mid December last year and that slide accelerating more recently against a stronger Euro after news of expectations of the ECB unwinding its QE sooner than expected. Check out the second chart yesterday showing expectations of October against current reports of June. That sliding USD is boosting the AUD. The other factor at play is the expectations amongst some (and certainly Jeffrey Gundlach as we reported yesterday), that 2018 will see a rebound in commodities which would ordinarily be supportive of a higher AUD.

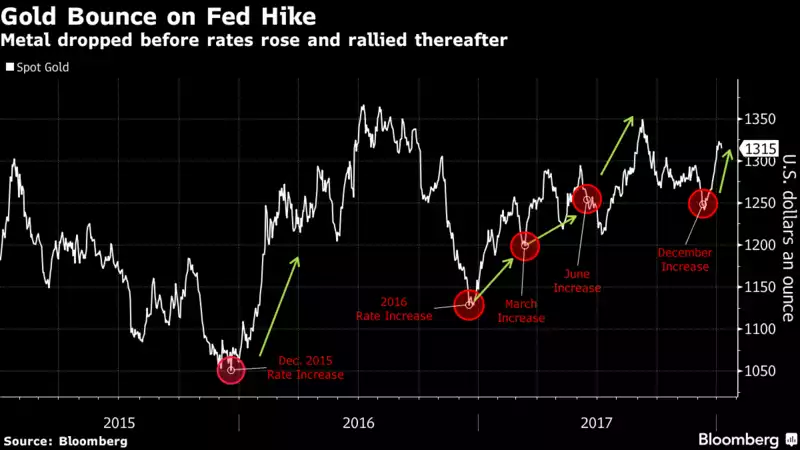

Where gold and silver sit in this equation is interesting. The USD gold spot price has hit a 3 month high and only $10 off the August highs of last year and $25 highs not seen since 2013. This rally has been in lockstep with the falling USD since the Fed rate hike in December. However that dynamic of the rising AUD against that falling USD means that since that day gold has risen only 3% in AUD terms compared to the 8% rise it has enjoyed in USD. A nice return for just one month, but takes the shine off nonetheless. That USD spot return, however, has beaten all comers. From Bloomberg:

““Since the December hike, gold is beating stocks, the dollar and bitcoin,” Bloomberg Intelligence analyst Mike McGlone wrote in a note. “Unless greenback weakness reverses, gold should shine.”

The metal’s sparkling performance in the face of tighter rates, though counter-intuitive, has become the norm. Gold prices have been turning higher soon after the Fed raises rates ever since the global financial crisis.”

Food for thought considering economist predictions of anything from 2 to 6 hikes to come out of the Fed this year…

The ABC polled economists from nine different banks about the AUD in 2018 and got a divergent response. HSBC was the most bullish at 84c and JP Morgan Stanley the most bearish predicting the AUD "to depreciate sharply over 2018" to just 67c (down to 65c in March 2019!).

They cite both that interest rate dynamic and also a darker view on commodities:

“"Our commodity team is forecasting flat commodity prices into 2018, largely driven by weaker demand," Morgan Stanley equity strategist Chris Nicol said.

"Importantly for Australia, however, iron ore and coking coal prices are expected to decline as China's environmental policies reduce the demand for steel."”

Westpac weren’t far behind at 70c for much the same reasons though they are more worried about the Chinese economic outlook:

"If we are speculating on the most significant 'unknown' for 2018 and 2019, the Chinese financial system, particularly for Australia, stands above any other issues that should be worrying us," Bill Evans, Chief Economist for Westpac. China largely saved Australia from the full impact of the GFC and may well be the catalyst for our next downturn.

For gold and silver investors a drop to 67c from the current 80c would see the price for both metals jump 19% in AUD terms. Should the AUD strengthen against the USD falling, that falling USD would most likely see the US spot price of gold strengthen and overcome any AUD spot falls. If the AUD strengthens against rising commodity prices, again you would expect gold and silver (in particular) strengthen in that environment too.