$200b QE for Australia – Goldman Sachs

News

|

Posted 03/10/2019

|

11333

Last night saw a worsening of the previous northern hemisphere session with Wall St down around 1.8-1.9%, the USD down again and gold up 1.4% with silver up 1.8% as the GSR drops to 85. Last night was a continuation of poor global economic data and weaker than expected US jobs numbers. None of these ‘sound bites’ of data should come as a surprise to anyone looking at the macro position as we do every day. But markets currently are a dangerous yet predictable mix of being on tenterhooks and emotion driven. That means central banks feel the need to keep everyone ‘calm’ through stimulatory support, less, God forbid, we have a ‘correction’ to bring us back to a natural order. As we repeatedly remind you, the longer they artificially hold up the market, the more likely the ‘correction’ becomes a precipitous crash when they lose control. These clever folk think they can somehow take a century of natural market cycles and make “this time different”.

To date we in Australia have watched these so called “unconventional monetary policies” from afar within our China supported ivory tower thinking “that could never happen here”. As we warned most recently here, that tower is looking decidedly unstable. Additionally, as we wrote here, on Tuesday the RBA took us within just 3 cuts of zero interest rates. Our Aussie dollar has been comparatively strong as everyone else had zero rates but us. That’s now changed. Goldman Sachs now also think something else could change. Goldman Sachs don’t think the RBA will achieve their inflation mandate without taking rates into the negative or joining the “unconventional monetary policy” of quantitative easing (QE). From Bloomberg:

“Using the RBA’s new large-scale macroeconomic model, Goldman economists led by Andrew Boak said current market pricing of a cash rate around 0.5% would probably fall “well short” of achieving the RBA’s inflation mandate of 2% to 3%. The cash rate would need to be negative 1% to reach inflation and employment goals over a two-to three-year time horizon, they said.

“Assuming the RBA refrains from implementing negative rates in practice, we estimate that an equivalent amount of stimulus could be delivered by lowering rates to their effective lower bound (GS: 0-0.25%) and implementing a QE program worth around A$200 billion,” the Goldman economists said in a report dated Oct. 1. The QE would amount to $134 billion in U.S. dollars.”

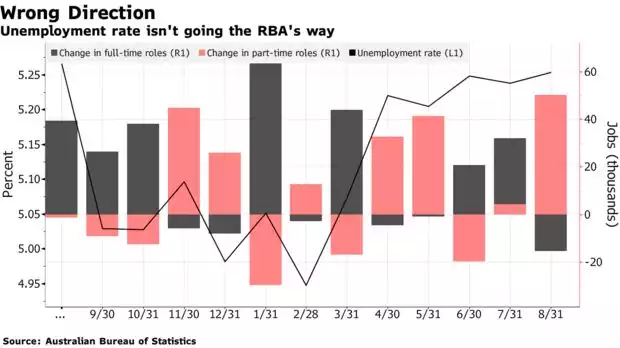

The RBA have another mandate and that is unemployment. That same Bloomberg article showed the concerning trend for Aussie unemployment and within the headline, the growing move to part time employment over full time as nervous business owners become reluctant to commit or people take multiple part time jobs to make ends meet.

As we discussed yesterday, there are sectors of Australia’s workforce still ‘busy’ as they complete contracts made a year ago. The problem is there is little in the pipeline once they are finished. That, combined with weakening global trade, is playing out already in the chart above.

The Australian government is under growing pressure to start stimulating the economy with fiscal stimulus in the form of spending on infrastructure either new or repairs. That can only happen in any meaningful way via debt funding and hence a national deficit. They are still desperate to be the ‘surplus’ government given all the pre-occupation on that during the last elections.

Currently Australia has one of the highest personal debt rates in the world but a modest public debt. Looks a little like shuffling the deck.

Precious metals and crypto sit outside this ludicrous system.