2 Charts That Can’t Be Ignored

News

|

Posted 16/10/2020

|

12514

Today we simply share 2 charts that tell the very simple and compelling story that is the gold investment case. Cut through all the noise and economic rationalisations amid this pandemic and Blind Freddy should be able to do the math on this.

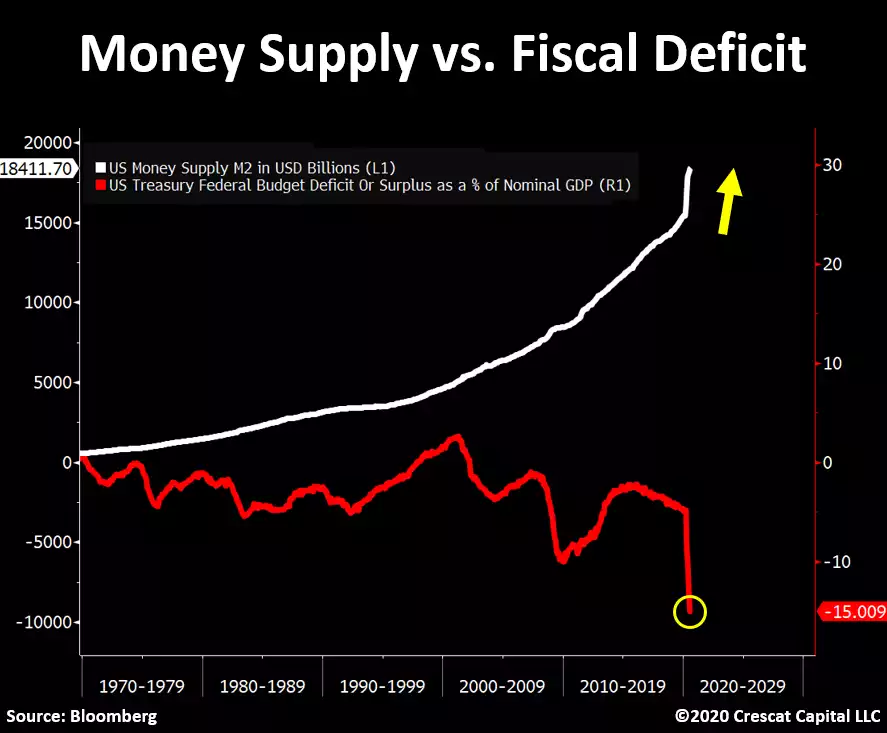

Stimulus is ultimately either monetary policy of a central bank or fiscal deficit spending of a government. The chart below combines both for the US, showing the M2 money supply rocketing up, and the US deficit rocketing in unison. For context, please note the tiny blip in 2009 in M2 followed by a relentless surge for something that was supposed to be a short term fix.

That, in one picture, should be screaming a warning to any sentient being. Forget the pandemic, this was a trend well in play beforehand, its just taken it into exponential territory.

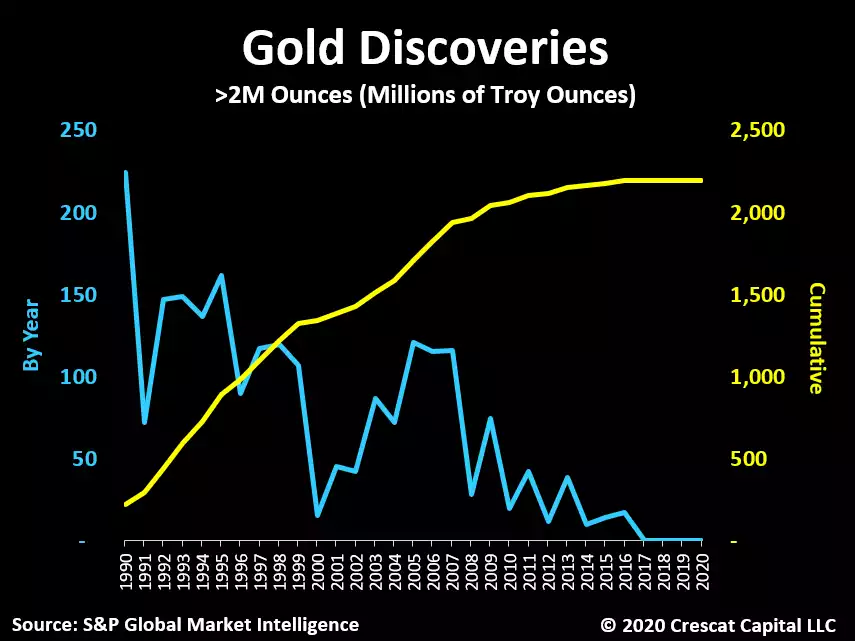

So what’s the antithesis of this? Where could one invest in something the presents effectively the opposite of what this illustrates? Whilst the gaping crocodile jaws shape may be the same, the chart below presents the very opposite case to that above. What it tells us is that for decades there has been a trend of decline in large new gold discoveries. We have written previously about calls from very senior mining executives that around 2015 saw ‘peak gold’. The chart below reinforces that thesis in that since then that yellow line of cumulative new discoveries has flatlined. Indeed there have been zero new large discoveries since 2016. Zero!

That, in 2 charts, tells the story. Fiat currency can be printed with reckless abandon to keep this global debt cycle alive as has been done in all previous cycles with a 100% track record of failure.

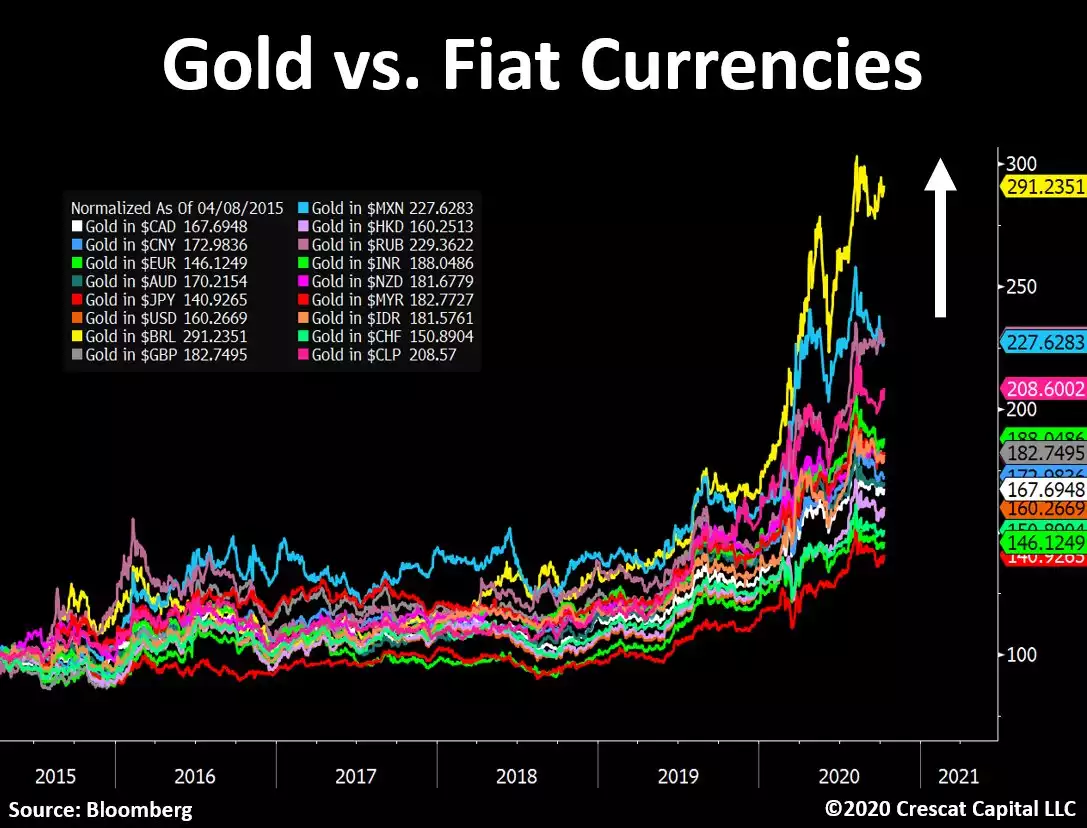

But don’t take our word for it. The chart below shows the price of gold in every major currency since 2015. You can look at this 2 ways. The price of gold is going up, or the value of every currency in the world is falling against the one true money… gold.

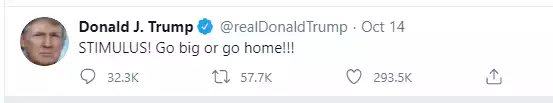

Finally, let us leave you with a simple one line economic position statement from the leader of the world’s largest economy and ‘owner’ of the first chart….

Whilst he may not be the leader in a few month’s time, Biden is widely expected to go ‘bigger’.

This aint over folks. It’s not too late to protect your hard earned wealth.